Happy Wednesday, Daily Direction readers!

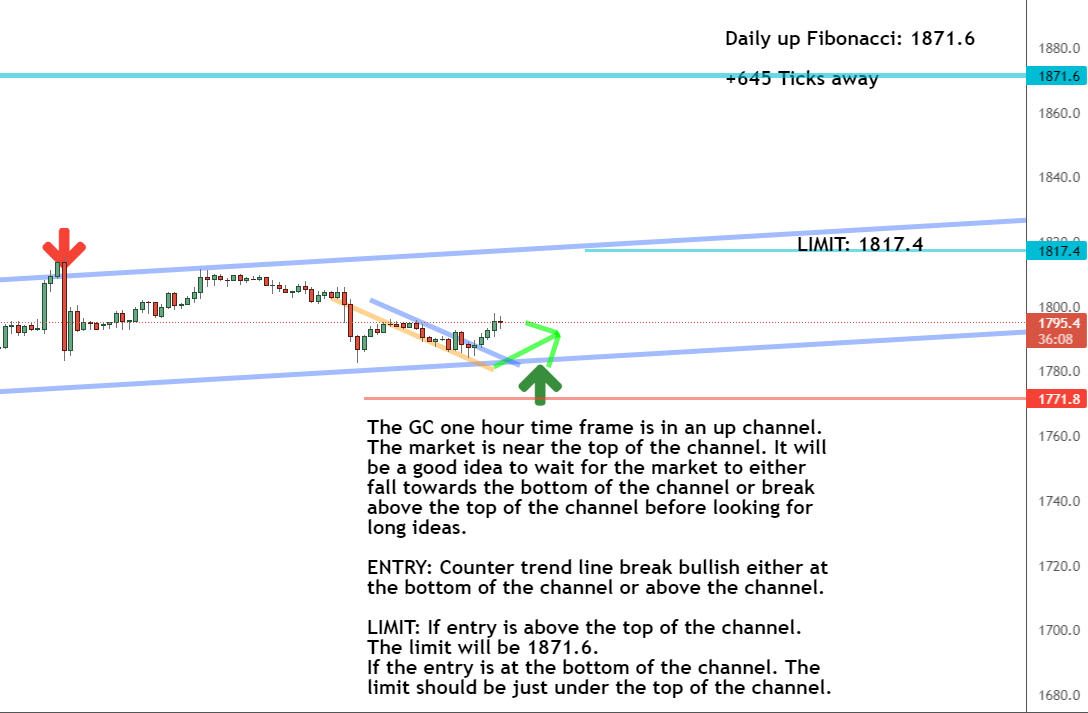

It’s time to take a look at the gold futures market (GC) again as the short-term direction is now up!. We recently talked about how we were out of the GC thanks to the market hitting our limit. Now, the price has dropped toward the bottom of the channel and is rebounding back up.

The daily timeframe is still moving upward, meaning the market is in a position to give us opportunities to trade in the long run. Within the one-hour timeframe, the GC has started to turn around. We’ll just need a counter trendline break bullish to give us an opportunity to buy the market.

We’ll keep looking for chances to buy the GC at low prices as it makes its way back into the buy zone at a low price.

Daily Timeframe Analysis

The market is currently heading upward on a daily basis, indicating that our long-term outlook remains favorable.

We’ll keep an eye on the one-hour timeframe for new market entries as long as the GC holds to an upward trend.

The long-term direction is up for the GC

The short-term direction of the GC is now up

The GC has rebounded off the bottom of the channel

Learn more about the Daily Direction Indicators here…

Within the daily timeframe, the GC continues on a positive path

Keep in mind that in many markets, we utilize trendlines to identify when we should enter a trade. Without the data supplied by the trendlines, we wouldn’t be able to make such predictions. That’s why drawing trendlines accurately is so important.

One-Hour Timeframe Analysis

While we’ve been out of the GC thanks to the short-term direction being down, the one-hour timeframe now reveals that the market has bounced off the bottom of the channel. It’s showing signs of a bullish push back toward the top.

That means the short-term direction is now up, and we can start looking for opportunities to execute our buy-in strategy for the GC!

The GC has bounced off the bottom of the channel and is now rebounding back toward the top

Also, if you’re looking to figure out what futures trading technique to utilize, have a look at what I have to offer. It’s the only way to put what I teach in the Daily Direction into practice in the real world!

The Bottom Line

Now that the short-term direction is up for the GC, we can follow our timeframe charts and look for opportunities to buy the bullish push at low prices as the market moves across the buy zone and toward the top of the channel.

As evidenced by our charts from the last few days, these market changes can happen quickly. That’s why it pays off to pay attention to the data!

Things are looking up for the GC!

If you’re already trading with one of my strategies, you can now apply this information to a setup for the GC market. But if not , now is the time to get in and begin making more profitable trades. There’s no reason you can’t start right away!

But before you go: you need to take a look at something that has the potential to put an extra $400 to $1000 a day in your account. I know it sounds impossible, but it all makes sense once you understand it! Here’s how to find out more.

Keep On Trading,

Mindset Advantage: Accept

It’s not the market. It’s not your indicator. It’s TRADING.

Let it go. The first step toward consistent profits comes when you accept the reality that losses will occur. Prices have a mind of their own at times. The institutions are at the wheel. The sooner you accept this, the more progress you’ll make.

Look at the past, but don’t stare. Accept what’s happened and move on.

Target tighter entries. Get the heck out of those losers you’re hanging on to.

Accept. And start to enjoy trading.

Traders Training Session

Anticipating Future Market Price Direction

Stay tuned for my next edition of Josh’s Daily Direction.

And if you know someone who’d love to make this a part of their morning routine, send them over to https://joshsdailydirection.

The post When the Short-Term Direction Shifts Up, Here’s What to Do appeared first on Josh Daily Direction.