Good morning, Traders!

Yesterday, I gave an update on the Nasdaq 100 E-mini futures market (NQ). Today, we’ve seen some encouraging movements from the NQ. While the short-term direction is still down, we see signs that the market is starting to break that short bearish trend.

The market didn’t break through the up trendline, and that’s certainly good news. It means the price held at that point and didn’t go any lower. So long as that continues to be the case, we can look forward to the market likely pushing bullish to the buy zone.

It can be annoying to wait for an opportunity to buy a market, but it ultimately pays off. A good trading strategy forces you to make wise decisions by helping you control your emotions. Remember that emotional trading eventually leads to an empty account. We want to wait for the opportunities to come to us!

And speaking of opportunities, I don’t want you to miss out on one I’ve recently developed for everyday traders like you. If you want the potential to earn an extra $400 to $1000 per day, be sure to check out this little-known portal hiding in your trading account before jumping into today’s timeframe analysis:

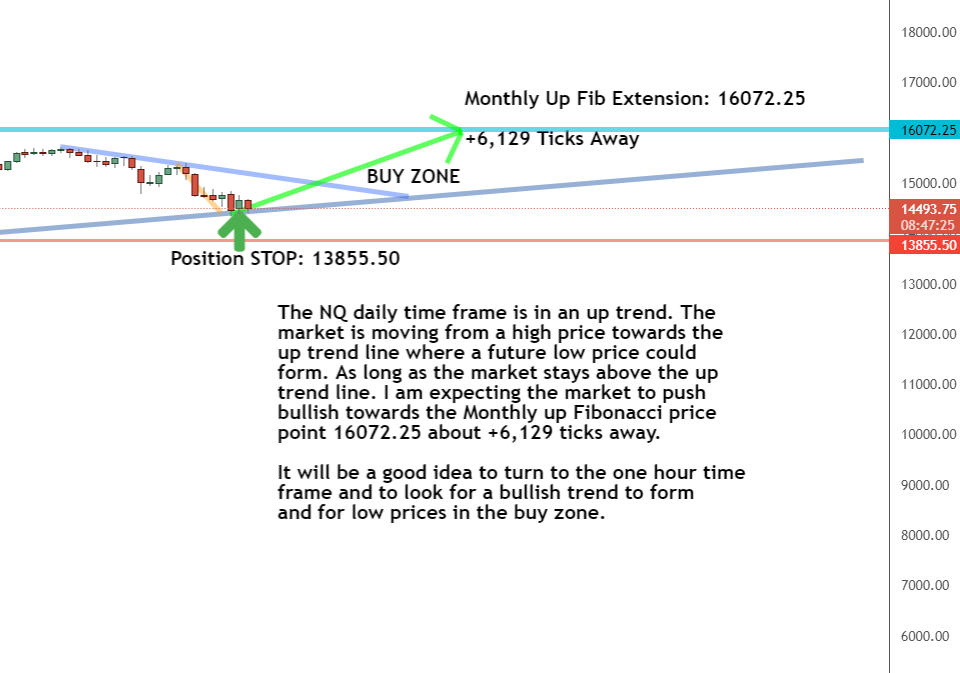

Daily Timeframe Analysis

The NQ stayed above the up trendline (long grey line), which is great news! That means the market didn’t sink to a new low. So long as the NQ stays above that line, we have a good chance of seeing the market push bullish back into the buy zone.

This is an example of why trendlines are so important. Without seeing the market’s interaction with that up trendline, we’d have no idea if the NQ was getting in a position to give us buying opportunities again. All we need now is for the market to give us a solid positive turn and a counter trendline break!

The long-term direction is up for the NQ

The short-term direction of the NQ is down

We’re waiting for the NQ to U-turn back toward the buy zone

Learn more about the Daily Direction Indicators here…

The NQ held above the up trendline in the daily timeframe. That’s good news as we wait for the market to return to the buy zone

We’ll continue to watch the NQ and its position relative to that up trendline in the daily timeframe chart. Once we see that it’s pushing bullish toward a new high price, we’ll turn to the one-hour timeframe to begin searching for buy-in opportunities.

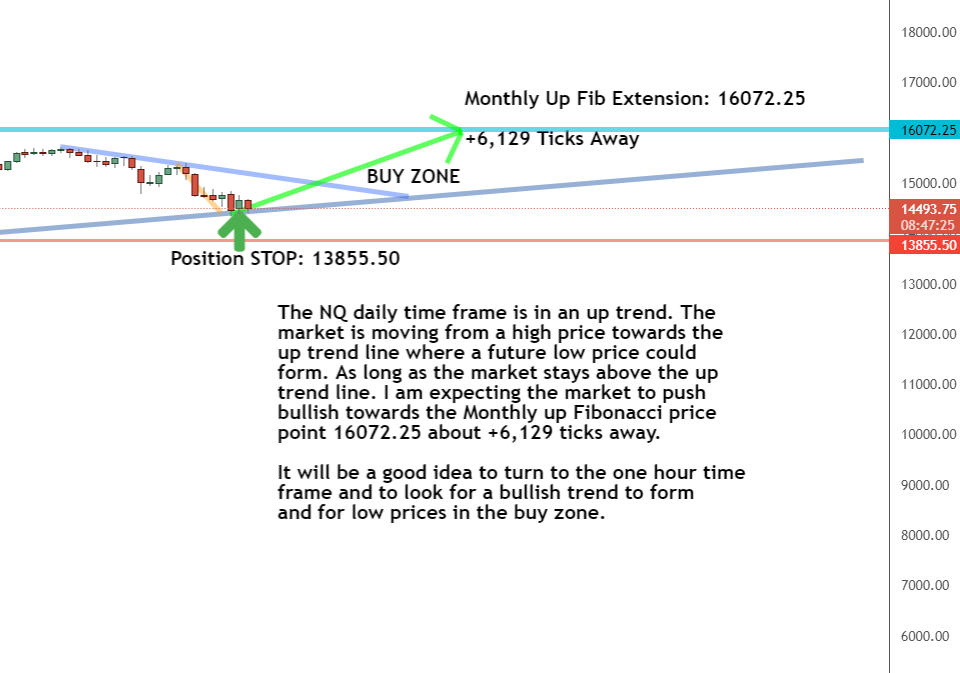

One-Hour Timeframe Analysis

As I said yesterday, we’re out of the NQ while waiting for confirmation that the market has resumed its bullish run. And all indicators point to the market heading in that direction.

But until we get that turnaround, we’ll keep an eye on our timeframe data for evidence that the market has completed a U-turn is and returning to the buy zone. While the short-term direction is still down, we need to remember that the long-term direction for the NQ is up!

The hourly NQ timeframe is showing some signs of turning upward again, as you can see the upward tick in the above chart

This trade, once it turns around, has the potential for a +6,000 tick movement. In other words, there’s money to be made in the NQ once it gets in the right position.

The Bottom Line

The NQ’s long-term trend is upward, and we fully anticipate the market to provide us buy-in prospects once more. But until we get confirmation that the market has returned to the buy zone, we’ll stay out of the NQ for right now.

Waiting is sometimes the best thing a trader can do, and the current setup for the NQ is evidence of that. We want to give ourselves the best chances of making a profit with a trade. Right now, that means we need to hurry up and wait!

We’re waiting for the NQ to rebound and push bullish again in the short-term timeframe

That is why adopting my futures trading technique can be extremely beneficial to you as a trader. You’ll learn when it’s a good idea to enter a market and when it’s better to avoid it. I know you want to start making smart trading decisions right now, so now’s the time to jump on board. There’s no need to put it off any longer!

Keep On Trading,

Mindset Advantage: Forgive And Forget

Move on with your trading and leave the past where it belongs…. in the past.

It’s a recurring theme. It happens over and over again. You can feel it the second it comes on. The market is going to do ‘it’ – whatever ‘it’ is – again… to you and your account. The flashbacks start pouring in. It’s impossible not to relive it all.

In an instant, a calm Wednesday morning is now haunted by a trading session ages ago. Just when you thought you would never, ever, ever find yourself in that situation again.

It’s time to move on. Sure, mistakes repeat themselves, but the key to getting past errors and losses of the past is first to embrace them. Own them. Take them as they are. After all they’re yours. Forgive and forget!

Traders Training Session

Trading Longer Time Frames vs Shorter Timeframes

Stay tuned for my next edition of Josh’s Daily Direction.

And if you know someone who’d love to make this a part of their morning routine, send them over to https://joshsdailydirection.

The post Just waiting on that bullish turn appeared first on Josh Daily Direction.