Good morning, Traders!

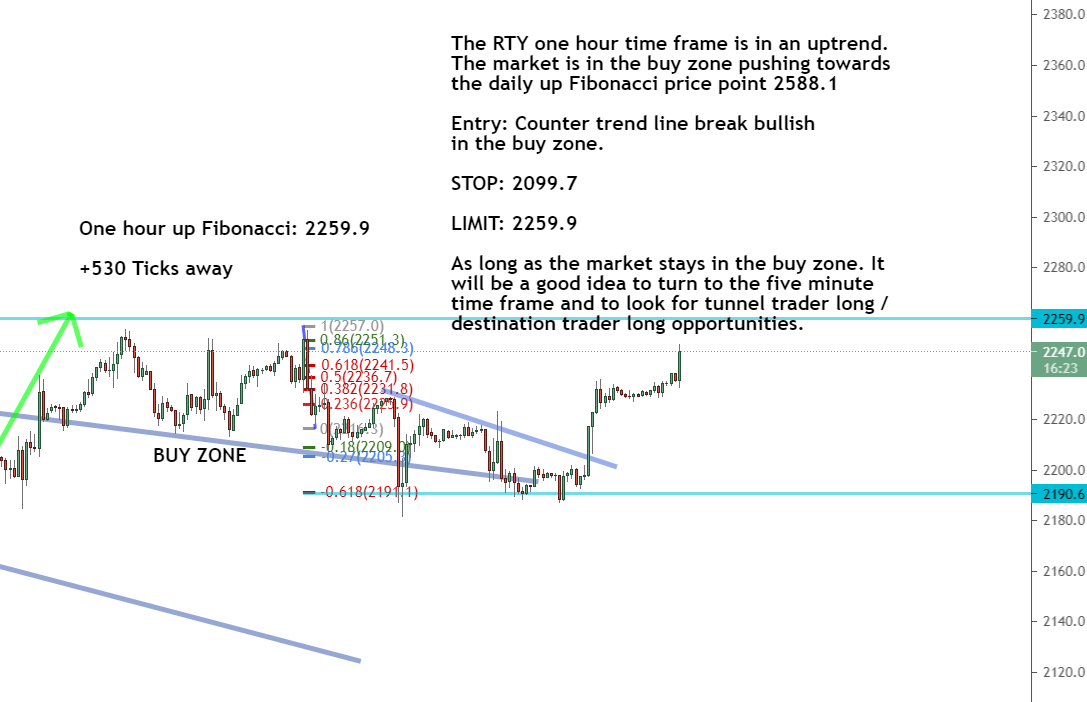

The E-mini Russell 2000 (RTY) is looking strong as the long and short-term directions remain up! The market fulfilled the down Fibonacci extension beautifully, has broken the counter trendline, and is headed to a high price of 2259.9.

I mention counter trendlines a lot, and that’s because they’re critical to when and how we enter the market. The RTY is now providing a prime example of how a counter trendline break helps us plan our entry strategy. This free resource I created will help you see how we use counter trendline breaks for entering the market. Be sure to check it out!

The RTY looks solid and is making its way to higher prices within the buy zone. That means we have plenty of opportunities to look for buy-in options as we prepare to make some profitable returns on this market!

But before we can jump in, we need to look at our timeframe analysis for the RTY:Daily Timeframe Analysis

The RTY right now is a textbook case of a proper U-turn and counter trendline break, as shown by the daily timeframe chart.

The market U-turned after a recent retracement (dark green arrow) and broke through the counter trendline (short, diagonal grey line ) to push bullish into the buy zone. That tells us the market is ready to move toward a higher price as the buyers take control. DAILY TIMEFRAME

The daily timeframe shows that the RTY is moving upward

The RTY one-hour timeframe shows positive movement

The RTY has made a solid U-turn and pushed through the counter trendline

Learn more about the Daily Direction Indicators here…

The RTY has U-turned off support (dark green arrow), pushed through the counter trendline (short, grey line), and is bullish into the buy zone!

Once we confirm that the daily timeframe is showing us the market is headed to a new high price, we can turn to the one-hour timeframe and look for a chance to buy the market! We can’t make money unless we spend it first…

| There’s a lot of backroom whispers going on right now that are saying if a stimulus deal isn’t reached soon that we might end up with a major contraction in the markets.

But Josh has identified an opportunity that can help you turn that potential contraction into big profit potential. If you aren’t always quite sure about what to do in the current environment, we have VERY good news for you. Expert trader Josh Martinez keeps uncovering increased trading opportunities like crazy, and they could happen at ANY moment. Click Here to Learn How to Get Started Today While the Market Conditions are so Ripe for the Picking. |

One-Hour Timeframe Analysis

As you can see in the one-hour timeframe chart, the RTY is rocketing toward the up Fibonacci extension of 2259.9. The overall trajectory of this market is impressive! The upward movement has been solid, and it looks like the RTY is going to keep pushing bullish through the buy zone.

But remember that we want to buy the market at low prices. Resist the urge to jump in blindly without a plan just because the market is up. That’s a surefire way to lose money! Instead, utilize my strategy that takes all of the information from these charts and puts them to work!

The RTY is making a solid push toward the Fibonacci extension of 2259.9

We’ll monitor the RTY one-hour timeframe as we look for ways to jump in, buy low, and then sell when the market hits its high price and prepares for a retracement.

The Bottom Line

The directions for both the long-term and short-term are up for the RTY market. The RTY broke the counter trendline and is heading for a new high price of 2259.9

This is a good example of how my trendline process reveals opportunities in the market that will help you grow your trading account. But it only works if you use it!

The RTY will continue to push higher as it looks to hit the up Fibonacci through its current bullish run

Are you prepared to take advantage of the current trading situation now that you have a better understanding of the RTY? Check out my resources to learn how to become a real futures trader who profits from the market. If you follow my method, you’ll see that it’s not as difficult as you may think!

Keep On Trading,

Mindset Advantage: Pace Yourself

You can’t make a full-time career in a day, but you can blow it in a minute.

Slow the [insert word of your choice] down! Time and time again, we talk to traders that YOU JUST KNOW are thinking…. ‘Boy I’ll never retire at this pace.’

What comes next is as predictable as death, taxes and your mother-in-law’s glare. Contracts go from one… to three… then five or more. Stops get pushed back. Losses pile up. More trades take place to cover those losses.

And then it’s over. Good night Irene – the account has been cleared.

Just pace yourself. There’s plenty of money and plenty of trades to take. Stick to your risk/reward ratio. Hold to those stops.

Take the losers with the winners and become consistent.

Build your empire with time and care!Traders Training Session

This is why the Nasdaq is so popular

The post This is what tells us to buy… appeared first on Josh Daily Direction.