Good morning, Traders!

We’ve seen the market dip over the last 24 hours, but that doesn’t mean it’s time to pack up and get out of trading! We could see some nice opportunities to buy futures and turn a profit. And that’s what I’m seeing with the E-mini Russell 2000 (RTY) right now.

Currently, the RTY is retracing. That means the market is temporarily dipping in price. And as the market moves closer to support (the point at which buyers should take over), we should see a U-turn back bullish toward the 2302.4 price point.

Remember that the market moves in waves. We see high prices, then low prices, and then we return to high prices again. But the overall trend for the market remains up, even as the prices ebb and flow. That’s how the market works.

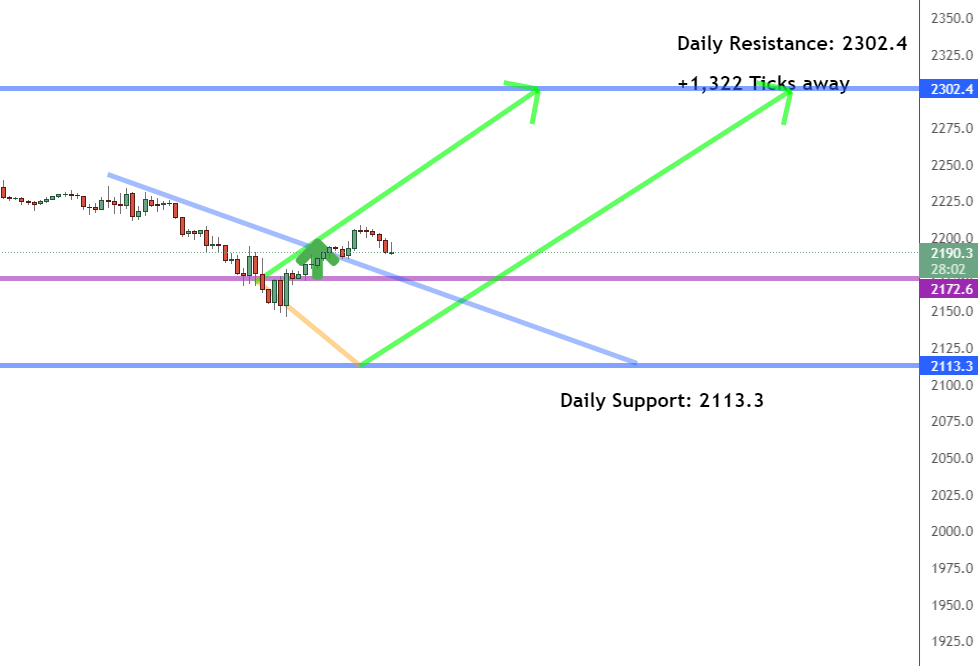

And to see how the current setup works for the RTY, let’s take a look at the timeframe analysis:

Daily Timeframe Analysis

The RTY has remained mostly sideways within the daily timeframe. Visually, this chart is an excellent way to see how retracement, U-turn, and counter trendline breaks work as the RTY’s current movement plays out.

The long-term direction is up for the RTY

The short-term direction of the RTY is currently up

We’re waiting for the RTY to U-turn back bullish

Learn more about the Daily Direction Indicators here…

The RTY is retracing down toward support, but should U-turn back toward a bullish rally

This example demonstrates the importance of properly drawn trendlines in your charts. Without them, you risk receiving incorrect data and a chart analysis that will not support you in making sound trading decisions!

One-Hour Timeframe Analysis

As we watch the one-hour timeframe for the RTY, we’ll want to pay close attention to when the retracement plays out and the market U-turns away from support. When that happens, we’ll then wait for a counter trendline break bullish to let us know that it’s time to prepare our entry strategy for the RTY!

We need to wait for the retracement to work itself out, then wait for the U-turn. After that, we can plan our entry strategy for the RTY

But we need to remain patient as the current sell-off works itself out. We don’t want to jump in until we see that U-turn. That lets us know the RTY is heading back toward bullish territory.

The Bottom Line

Our timeframe charts will play a critical role in helping us decide when it’s time to buy the RTY. Once we see our key indicators develop within the charts, we can plan our entry strategy accordingly. Without our charts, we’re dead in the water. That’s why my strategy is so important for traders who want to consistently win more than they lose!

Our timeframe charts will be critical in helping us determine when’s the right time to jump into the RTY

And that’s why following my futures trading strategy can benefit you immensely. You’ll see when it’s profitable to enter a market and when it’s wise to stay away. Now’s the time to get on board if you’re ready to make smart trading decisions today. There’s no reason to keep putting it off!

Keep On Trading,

Mindset Advantage: Find Balance

When it comes to your mindset for trading, you’ll find that your ability to cope with the markets, bad trades, good trades – whatever – has more to do with how you spend your time outside of trading. More specifically, how much balance you have.

In fact, of your total state of readiness 10% may have to do with charts and price levels. The other 90% has to do with how rested you are. How focused you are. How happy you are.

Find a balance that works for you and begin the path towards happy trading.

Traders Training Session

Understanding Futures Contract Sizes and Tick Values

Stay tuned for my next edition of Josh’s Daily Direction.

And if you know someone who’d love to make this a part of their morning routine, send them over to https://joshsdailydirection.

The post The right way to prepare your entry appeared first on Josh Daily Direction.

2 Comments

September 23, 2021 @ 12:03 am

HI

I’m not able to find a platform where I can trade RTY. On Ameritrade it shows RTYiv.p only under options. It’s not on Robinhood and on Webull it can’t be traded.

Can you advise?

September 23, 2021 @ 3:24 am

Hi Ahmed. Thank you so much for leaving us a message and giving us the opportunity to help. Traders Agency does not endorse any particular platform. I personally use TradeStation and I can access the RTY. The other option if you want to trade the [ETF] for the RTY you can look at ticker IWM. I hope this helps. HAPPY TRADING!!!