Back on Aug. 26, the market got hit by a sharp Friday selloff.

The S&P 500 dropped 3.4%, while the Nasdaq 100 lost 4.1% and the Russell 2000 fell 3.3%.

Sparking the decline were comments by Federal Reserve Chairman Jerome Powell about the Fed’s path of interest rate hikes.

Powell set the tone for another big rate hike, which came as a surprise to the market.

In turn, stocks sold off and have continued to trend lower since then.

Well, we’re now just hours away from the Fed’s actual decision and the press conference with Chairman Powell.

Here’s why today’s announcement is so important…

The Big Day is Here

The Federal Reserve kicked off its latest policy meeting yesterday, and it will conclude the meeting today with a decision on monetary policy and the news conference with Chairman Powell.

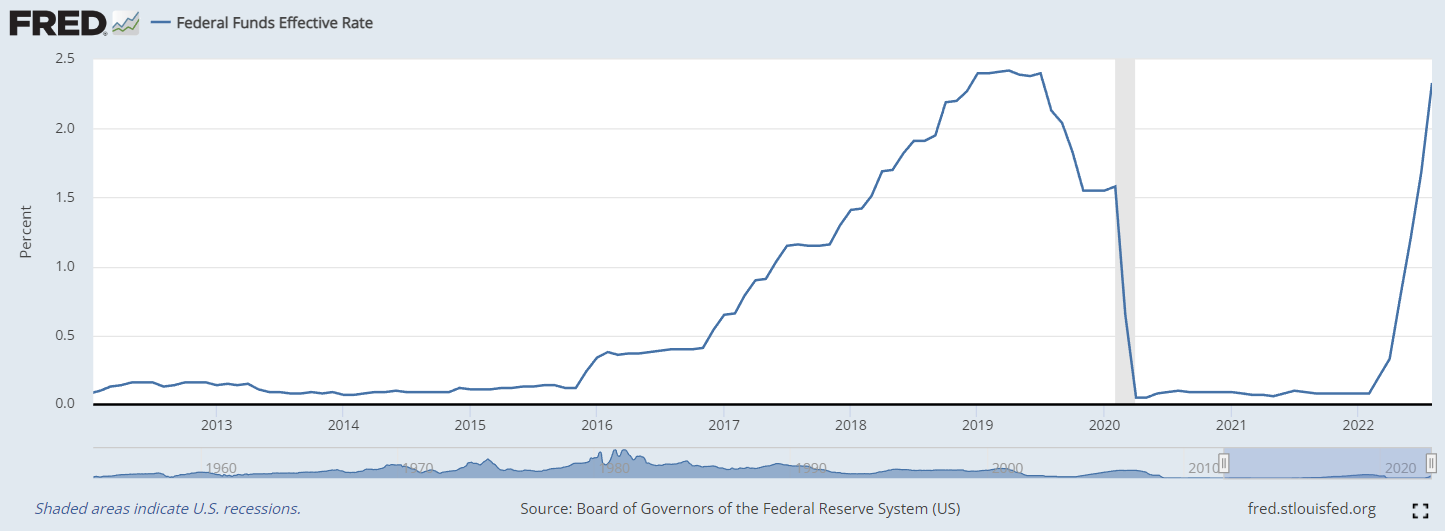

Most market participants are expecting another 75-basis-point (0.75%) rate increase today, which would bring the Fed funds target rate to a new range of 3%-3.25%.

Unfortunately, inflation continues to reveal itself as worse than expected.

And as you can see in the chart above, the Fed has already been raising the Fed funds rate aggressively this year to levels not seen since 2019.

As regular readers know, higher interest rates are bad for stocks, but excessive inflation is also not good for the economy or the markets.

So, the Fed is trying to walk a fine line by managing inflation without wrecking the markets.

Want to Trade the Fed Move?

Now, here’s why today’s meeting is so important…

If you’re a short-term trader, Fed meeting days are abound with opportunities for short-term gains.

Typically, there is a big move in the markets around the time of the policy announcement.

And there are usually further tradable opportunities later on in the session depending on what happens at the news conference.

This brings me to my colleague and expert trader Josh Martinez, who has developed the Tunnel Trading strategy for finding and acting on intraday opportunities..

Utilizing this strategy, Josh has been identifying short-term trading opportunities in both up and down markets.

And luckily for you, he’s hosting a special introductory session today at 12 p.m. ET– ahead of the Fed announcement — to tell you exactly how to get started.

Embrace the surge,

Ross Givens

Editor, Stock Surge Daily