Good morning, Traders!

Gold futures (GC) have finally hit the low price we’ve been anticipating. We could now see a +1,100 tick bullish run with the current setup, giving us plenty of opportunities to make money! That kind of tick movement means $11,000 for a full contract and $1,100 for a micro! This could be a BIG market movement as it plays out.

The market has hit support and is poised to U-turn back into a bullish rally. If that support holds, the price will move upward toward the next Fibonacci extension of 1922.4 for a +1,160 tick rally.

It’s critical that we watch the one-hour timeframe to see when the market reverses its downward movement. You really need to stay on top of this! The GC is currently a seriously good buy. But you can’t just jump in without the proper trade setup. Take advantage of my resources to make sure you don’t miss out on this money-making trade!

Let’s dive into the timeline analysis to see how this amazing opportunity will play out:

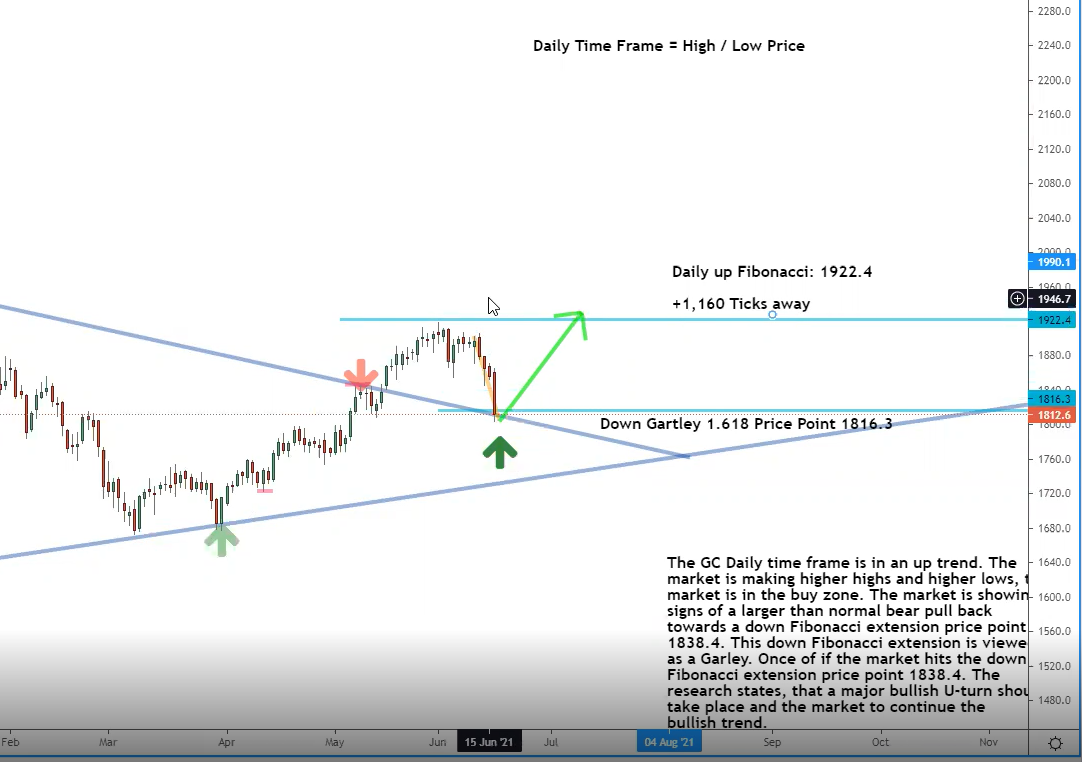

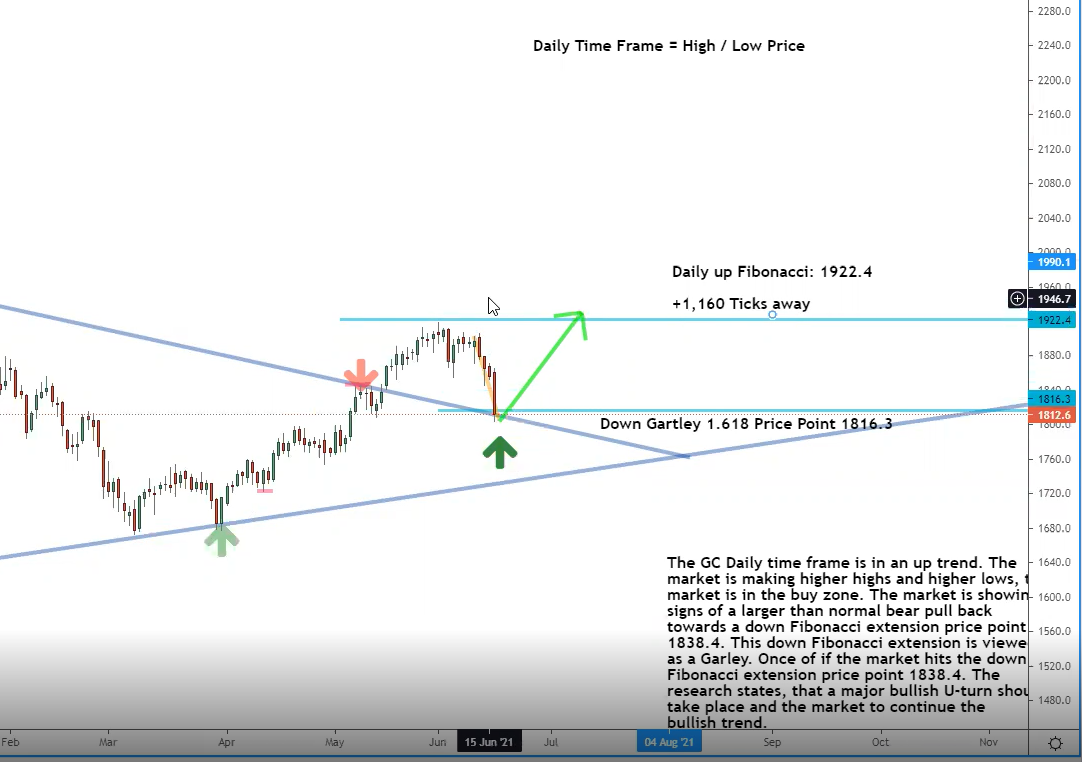

Daily Timeframe Analysis

The GC market has settled on support (diagonal grey line) and is poised to make a reversal back toward a bullish run. Remember that support is the point at which a market bottoms out before buyers take over and drive the price back up.

The GC is ready to make a seriously bullish run to a new high price. We can expect a +1,100 tick movement with this setup. The price has settled at support (dark green arrow) and is ready to U-turn!

When that happens, we can expect the rally to rack up a +1,100 tick movement. This bullish rally has the potential to be big. And that means anyone who gets in on this can make some serious money!

Now let’s turn to the one-hour timeframe chart for the GC. That’s where all the action is unfolding!

One-Hour Timeframe Analysis

The one-hour timeframe confirms that the GC is at a low price and preparing to enter a new bullish rally. You can see in the chart that the market is beginning to trade sideways at a low price. That should entice buyers to take control and drive up the price again.

We’ll use the one-hour timeframe to watch the market U-turn. Once that happens, it’ll be time to buy in and ride the rally back to the top

The hourly timeframe is where we’ll spend most of our time as we watch this market. We need to keep an eye out for a U-turn that sends the price back upward. Once that happens, we can work on executing our entry strategy and ride the market back to the top! I can not stress enough how big this opportunity is.

The GC is a definite buy. Make sure you read up on how I predict future price movement to learn more about why this is such a great opportunity to make a profitable trade!

The Bottom Line

This is a great opportunity to make some serious money from futures. You’d be crazy to skip out on this. The GC is set to rally +1,100 points. And thanks to tick values (which you can learn more about here), that means traders who get in on this will see an impressive return on their investment.

The GC is presenting us with a golden opportunity to make money! This is the perfect time to get in and see how futures trading really works

Stop delaying. It’s time to get on board. Once this ship sails, it’s gone! So make the decision now to join me on the path toward profitable futures trading. Today is the day to say yes to your future!

Keep On Trading,

Mindset Advantage: Accept

It’s not the market. It’s not your indicator. It’s TRADING.

Let it go. The first step toward consistent profits comes when you accept the reality that losses will occur.

Prices have a mind of their own at times. The institutions are at the wheel. The sooner you accept this, the more progress you’ll make.

Look at the past, but don’t stare. Accept what’s happened and move on.

Target tighter entries. Get the heck out of those losers you’re hanging on to.

Accept. And start to enjoy trading.

Traders Training Session

Don’t let sloppy stop orders ruin your trade!