Good morning, Traders!

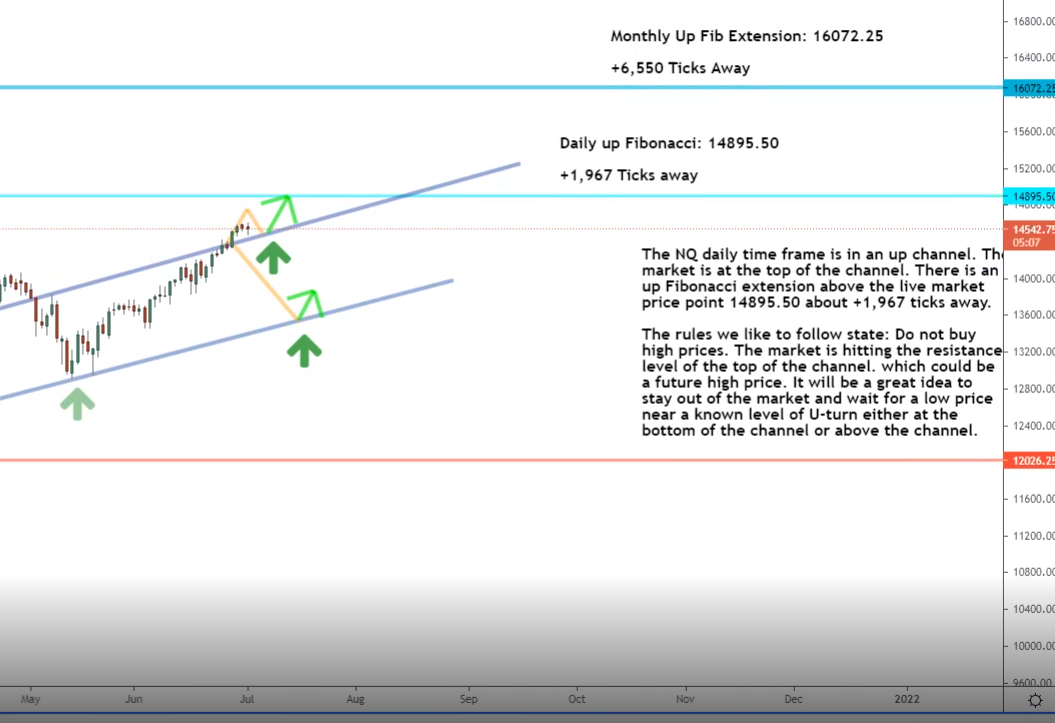

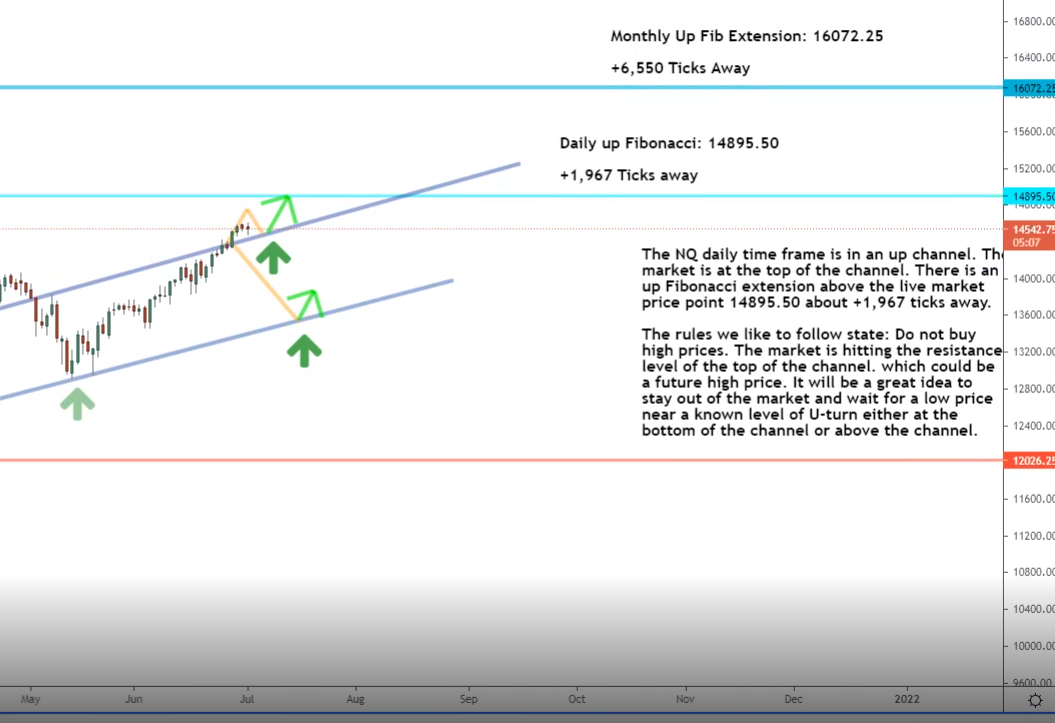

I’m pretty happy with the Nasdaq futures market (NQ) right now! We’ve broken above resistance, both the long-term and short-term directions are up, and the market is headed for the 14895.5 price point. That means we could see a +1967 tick movement from this current push!

Now, as you’ll see in the charts below, we shouldn’t rule out the possibility that the market could dip again before continuing on toward a new high price. And that’s because the market trades in waves! I know I sound like a broken record, but it’s because this is an important point to remember. The market trades in waves, so temporary price dips shouldn’t bother us when we’re in an uptrend. Read my article on recognizing market patterns to understand how it all works!

Let’s check out the timeframe charts to see what we can expect from the NQ right now:Daily Timeframe Analysis

The NQ has bounced off support (bottom grey line) and U-turned into a bullish rally above resistance (top grey line) as the market makes its way to the 14895.5 price point. That’s our next Fibonacci extension.

Fibonacci extensions can sound confusing, but they’re an essential part of a successful trading strategy. Use my free resources here to understand how they work!DAILY TIMEFRAME

The direction within the daily timeframe is up for the NQ

The one-hour timeframe shows an overall positive direction as the market rallies

The NQ has reached a known level of U-turn toward the buy zone

Learn more about the Daily Direction Indicators here…

The NQ daily timeframe remains in an uptrend as the market U-turned off support (short green arrow to the left) and is making a bullish rally to 14895.5 (top blue line)

We’ll watch the NQ daily timeframe in the coming days as the overall direction for the market remains up. We have plenty of ticks left until the price hits the next level of resistance.

While we could see a retracement (temporary price drop) along the way, it’s not something that should scare us away from the market!

| Recommended Link:[Limited-Time Replay] How To Get Legal Inside Stock Tips Straight From The SEC Josh just hosted a groundbreaking live event with fellow trading pro Ross Givens to reveal the “secret” SEC loophole that allows corporate insiders to legally trade their own stocks… and also allows US to follow their moves to potential windfall gains! This event created so much demand that attendees literally crashed multiple servers trying to get access to the brand new service Ross just launched to take advantage of this loophole… so we’ve decided to post the on-demand replay for a limited time to allow everyone a chance to get in on this. Click here to view the full replay right now… and discover the best-kept secret that the financial elites do NOT want you to know! |

One-Hour Timeframe Analysis

The one-hour timeframe for the NQ is what we use to determine a good entry point for our trades. Remember that we look for low prices within the buy zone that allows us to get in and then ride the rally to an even higher price point. That’s the key to making money in these trades!

Right now, the market is above the top of the channel (top grey line) and making positive movements toward the next Fibonacci extension. We could see a big rally in the one-hour timeframe before the next retracement!

For more information about price movement, see what I have to say about how it all works. You don’t want to miss out on this free information!

The one-hour NQ remains above the top of the channel, making positive moves to even higher prices. We’ll see a few dips along the way, but the short-term direction for the NQ is still up

While we could see a retracement (temporary price drop) along the way, it’s not something that should scare us away from the market!The Bottom Line

The NQ is making all of the right moves as it inches closer to a new high price. This is a good time to make a profitable trade by following the timeframe charts.

The overall direction for the NQ remains up. We’ll see higher highs and higher lows. The tick movement potential for the market is strong, so it’s a good idea to keep an eye on the one-hour time frame and look for your chance to buy into the NQ!

The outlook for the NQ is great right now! This is a perfect opportunity to jump in and make some money as the market continues its latest bullish rally

But why risk doing this alone? I’m here to help you realize your money-making potential in futures trading. Just follow along as I reveal the crucial aspects of my trading strategy that will allow you to become a profitable futures trader!

Keep On Trading,

Mindset Advantage: Balance

When it comes to your mindset for trading, you’ll find that your ability to cope with the markets, bad trades, good trades – whatever – has more to do with how you spend your time outside of trading. More specifically, how much balance you have.

In fact, of your total state of readiness 10% may have to do with charts and price levels. The other 90% has to do with how rested you are. How focused you are. How happy you are.

Find a balance that works for you and begin the path towards happy trading.Traders Training Session

What are future contract sizes?