Good morning, Traders!

I’m constantly reminding my students that the market trades in waves. And the Nasdaq 100 E-mini market (NQ) is proving why that’s such an important fact to remember. Right now, the long-term direction for the NQ is up, but the short-term direction is down. I expect the NQ to lose about 1,500 ticks as it falls toward the 14,600 price point.

But that doesn’t mean we’re done with the NQ. My strategy uses the wave movement of the market to help us lock in low prices when the market rebounds. To learn more about how that works, check out my free resources here.

So while the market dips toward a lower price within the short-term timeframe, we’ll keep watching the NQ for signs of bouncing back so we can prep our entry strategy on the way back up.

Let’s go over the timeframe analysis for the NQ so you can see what I mean:Daily Timeframe Analysis

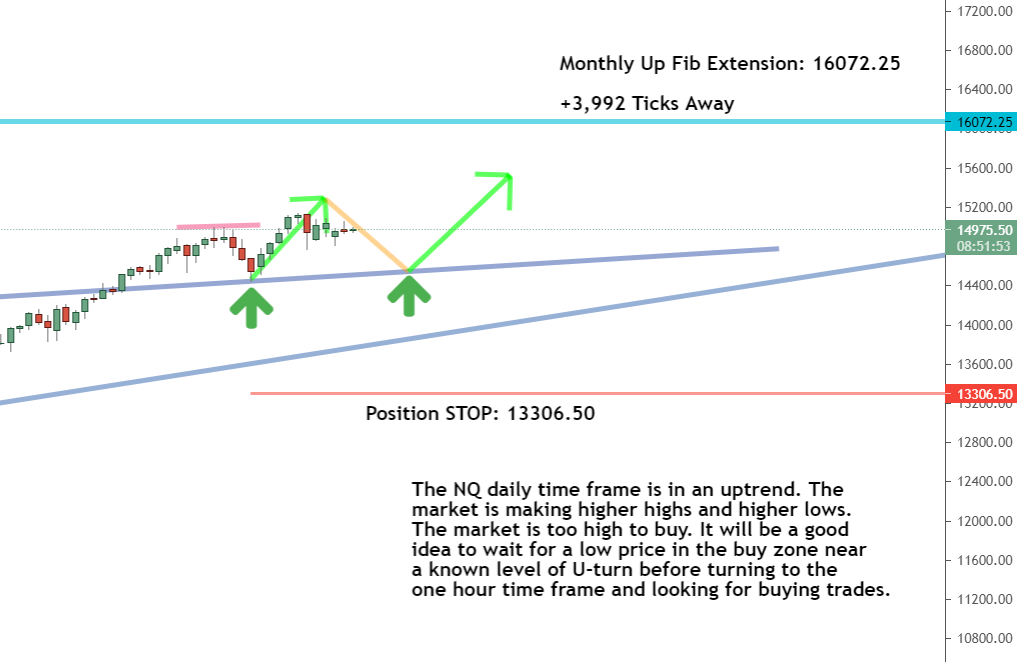

As you can see in the below chart, the NQ has made some decent gains over the last few days, but it’s getting ready to drop back down (follow the yellow line) before it rebounds toward a new high price.DAILY TIMEFRAME

The long-term direction is up for the NQ

The short-term direction of the market is down for the NQ

We’re waiting for the NQ to dip and then U-turn back bullish before we buy

Learn more about the Daily Direction Indicators here…

The NQ is preparing to dip in price after days of pushing bullish

I keep saying it because it’s important: the market trades in waves. So these price dips shouldn’t scare us. In fact, they’re setting us up to buy the market at a lower price before it rebounds and goes higher.

Don’t let these market movements scare you away from trading. Learn how to utilize them to make money!

| Recommended Link:Josh Martinez has become an expert at identifying financial patterns that tend to repeat themselves consistently time and time again. And just as his track record shows, he’s identified a new “Millionaire’s Pattern” emerging right now. The last time an anomaly this BIG was spotted in the financial markets, he was able to shape an initial deposit investment of $500 into $39,282! Based on our research, we are at the starting point of the “Next Big Thing”. Only this time, we’re talking about a far BIGGER,$500-into-$50,000 opportunity… Use this special link to explore Josh’s #1 investment opportunity for 2021 |

One-Hour Timeframe Analysis

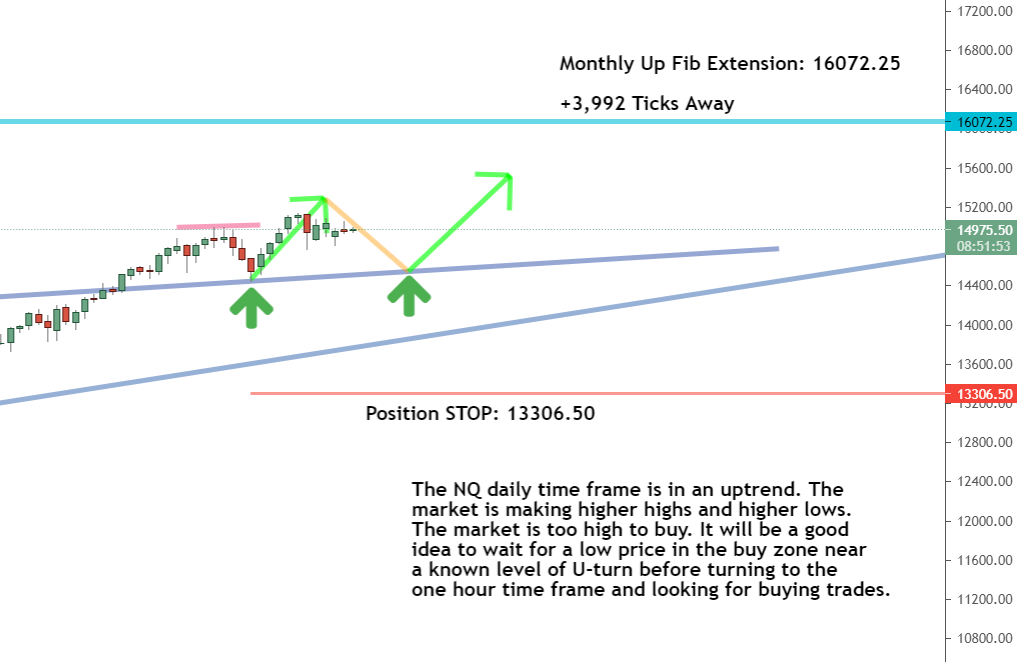

The one-hour timeframe is where we’ll watch the NQ closely as the price begins to drop. This is how we’ll know that the NQ has bottomed out and is getting ready to turn bullish again.

We’ll look for a U-turn. That’s when the market reaches a point where it begins to reverse direction. A U-turn towards a bullish push tells us that the price drop has ended, and the price is rebounding.

Once the price dip bottoms out for the NQ, we’ll look for a U-turn toward bullish before we buy

After we spot a U-turn, we’ll watch for the market to push into the buy zone. When that happens, we’ll prepare our entry strategy so we can buy the NQ and ride the market to a new high price. That’s how we make money with futures trading!The Bottom Line

While the short-term direction is down for the NQ, the long-term is still up. That means the price dip I see coming will be short-lived. There’s no reason to panic. These dips actually give us a chance to reset and prepare for another bullish rally.

Too many traders get pessimistic when a market dips in price, but that’s exactly how this works. We wait for low prices in the market, buy in, and then sell when it hits a new high price. The market dips again, and the process repeats itself all over. So we’ll keep an eye on the NQ via our timeframe charts and wait for the next buying opportunity.

We’ll watch the NQ as it drops in price. Once it rebounds, we’ll be ready to buy into the next bullish push (up green arrow)

So what are you waiting for? Dump the excuses and get started now! Follow along as I reveal the crucial aspects of my trading strategy that will allow you to become a profitable futures trader!

Keep On Trading,

Mindset Advantage: Own It

It’s not the market. It’s not your indicator. It’s you. Own it.

‘Oh that one was a mistake’…. and then there’s ‘I had the settings on my indicator wrong’… or our personal favorite: ‘I was trying an experiment’…

Like a 7th grade English teacher, after a while you hear them all. The number one thing we look for when working with a new trader? Accountability.

Own where you’re at with your trading. Embrace the failures and the setbacks. Stare them in the face with an unflinching honesty.

Only then will you conquer and advance to consistent profitability.Traders Training Session

Understanding Trading Margin and Managing Losing Trades

The post Don’t let this market movement scare you… appeared first on Josh Daily Direction.

1 Comment

August 4, 2021 @ 10:07 pm

Thank you and respect !!!