Hey friend,

As we enter the middle of the week, let’s see how the markets have been moving.

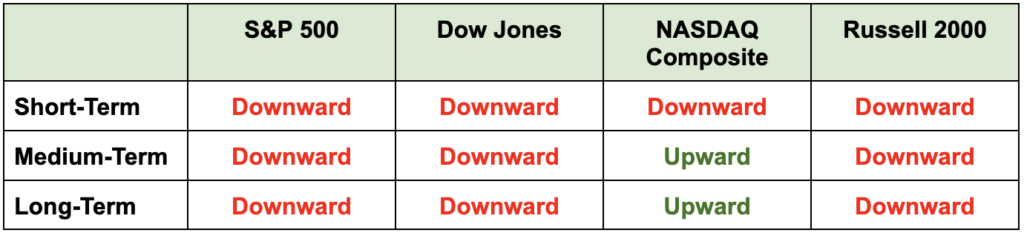

The Daily Direction

Note: Inflation numbers that came in as expected – plus lesser fear surrounding bank stocks – pushed all the indexes to a positive close. Not enough to reverse the downward directions for most, except in the NASDAQ.

The Daily Nugget

Adjust your position sizing to survive down markets and losing streaks.

We’ve talked a lot about the importance of stop losses in this newsletter. But one thing to also pay attention to is position sizing – the amount you’re staking on each trade.

When you’re in a down market or in a personal losing streak, it’s tempting to start disregarding all your usual entry signals.

But doing so could cause you to miss out on the opportunities that are always there regardless of market conditions. At the same time, it’s not easy to ignore your screaming emotions during times like that.

The answer? Adjust your position sizing. Putting on smaller positions (with stop losses of course) during down markets or losing streaks will help manage your emotions while also exposing you to the potential upside.

Because make no mistake – there’s always potential upside to be had. Ross Givens knows this all too well, thanks to his top strategy for spotting fast-moving stocks in any market.

The Traders Agency Team

P.S. Want special trade prospects and potential market moves from Ross sent directly to your phone so you don’t miss out on anything? Text the word ross to 74121 now.