The market is looking forward to this afternoon’s interest-rate decision from the Federal Reserve.

Expectations are for another 0.75% rate hike, which would bring the target federal funds rate range to 3.75%-4%.

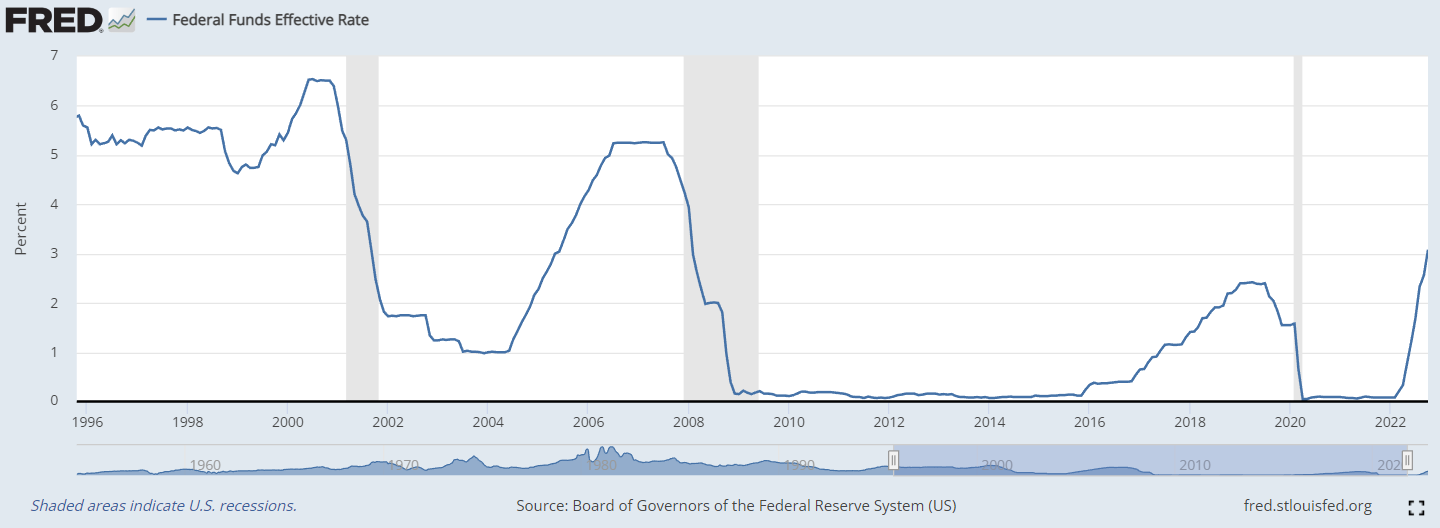

As you can see in the chart above, that would be the highest level for fed funds since about 2008.

You’ll also notice how sharp the increase in rates has been, which shows why the market has been so rough this year.

Levels to Watch

Now, there has been some talk in the financial press lately about the potential for the Fed to slow or stop its pace of rate increases going forward.

A number of analysts are expecting the Fed to raise again in December, but only by 0.5% rather than the 0.75% increase that’s expected at today’s meeting.

This sets up the the markets to potentially make a big move this afternoon if any part of the Fed’s decision is not priced into the market already.

With that in mind, here are a few levels to watch on the benchmark S&P 500 index today…

The S&P popped above its 50-day moving average (MA) last Friday for the first time since mid-September.

As I mentioned on Monday, that was a positive sign, and the 50-day at 3,829 should act as the first line of support on any decline.

Just below that, there is short-term support around the 3,790 level, followed by support around 3,665 that stems from the June low.

The first line of resistance, which the market has already reacted to this week, is just overhead at 3,905.

And of course, the 200-day moving average at 4,105 is going to be a big challenge when or if the market gets there.

Trade the Fed Tunnel

Now, if you’re a short-term trader, you know Fed meeting days are abound with opportunities for short-term gains.

Typically, there is a big move in the markets around the time of the policy announcement.

There are usually further tradable opportunities later on in the session depending on what happens at the Fed Chair’s press conference.

This brings me to my colleague and expert trader Josh Martinez, who has developed the Tunnel Trading strategy for finding and acting on intraday opportunities..

Utilizing this strategy, Josh has been identifying short-term trading opportunities in both up and down markets.

And for all you day traders out there, he’s hosting a special introductory session today at 12 p.m. ET — ahead of the Fed announcement — to tell you exactly how to get started.

Embrace the surge,

Ross Givens

Editor, Stock Surge Daily