Hey friend,

Too many traders were expecting the Fed to cut rates as early as March.

Now cold water is being thrown on those expectations, causing this perfectly healthy pullback to drag on longer.

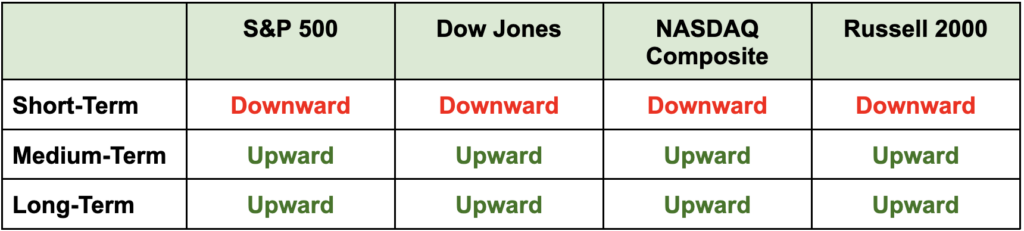

The Daily Direction

Note: Indexes ended yesterday lower, with all their short-term directions now downward. As we said a couple weeks ago, this was to be expected.

The Daily Nugget

The best times to buy will ALWAYS be the most difficult.

This is true by its own definition.

If it was easy to buy during these times, then everyone would do it…

Which would in itself make it a bad time to buy.

The reality is, by the very nature of the market itself, the best times to buy will ALWAYS be the most difficult.

Look at the situation we’re in now – smack dab in the middle of a prolonged pullback.

After the sizzling market action in the last two months of 2023, buying in right now – when the market has largely been moving sideways – is much less emotionally appealing.

Sentiment is much less enthusiastic, and that affects everybody – even the most seasoned traders.

But the truth is, it’s precisely sentiment like this that makes it the best time to act.

Remember that the market started rallying hard last November when sentiment was at its lowest – not highest.

That’s why Ross Givens is still aggressively going after the market leaders…

The Traders Agency Team