Stan Weinstein is one of the godfathers of technical analysis.

His book, Secrets for Profiting in Bull and Bear Markets, is on my desk as I type this.

It’s one of my favorites.

Sam was a big proponent of stage analysis, which I have written about in length.

As regular readers know, we buy in Stage 2. And we sell in Stage 4.

But what is the ideal entry point?

How do you know if you are too early or too late?

The Ideal Short Sale

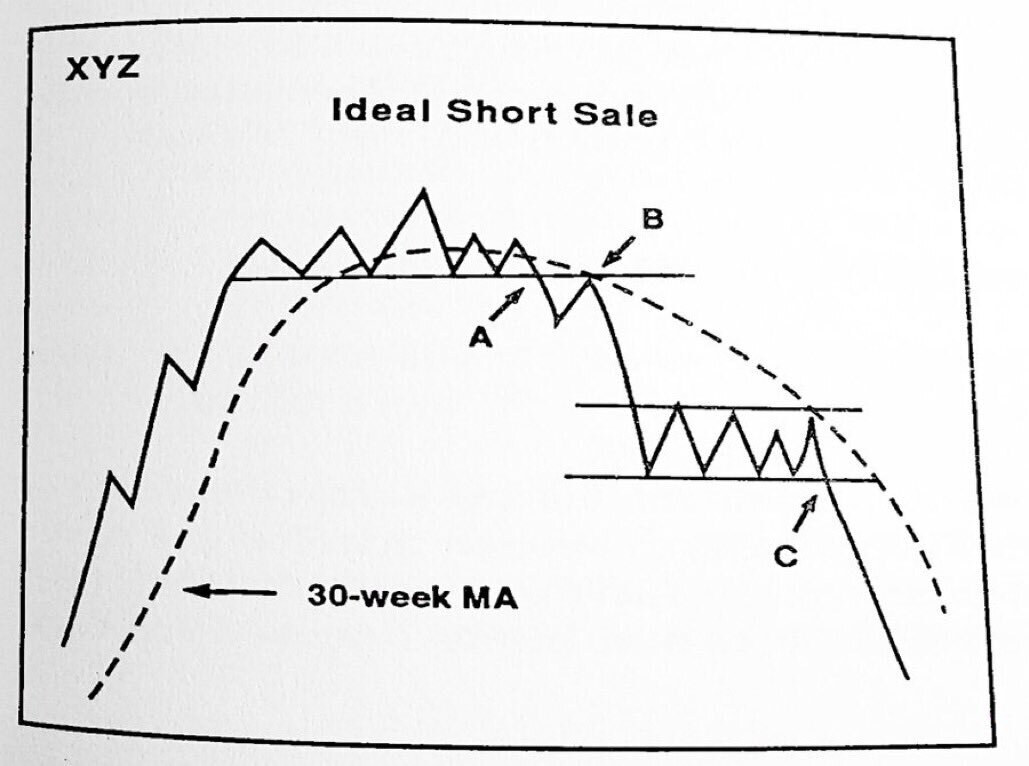

The image below is from Stan’s book…

It identifies three entry points for selling a stock short.

Those of you who have attended my live Stealth Trades sessions are no doubt familiar with the four stages of the stock cycle.

You can probably point them out on the chart.

You know that points A and B are the beginning of Stage 4. Point C is a continuation of that decline.

The Initial Breakdown

Sell point A is essentially a breakout, but in reverse.

Instead of waiting for a stock to break higher above resistance, you short it when it breaks down through support.

If you miss that entry, you generally get a second chance on the re-test at point B.

Inexperienced investors who have been trained to “buy the dip” will often step in when a stock gets cheap and push it back to the previous breakout level.

This is one of my favorite places to sell a stock short.

The previous support level now serves as resistance, and the stock is likely to fall again when it touches that level.

The Last Leg Lower

The third place to sell short is point C.

Just as stocks offer multiple buy points on the way up, they do the same thing on the way down.

After a significant drop in price, the stock will consolidate in a tight range to form a base.

This is the result of short sellers covering their positions and other investors adding to their positions on the dip.

(This is a terrible strategy by the way. Just take a look at Cathie Wood’s ARK Innovation ETF (ARKK) and you’ll see what I mean.)

In any case, once the base fails and the stock breaks through the low, point C is another high probability area to enter a short trade.

Join Today’s Live Session

Now, if you are looking for a way to navigate this bearish market landscape, check out my premium Alpha Stocks trading service.

We have plenty of long ideas for the right stocks…

We recently generated a gain of 21.3% in just 15 days in Permian Basin Royalty Trust (PBT) as that stock broke out of its range, and another winner in Enphase Energy, Inc. (ENPH) for a quick gain of 22.5%.

And earlier this month, we closed out our position in Catalyst Pharmaceuticals, Inc. (CPRX) for a solid return of 11.5%.

But we’re also not afraid to go short… We recently recorded a 21.6% gain on the downside in only eight days as Pegasystems Inc. (PEGA) stock plunged…

Of course, we also get together every Monday for an hour-long live session so that subscribers can ask questions and get guidance about our trades.

If you’re ready to see what you could be missing out on, I’m holding a special session this afternoon in which I’ll discuss my strategy in more detail…

Just click here to register and learn more about Alpha Stocks now!

Embrace the surge,

Ross Givens

Editor, Stock Surge Daily