Good morning, Daily Direction readers!

Today we’re taking a look at light crude oil futures (CL) as the market sets up for another bullish push. But we’ll need to wait until the CL gets into the right position before we jump in.

Waiting can be tough, especially when you’re ready to make profitable trades. However, patience is an important part of any good trading strategy.

Right now, the CL is up for both the long-term and short-term outlooks. But the market needs to push into the buy zone before we can take a position.

Waiting for trendline breaks may seem to drag things out. In reality, it’s an essential part of a strategy that appropriately manages risk. Remember: we’re here to make money. If we don’t follow our carefully planned strategy, we’re basically tossing our money out the window!

With everything that’s happening in the energy sector, the CL has the potential to give us a solid bullish run with a healthy tick movement. Check out what the timeframe analysis has to say:

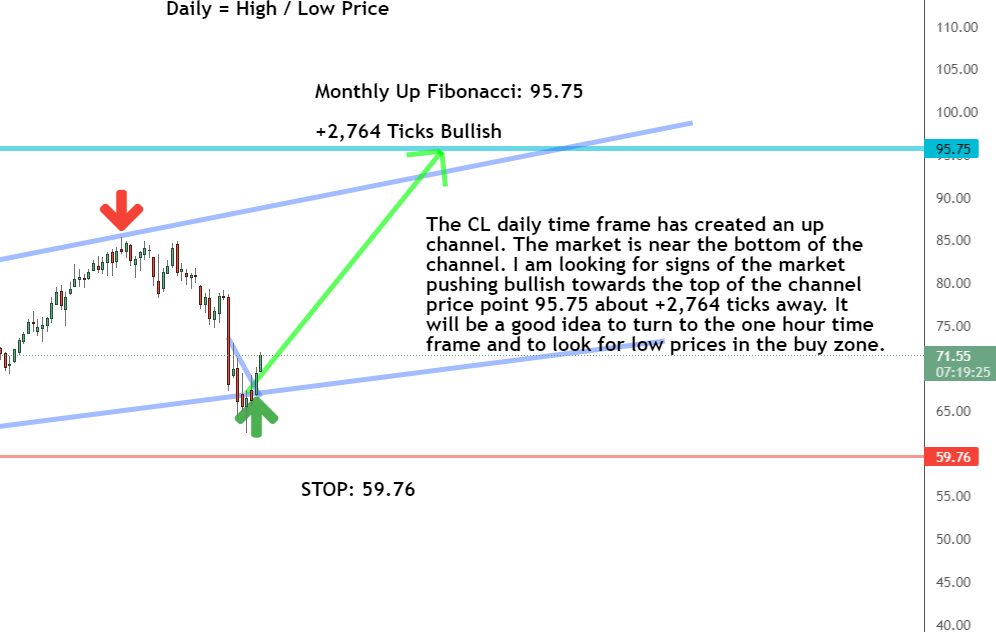

Daily Timeframe Analysis

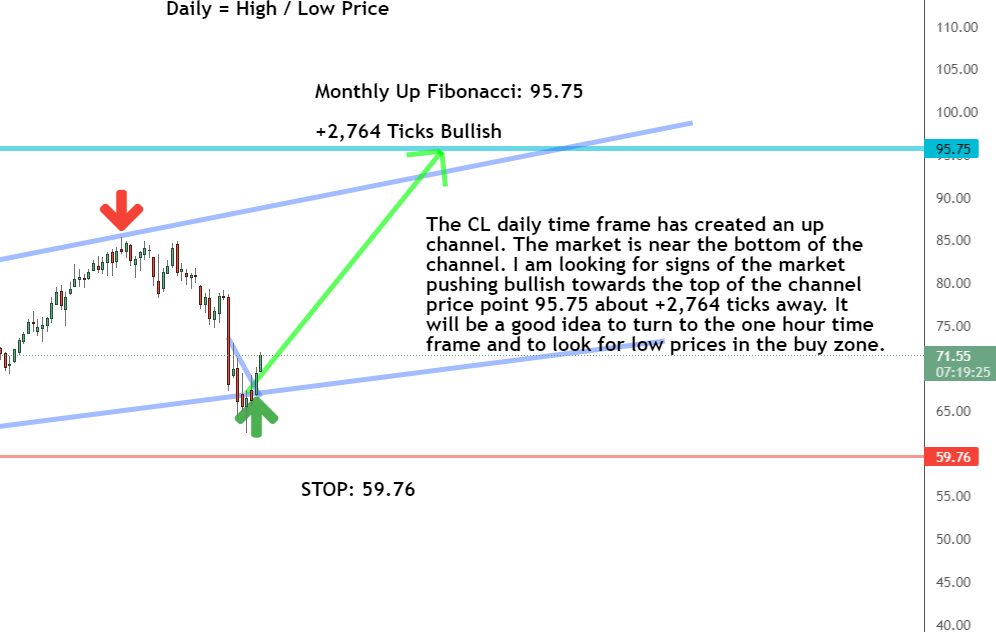

The CL is showing signs of pushing back to the top of the up channel within the daily timeframe. Based on our chart, it looks like the CL is recovering and headed for a new high price.

We can see the market pushing through the counter trendline as it turns bullish again. That means we need to turn to our hourly timeframe to confirm that the CL is now pushing into the buy zone.

Now is the time to prepare our buy-in strategy as the CL sets up for a positive push. But let’s not jump the gun! We need to confirm all of our indicators before buying the CL. That’s where the one-hour timeframe comes in.

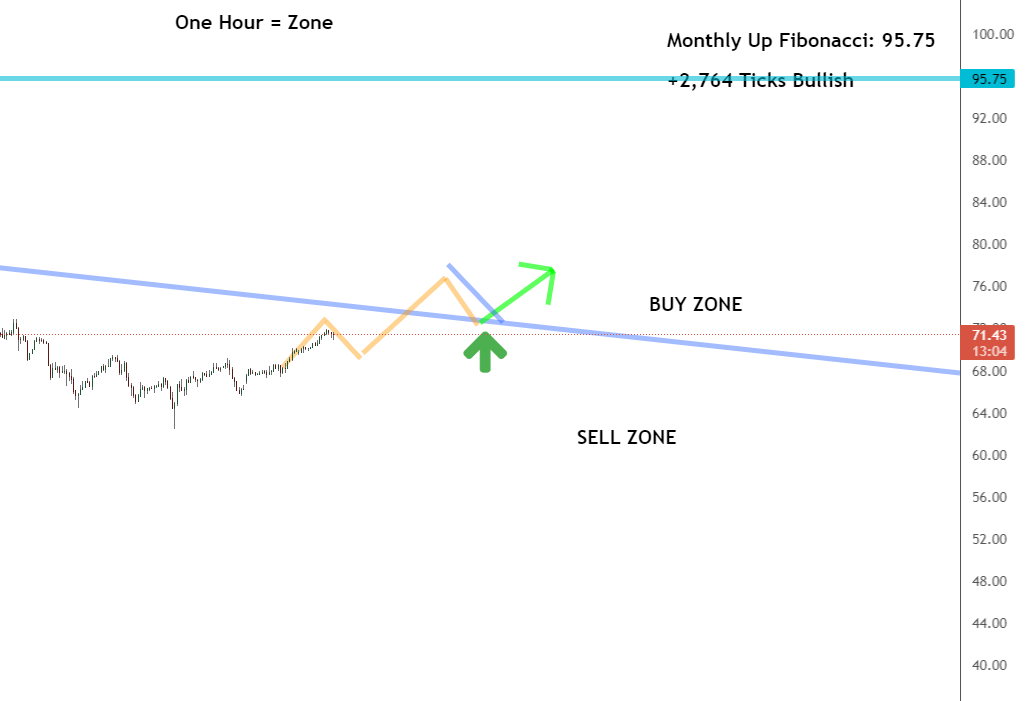

One-Hour Timeframe Analysis

With the one-hour timeframe analysis, we’re waiting for the market to push back into the buy zone. As you can see, the CL is making its way up toward the trendline. It has a few more ticks to go before it breaks that line and enters the buy zone again.

When that happens, we’ll be ready to buy the market at a low price as it continues to move higher.

The best policy right now is to wait until we see the CL break that down trendline. We don’t want to buy too early. The market could dip again before it gets back into the buy zone. We use these strategies to reduce our chance of loss, so it’s important to follow them!

The Bottom Line

The long-term and short-term directions for the CL are both up, but we’re waiting for the market to hit the right spot before we buy it.

As soon as the one-hour timeframe shows the CL breaking the down trendline and moving into the buy zone, we’ll be ready to execute our buy-in strategy and work toward making profitable trades in the CL. Until that happens, we’ll patiently wait on the sidelines.

You’d be absolutely lost if you didn’t have my technique to guide you through the current movements of the CL futures market. That’s why it’s time to start utilizing my knowledge and expertise! You can’t afford to miss out on this.

Keep On Trading,

Mindset Advantage: Accept

It’s what you don’t lose that counts first.

Followed by what you get to keep.

We hear the same story time and time again… the money gets made… the profits are amazing… and then it’s all given back to the harsh maiden of the market.

It’s not because the money isn’t there to be made. It’s often due to good old fashioned greed. Stops get pushed back. Targets get forgotten. That trade made $100… why not turn it into $500 or $1,000?

These are the traps that snare 95% of the trading profit. Take what the market gives you and go about your business. Honor ‘thy stop’ and your risk / reward ratio.

Don’t take that trade if you don’t feel good about it.

The ones you don’t take, or the ones that you end up stopping out of… those are the ones that keep you on the path to consistent profits!

The post Keep Your Eyes on Crude Oil appeared first on Josh Daily Direction.