Over the last couple of weeks, we’ve looked at the “head and shoulders” pattern from all angles.

We saw that the pattern can be either bullish or bearish and can act as either a continuation or reversal pattern.

You’ve also heard me talk about the “high-tight flag” and the “cup-with-handle,” which are some of my favorite advanced trading patterns.

But today, I want to break down a more basic pattern and look at the bullish “flag” setup.

Let’s dive right in…

Find the Flag

For any flag to fly, the first thing you need is a “flagpole.”

Because a flag is really just a consolidation period, the first thing we need to see before a consolidation is a directional move.

And in trading, this is what we call the flagpole. It is typically formed by a short-term move to the upside with few pullbacks.

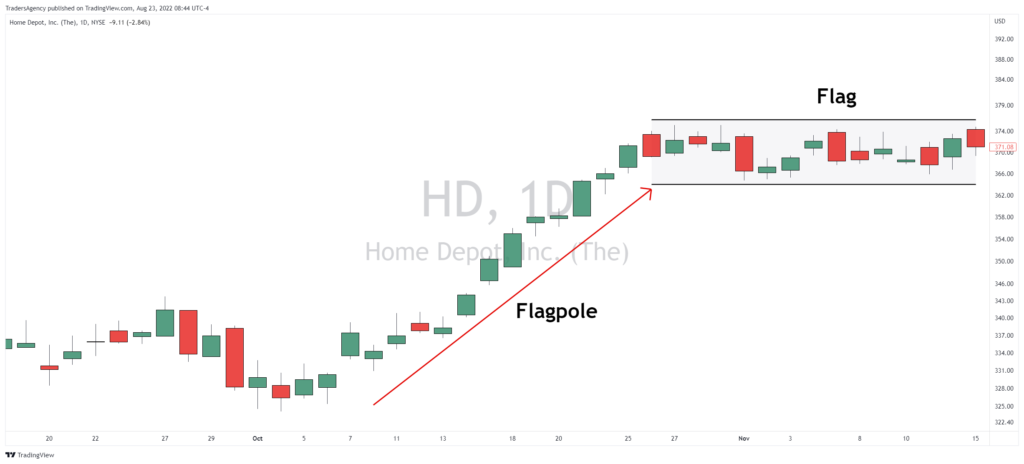

In the example above, we’re looking at a daily chart of The Home Depot, Inc. (HD).

As you can see, the stock made a nice upward move throughout October 2021, gaining about 14%.

This move represents the “flagpole” in this example.

But after such as a strong move, a consolidation was to be expected. And that’s exactly what happened.

You can see that the stock subsequently traded in a narrow range for about three weeks.

This sideways action represents the flag in this example.

The Breakout

Now, the whole reason that we’d want to go look for flag patterns is so we can be there for the breakouts!

And because these flags are just sideways consolidations with horizontal upper boundaries — like many of the setups I bring to your attention — the breakouts can be really strong.

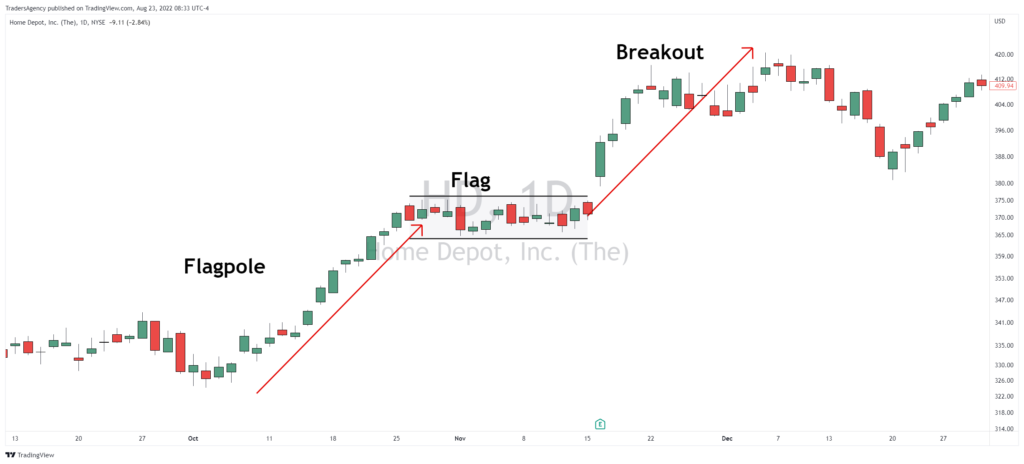

Just take a look at how the move in HD played out…

After breaking out from the flag pattern, HD gained another 12% before some profit-taking started.

In this example, that makes perfect sense. Why?

Because it is often said that the move following a flag breakout will be roughly equal to the move before the flag.

In other words, because the flagpole showed a move of 14%, traders would expect a breakout move of approximately the same magnitude.

Of course, it’s rarely going to be a perfect match, but that’s the general rule for flag breakouts.

Join Today’s Live Session

Now, if you want to get my absolute best stock tips sent directly every time there’s a new opportunity, check out my premium Alpha Stocks trading service.

We have plenty of long ideas for the right stocks… We recently generated a gain of 21.3% in just 15 days in Permian Basin Royalty Trust (PBT) as that stock broke out of its range.

And last week, we closed another winner in Enphase Energy, Inc. (ENPH) for a quick gain of 22.5%.

But we’re also not afraid to go short… We recently recorded a 21.6% gain on the downside in only eight days as Pegasystems Inc. (PEGA) stock plunged…

Of course, we also get together every Monday for an hour-long live session so that subscribers can ask questions and get guidance about our trades.

If you’re ready to see what you could be missing out on, I’m holding a special session this afternoon in which I’ll discuss my strategy in more detail…

Just click here to register and learn more about Alpha Stocks now!

Embrace the surge,

Ross Givens

Editor, Stock Surge Daily