Hey friend,

Markets aren’t moving much – but this morning’s Personal Consumption Expenditures data, the Fed’s preferred inflation gauge, should give markets something more substantial to digest.

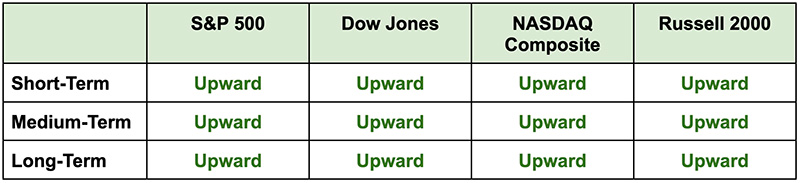

In the meantime, let’s see where the index directions are headed.

The Daily Direction

Note: All indexes closed lower yesterday, but not low enough to affect the 100% upward index directions.

The Daily Nugget

Being able to gauge market sentiment is an incredibly powerful trading skill.

Some people think that what they feel about the market is what market sentiment is.

Others just glance at the price action and make automatic assumptions about sentiment.

But truly skilled traders know how to look beneath the surface, studying various factors to get the most accurate gauge of market sentiment possible.

This is hugely important, because being able to accurately gauge market sentiment allows you to time some of the biggest opportunities out there…

Like when Ross Givens saw bearish sentiment peaking in late October – which allowed him to perfectly call the huge rally that came right after.

And now, Ross is seeing some very bullish signs of market sentiment – which creates some fast opportunities we can take advantage of.

That’s why later today at 12 p.m. Eastern…

Ross is going LIVE for a masterclass on his “insider” strategy that will allow you to target little-known fast opportunities right now.

Few can recognize these opportunities because they rely on “unexpected” market-moving catalysts in individual stocks…

But Ross’ “insider” strategy allows you to identify them by leveraging the power of corporate insiders.

This strategy’s most recent pick is now up over 58% in just two weeks…

But with bullish market sentiment persisting, this could just be the start.

So please click here to save your seat for Ross’ masterclass before registrations hit their limit…

And we’ll send you the login details shortly.

Ross will see you soon.

The Traders Agency Team