Good morning, Traders!

The E-Mini Russell 2000 (RTY) looks to be setting up for a retracement (temporary price drop) in the short term, so I’m recommending that we wait and see which direction the market will go before we get back in.

While the long-term direction is still bullish for the RTY, the one-hour timeframe reveals that the price could drop before continuing its rally. But that’s not necessarily a bad thing. We want lower prices that allow us to buy into the market as it continues its overall bullish trend. Read my bonus material on predicting future price direction to better understand how it all works!

Making the decision to stay out of a market temporarily can be tough. But in the long run, it’s the right call. If the market does retrace, we’ll simply wait for a U-turn back toward a bullish rally and buy-in! U-turns are like signposts that alert us to when the market is done with a direction change and is headed back in the opposite direction. You can read more about market patterns here.

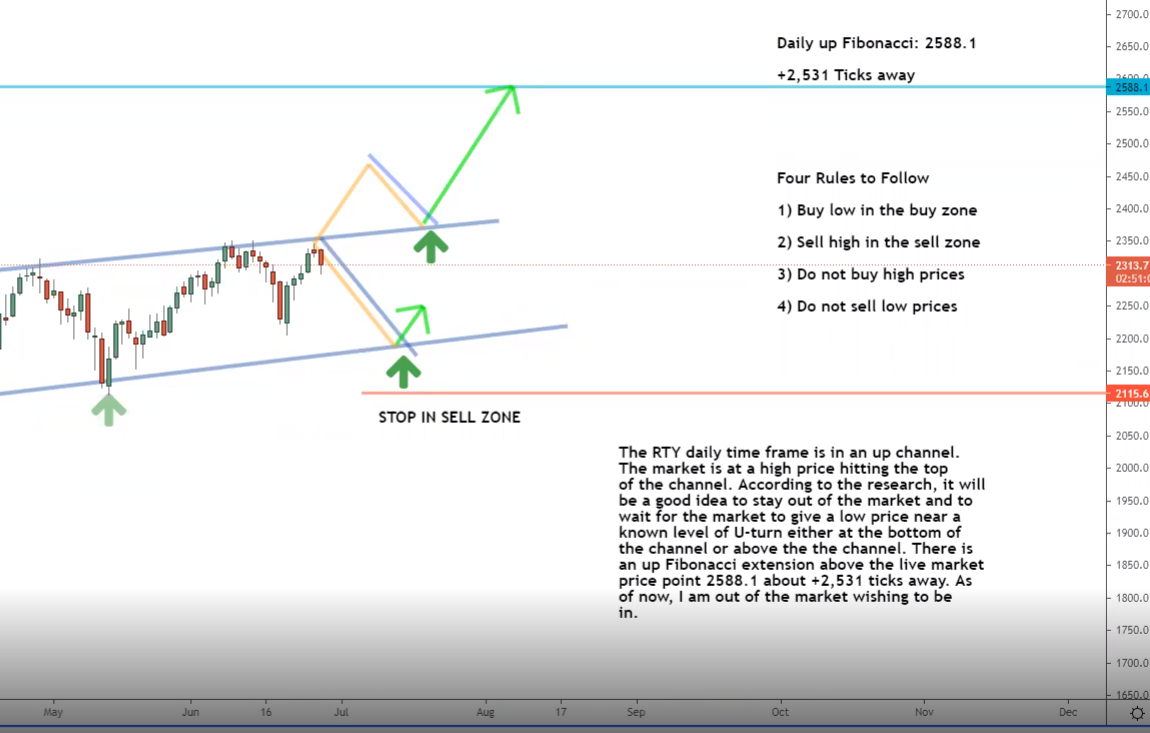

Now let’s take a look at the RTY timeframe analysis to understand what’s happening in the market:Daily Timeframe Analysis

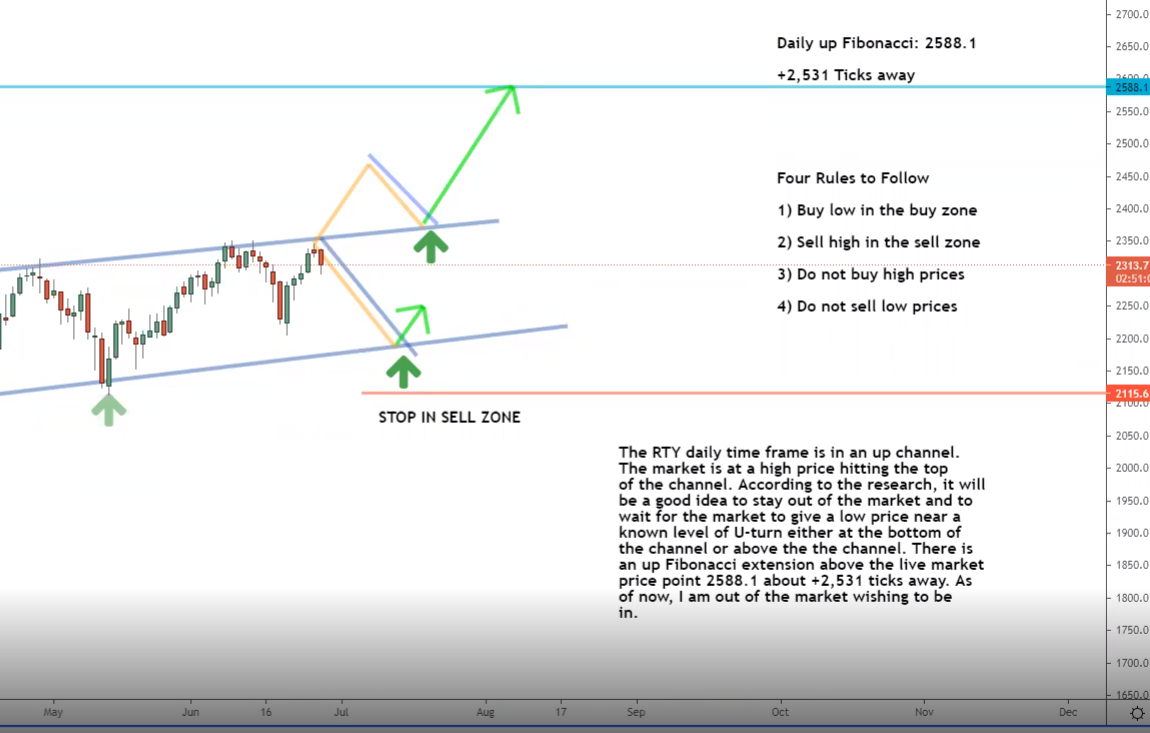

The RTY is still in an up channel, with the market’s overall direction remaining up in the daily timeframe. But if you look closely at the chart, you can see that the price has hit the top of the channel.DAILY TIMEFRAME

The direction within the daily timeframe is up

The one-hour timeframe is looking bearish

We’re waiting to confirm the short-term direction of the RTY

Learn more about the Daily Direction Indicators here…

While the overall direction for the RTY is up in the long term, we’re likely to see a retracement before the next rally

One of two things is likely to happen. First, the market could bounce off resistance and retrace back toward support (downward yellow line). Second, the price could push past resistance and continuing rallying before retracing. I believe the first scenario is likely given the history of the market in this chart.

| Recommended Link:We can’t believe why almost no one is talking about this. It’s potentially the BIGGEST investment news of the decade. Today, we’ll show you how accessing a little-known portal in your brokerage account… Is the key to potentially amassing a quick fortune. You can start with a minimum average investment of just $500… And turn it into a mind-blowing $50,000 payout! All because the Chicago Mercantile Exchange (known as the “Merc”), the giant 171-year old trading marketplace, effectively turned the investing world on its head. Overnight, they created a lucrative loophole so big it lets thousands of ordinary, hard-working Americans earn huge sums of extra cash. |

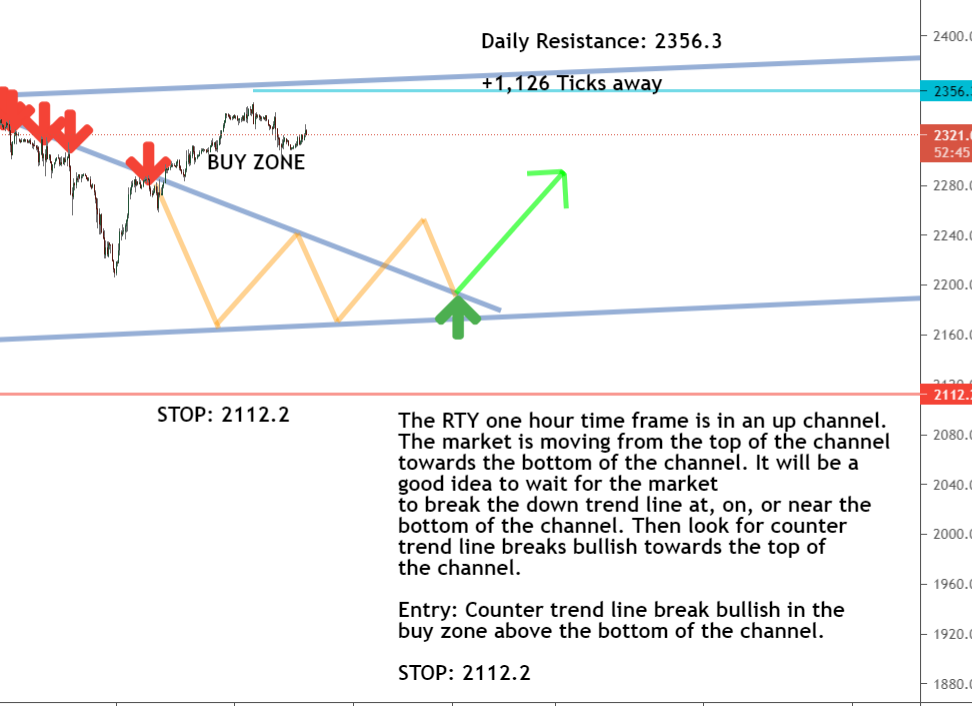

One-Hour Timeframe Analysis

The one-hour timeframe analysis confirms the data from our daily timeframe chart. The RTY is close to the top of the channel and is pushing near resistance. At some point, we’ll see a retracement back down toward support before the next rally. Remember that a retracement is just a temporary price dip.

We’re waiting for the RTY to head back down toward the bottom of the channel (lower grey line) before its next rally

The smart thing to do is wait and see what the RTY plans to do. Once we have a new low price, followed by a U-turn back toward a bullish run, we can then look to execute our entry strategy.The Bottom Line

We’re waiting to see when/if the RTY will drop back toward the bottom of the current channel. Once that happens, we’ll turn to our timeframe charts and look for a U-turn toward bullish territory. A U-turn alerts us to the fact that the market is making another push toward a bullish rally.

Don’t forget that the long-term direction for the RTY is positive. This is just another example of the market trading in waves! To learn more about how market direction works, check out this article I wrote.

Right now, we’re going to stay out of the RTY until the price settles lower and forms a U-turn

You now have what you need to better understand the RTY market, but do you know how to actually make money from it? I’ll show you how it all works! You just have to make the decision to get started.

Keep On Trading,

Mindset Advantage: Be Positive

Eliminate words like failure and loss.

It’s now all a learning experience.

That wasn’t a loss – just a new way NOT to do something.

That wasn’t a failure – just a way to manage expectations.

It’s ALL good.

Onward!Traders Training Session