Hello, Daily Direction readers!

The Nasdaq 100 E-mini (NQ) is so close to turning up for the short-term direction. Right now, the long-term direction remains positive, but we’re waiting for the short-term market to break into the buy zone before we consider buying the NQ.

It’s important to note that we won’t plan to take any long positions in the market until we see it break into the buy zone. After that, we expect the market to fall into a major bearish reaction.

While it can be difficult to predict future price direction, my timeframe analysis allows us to accurately see how a market will react in both the long term and short term. Armed with that knowledge, a trader has the chance to increase their win ratio and bring home some serious profits!

Now let’s look at the Nasdaq 100 E-mini timeframe analysis:

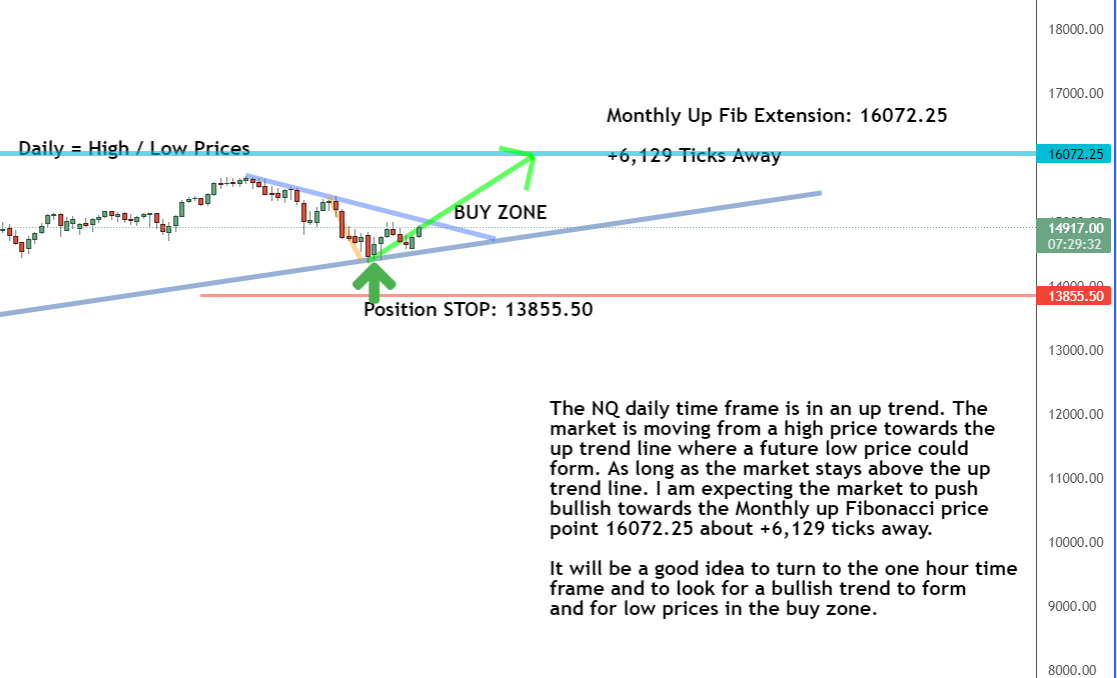

Daily Timeframe Analysis

The NQ is clearly headed for the buy zone in the daily timeframe chart. The NQ held at support, which allowed it to rebound and head back toward our next high price. The market is preparing for a counter trendline break as it draws closer to the 16072.25 price point. That would be a +6,000 tick movement!

The long-term direction is up for the NQ

The short-term direction of the NQ is down

The NQ is headed for a counter trendline break

Learn more about the Daily Direction Indicators here…

The NQ’s daily timeframe chart shows the market headed for the buy zone

Based on the daily timeframe chart, we’ll wait for the counter trendline break and then turn to the one-hour timeframe to look for buying opportunities within the NQ.

One-Hour Timeframe Analysis

In the one-hour timeframe, the NQ is below the short-term down trendline (the top blue line). But you can clearly see the market making it’s way back toward that line.

The one-hour NQ is below the short-term down trendline. The market is getting closer, so we should wait for it to break that line before buying

Until we see the market break the trendline, we’ll hold off on taking any long positions within the NQ. But once that happens, we’ll prepare our entry strategy and ride the next bullish push.The Bottom Line

The NQ is close to getting back into the buy zone for the short-term direction. Once that happens, we’ll execute our buying strategy and look to make money from the upcoming bullish run. But after that, we should prepare for a major bearish reaction within the NQ!

The long-term direction for the NQ is up as we wait for the short-term to move into the buy zone

As a trader, following my futures trading technique is extremely beneficial. You’ll learn when it’s a good idea to enter a market and when it’s preferable to stay away. I know you’re itching to get started making smart trading selections right now, and today is the day to make it happen. There’s no need to put it off any longer!

Keep On Trading,

Mindset Advantage: Accept

It’s not the market. It’s not your indicator. It’s TRADING.

Let it go. The first step toward consistent profits comes when you accept the reality that losses will occur. Prices have a mind of their own at times. The institutions are at the wheel. The sooner you accept this, the more progress you’ll make.

Look at the past, but don’t stare. Accept what’s happened and move on.

Target tighter entries. Get the heck out of those losers you’re hanging on to.

Accept. And start to enjoy trading.

Traders Training Session

Trading Longer Time Frames vs Shorter Timeframes

Stay tuned for my next edition of Josh’s Daily Direction.

And if you know someone who’d love to make this a part of their morning routine, send them over to https://joshsdailydirection.

The post We’re Close to Getting Back into This Market appeared first on Josh Daily Direction.