Stocks have been slaughtered this year… The S&P 500 is still down over 22%, while the Nasdaq 100 is off nearly 35%.

One strategy for avoiding this drawdown was to reduce overall exposure to the market. And that worked for a while.

But a trader can’t sit on the sidelines forever. At some point, you have to get back into the market.

So, how do you know when a stock is done falling? When should you buy?

Here’s what I look for…

Change in Behavior

First, I need to see a change in the behavior in the stock.

Simply put, I want to see it stop trending down.

The easiest way to judge this is just to draw a line.

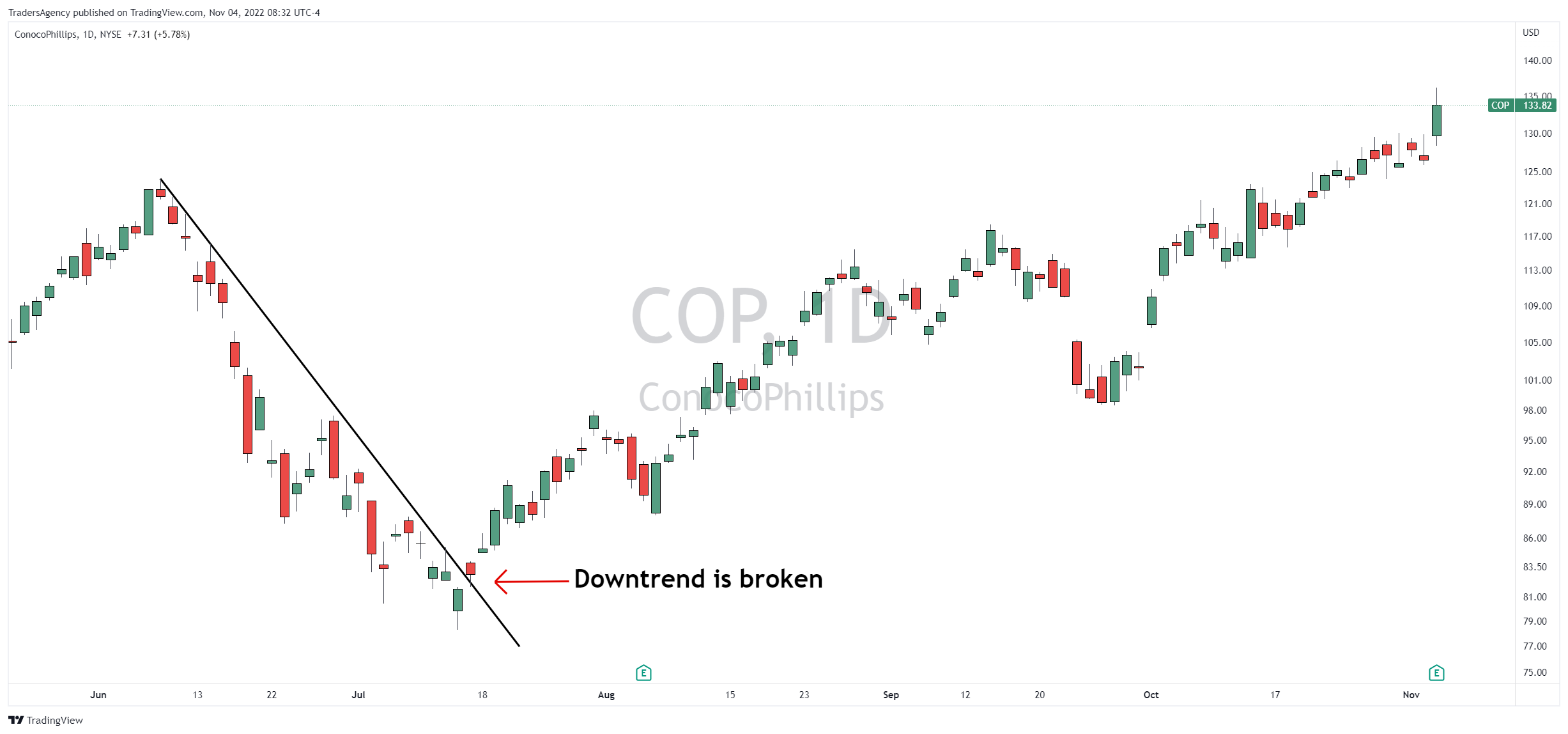

Here’s an example of such a change in behavior in ConocoPhillips (COP) stock…

You don’t need to overcomplicate it!

Draw a line that touches most of the highs… That’s your downtrend line.

And once that downtrend line is broken, the stock could be getting close to a buy point.

Next, it needs to form a “pivot.”

Find the Pivot

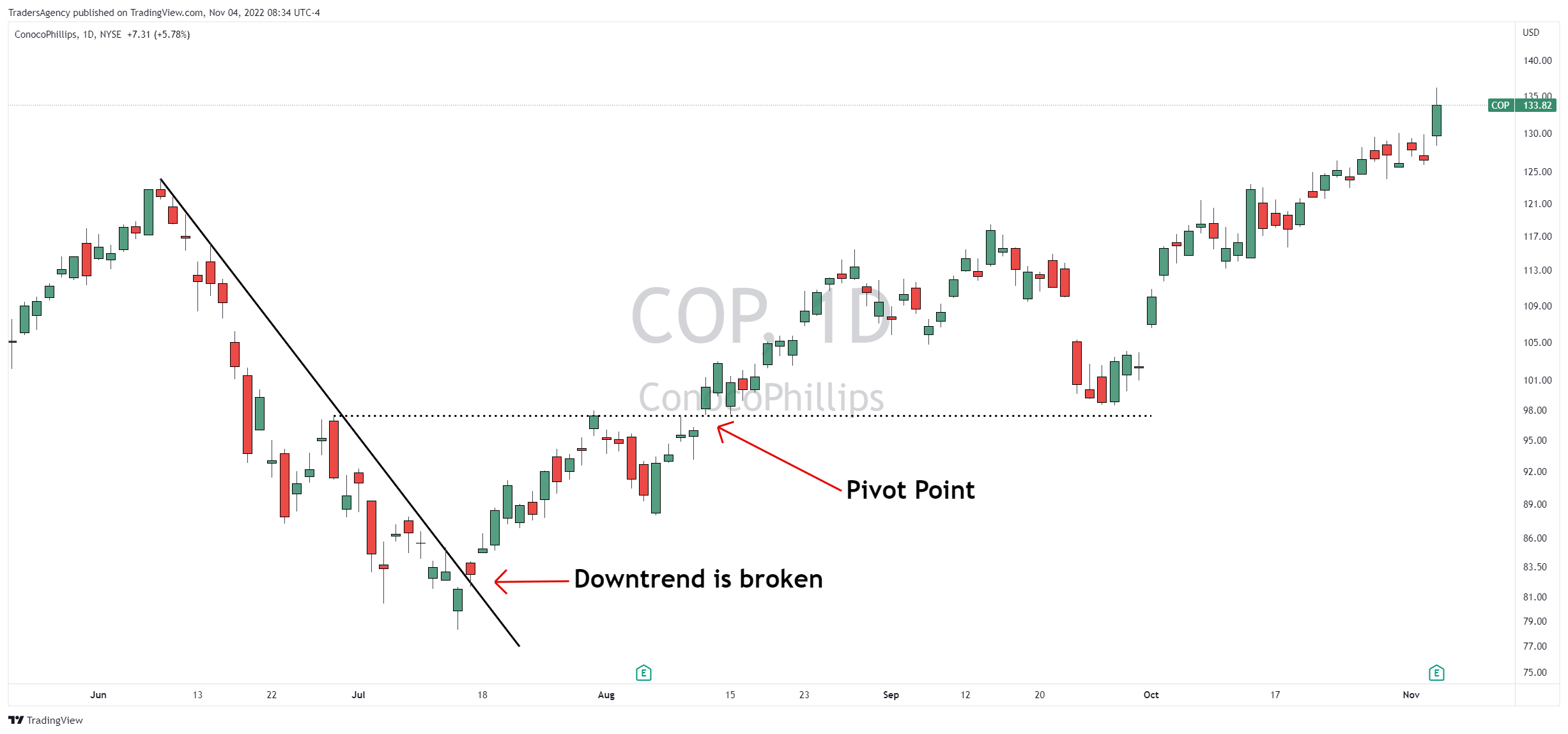

When looking for a pivot, I like to see price get tight.

In other words, I want to see the daily candles get smaller and close together.

I also look for a resistance level. This will be the price level that the stock is having trouble getting above.

In the case of ConocoPhillips, that was the dashed line at about $97.50…

That level then becomes my pivot point.

Once the stock gets above that price, that is where I want to buy.

The Price is Right

If you are right and the stock turns higher, you should know pretty quickly.

With this COP example, price rallied sharply for about six weeks after the pivot point.

And while the stock did pull back in September, it found support right at the pivot level we identified.

Since then, it has had another bullish push that took it to new all-time highs!

This strategy won’t work every time. But it’s the same when you’re wrong…

You should know fairly quickly that you’re wrong, and the loss can be kept small.

This is a far superior approach to blindly buying stocks when they’re in freefall.

Unfortunately, that’s what most investors do. But most investors lose money…

Follow the Insiders

Now, there’s another way to know when the selling has gone too far and the buyers are ready to step back into the market…

When corporate insiders like CEOs, CFOs, executives and board members put down their own hard-earned money to buy shares of their own companies, it’s a huge vote of confidence.

After all, these folks have a footing of knowledge about their companies that Main Street investors simply do not.

It’s absolutely free to attend, so I really hope you’ll join me.

I’ll cover my strategy for trading alongside corporate insiders and generating potentially massive gains with less risk.

I look forward to seeing you there!

Embrace the surge,

Ross Givens

Editor, Stock Surge Daily