Hey, everyone. Joshua Martinez here. Today’s date is June the 24th, 2020. Current time is 1:58 PM Eastern time. We’re going to do a Destination Review. Basically, we’re going to take a look at the last week of destinations and just basically count what the strike rate is, see how often did it work versus how often it did not work.

Now, we’re going to do this on light crude oil. So in front of you is the risk disclaimer. It just means there’s risk involved. You should never invest money you cannot afford to lose. Always keep risk management in mind. I understand that we are not CTAs which stands for commodity trading advisors, and what that basically means is what I’m going to share with you is research. What you do with this information is completely up to you.

How many times destinations worked versus how many times they did not work

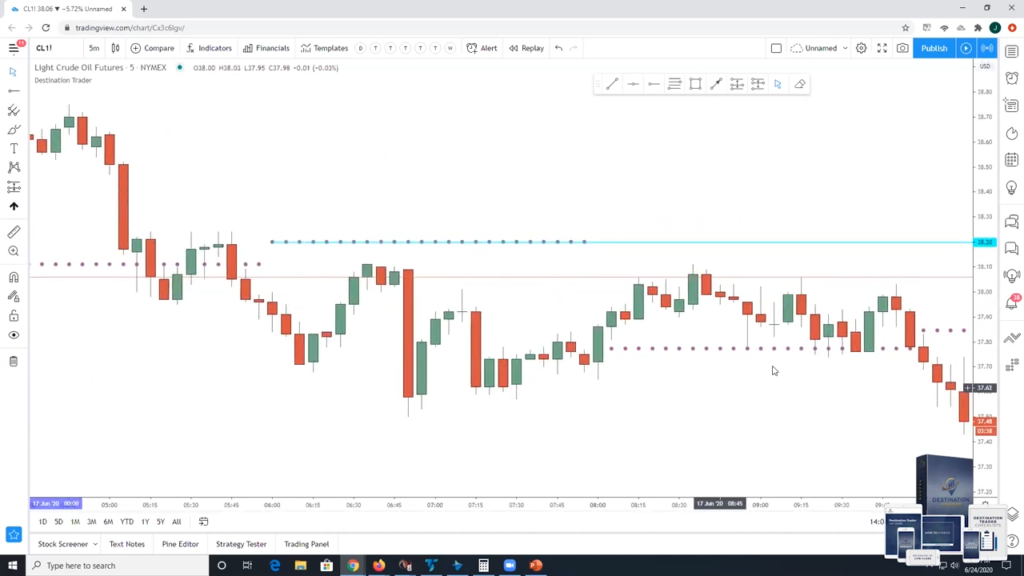

Okay? So today’s date is June the 24th. So let’s go look at the 17th, and we’re just going to put a blue line on the 17th. We’re just going to run through to see how many times destinations worked versus how many times they did not work. Here is the 17th right about here. Okay, perfect. So if you have destination, you just go to your indicators on TradingView. This is TradingView charting software. You click on invite only and go to destination trader invite only. What destinations, what they do is every two hours you’ll be provided a specific price point, and basically the goal is to trade towards the destination.

Then once price equals the destination, that is considered fulfilled. A fulfilled destination exactly what this is. You can see that when price touched the purple dots… So like an example, every two hours, we get receive a destination. So here is the destination right here. We’re going to anticipate price is going to fall and fulfill this destination. So we’ll put a little blue line on it. Let’s see if it works. It doesn’t mean that it’s going to work within the two hours. Sometimes it takes a bit longer, but we’ll track to see how many times it did not work and how many times it did work.

Diversification entry strategy

So you will notice how price fell down equaled this destination, and that one’s completed. Okay? Here’s another destination above the market. We’re just going to go to each one, one by one, see how the market reacts. So this one’s fulfilled, and all that really means is if you were using a diversification entry strategy sizing into the market or selling and holding, this trade would work out. Okay. Now, we’re expecting the market to increase in value.

And you can see this one, it fulfilled its destination within five minutes. So sometimes you get a destination that the opportunity won’t be available right away, and that’s okay. So this is an unfulfilled destination. That is an unfulfilled destination, and then now they’re both been fulfilled. So you see the markets equal the price points. And what we’re going to see, we’re going to continue on and just see how many times did it work versus how many times did it not work.

And basically all it really means is this. You turn to your computer, and you use the destination to help you forward project where the market may go next. So here we currently are. We’re just basically going to say, there’s up to a 9 out of 10 chance price will increase and touch the destination, and, bingo, that one’s fulfilled. That one’s done. You have another one below the market. Now we’re going to expect the market to fall. Let’s see what takes place. Market fall, that’s fulfilled. You have another one above the live market. Let’s see what takes place. Market rallies. That’s fulfilled.

So destinations are just doing a really, really great job. So far, they’ve all been fulfilled. They’re all being hit. Every two hours, we get a price point, and they’re being hit. So that one, you can see prices falling touching it. So these are all relatively quick trades. It doesn’t look as if we’ve had any trades that we’ve had to hold on for a couple of days or anything, if you’re using this for guidance. Here’s one. There we go. Right when I said that, now here comes the overall sell and hold. But ultimately we have up to a 9 out of 10 chance price will fall.

So if you’re using this strategy, basically what you would do is you’d turn on your computer, and you’d say, “Okay. Well, we’ve got a 9 out of 10 chance price is probably going to fall.” So just be aware that the dip’s coming. And along the way that you have… That one was hit. Along the way, you’re going to have destinations that guide you day-by-day. So there’s one there. There’s an unfulfilled destination here.

Let’s see what ends up taking place. So that one’s fulfilled. That one’s done. That one’s fulfilled. That one’s done. So go ahead and just delete it. You have this unfulfilled destination above the live market. Let’s keep going. That was hit. That was hit. That was hit. That was finally hit. Okay, you have this one that was not fulfilled, and that one was fulfilled. All of these have been hit so far. Excuse me. You have this unfulfilled destination.

As long as you’re trading with good risk management

So the draw down’s not too bad. As long as you’re trading with good risk management, the draw down’s going to be financially whatever you want it to be. Ultimately, if you risk too much money for trade, it doesn’t matter what your risk and ticks is. It’s going to be too much. But if you trade with good risk management, then you should be able to stomach the draw down. If you’re using a size in technique, it really makes this a very, very profitable strategy.

Okay? So that one’s fulfilled, and you still got this one down here. We’re still going to expect the market to drop, and finally the market falls. So it appears that… Did this one get hit too? Nope. In the last week, all destinations have been fulfilled except for one. And ultimately what that means is we’re more than likely going to anticipate we have up to 9 out of 10 chance the price is going to increase probably within this next couple of days, about 168 ticks.

So looking for a counter trend line break bullish. The market closes above this counter trend line. Placing a stop underneath that counter trend line is really going to be a smart idea. So ultimately you can begin to see the market is starting to make higher highs and higher lows, higher highs. Don’t be surprised if you start to see an upward movement take place, the market begin to extend that 100-plus ticks on the way up.

Don’t really need a huge stop unless you’re going to size in. That’s still a really good idea, but ultimately in this last week, all destinations have been fulfilled except for one. But ultimately, I think that one’s going to be fulfilling itself within the next few days. All right, everyone. This is Joshua Martinez. Have a wonderful day.