It’s Monday, fellow traders!

And that means it’s time to prep our strategy and jump into the futures market. Today, we’re tracking the Nasdaq 100 E-mini (NQ).

We’ve followed this market for the last few days, waiting for the NQ to move back into the buy zone. And based on the current timeframe analysis, it looks like we’re finally there.

One of the most important things about my strategy is waiting for a market to enter the buy zone before trading it. That reduces our chances of entering a bad trade and increases the likelihood of making a profitable trade.

Right now, the NQ has eased into the buy zone. If the market can stay about the current trendline, we’ll utilize our buy-in strategy and start trading the NQ!

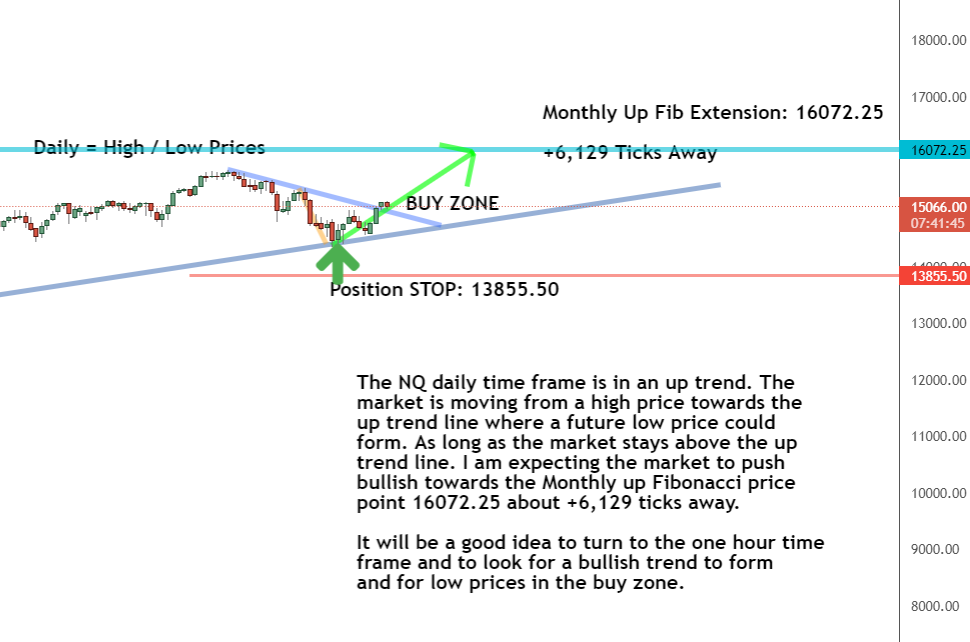

Daily Timeframe Analysis

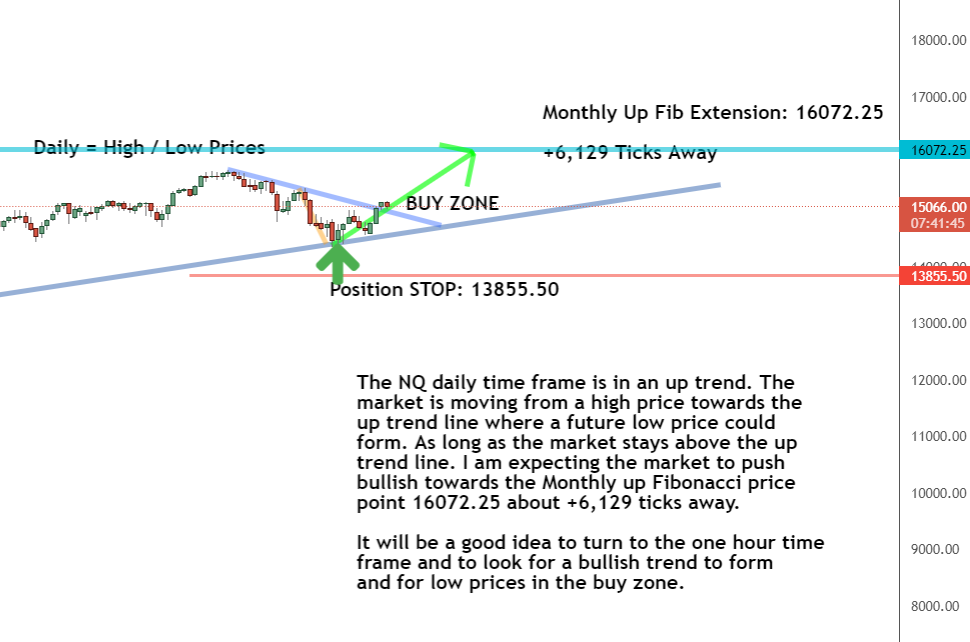

The NQ has finally pushed into the buy zone after breaking the trendline within the daily timeframe. If the market can stay above that line, we’ll expect it to move through the buy zone toward the 16072.25 extension.

The long-term direction is up for the NQ

The short-term direction of the NQ is up

The NQ is moving into the buy zone!

Learn more about the Daily Direction Indicators here…

The NQ is finally entering the buy zone as it breaks the trendline and moves toward the 16072.25 extension

If we follow the overall trend in this chart, we see that the market’s direction is up. That means we can take the data from our daily timeframe and move to the one-hour timeframe analysis to prepare for buying the NQ!

One-Hour Timeframe Analysis

Looking at the one-hour timeframe, the NQ has edged into the buy zone just above the down trendline. We’ve been waiting for this move for a few days now. If the market can fully close above that line, we’ll be ready to look for opportunities to buy the NQ as it makes its way to the 16072.25 monthly up Fibonacci.

With the NQ entering the buy zone, the short-term direction for the market is now up

Now that the NQ has entered the buy zone, we can say that the short-term direction is up. That means the market should present buying opportunities as it moves toward higher prices. Having a good entry strategy is crucial to getting this trade right!

The Bottom Line

Both the short-term and long-term directions for the NQ are now up. The market is entering the buy zone above the down trendline as it prepares to move higher toward the 16072.25 price point.

As the market tracks through the buy zone, we’ll look for opportunities to buy the market at low prices. If the NQ stays above that trendline, we’ll see a solid bullish run toward the Fibonacci extension.

If the NQ can stay above the trendline, we’ll actively look to buy the market

This trade is an example of why following my strategy is critical to making the best decisions for entering a market. Without it, you won’t have the foundation you need to increase your chances of making money in the market! So it’s time to stop putting this off. Join me now to start growing your trading account!

And before you go, I need you to check out this strategy that can put you on the winning side of losing trades. I know it sounds crazy, but it makes total sense once you understand it! Here’s how to learn more.

Keep On Trading,

Mindset Advantage: Acceptance

It’s not the market. It’s not your indicator. It’s TRADING.

Let it go. The first step toward consistent profits comes when you accept the reality that losses will occur. Prices have a mind of their own at times. The institutions are at the wheel. The sooner you accept this, the more progress you’ll make.

Look at the past, but don’t stare. Accept what’s happened and move on.

Target tighter entries. Get the heck out of those losers you’re hanging on to.

Accept. And start to enjoy trading.

Traders Training Session

Trading Longer Time Frames vs Shorter Timeframes

Stay tuned for my next edition of Josh’s Daily Direction.

And if you know someone who’d love to make this a part of their morning routine, send them over to https://joshsdailydirection.

The post We’re Closing Above the Trendline in This Market appeared first on Josh Daily Direction.

1 Comment

October 20, 2021 @ 3:39 pm

Longer time frames vs Shorter time frames — The video is not playing . It says ink is invalid.