US crude oil (CL) futures peaked at over $120 a barrel just over a month ago.

Since then, it has dropped nearly 23% and fallen back into the sell zone.

At this point, it looks like CL is set for another potential move, and we need to analyze it for the right direction.

So, let’s take a look at the crude oil chart and see where the market could be headed…

The CL Futures Market Review

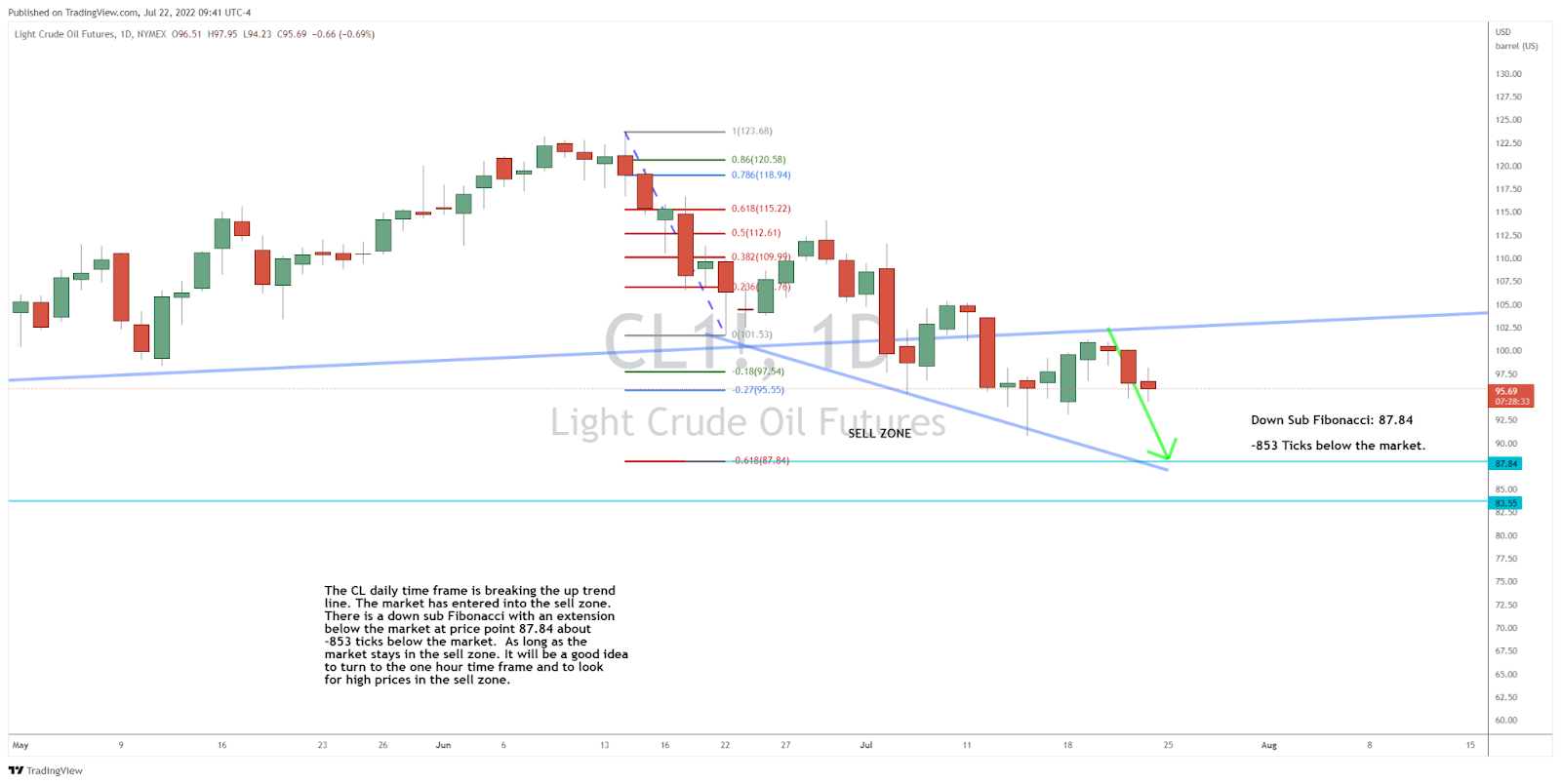

Here’s how the chart is setting up for the crude oil futures contract (CL)…

The crude oil futures contract (CL) daily time frame is breaking the up trend line, and the market has entered into the sell zone.

There is a down sub Fibonacci with an extension below the market at price point 87.84, about -853 ticks below the market.

As long as the market stays in the sell zone, it will be a good idea to turn to the one hour time frame and to look for high prices in the sell zone.

The Bottom Line

For more on the markets as well as trading education and trading ideas like this one, look for the next edition of Josh’s Daily Direction in your email inbox each and every trading day.

I’ll be bringing you more of my stock and futures contract trading tutorials as well as some additional trading ideas.

And if you know someone who’d love to make this a part of their daily trading routine, send them over to joshsdailydirection.com to get signed up!

Keep on trading,

P.S. Click here to get a full year of Stealth Trades for just 99 cents!

The post Is Crude Oil Set for More Downside? appeared first on Josh Daily Direction.