Good Morning, Traders!

I’m going to show you what indicators and setups I use to prepare my charts today.

I understand that dealing with all of the data for trading may be overwhelming, so I wanted to take some time to give you some real advice that will help you become a better trader.

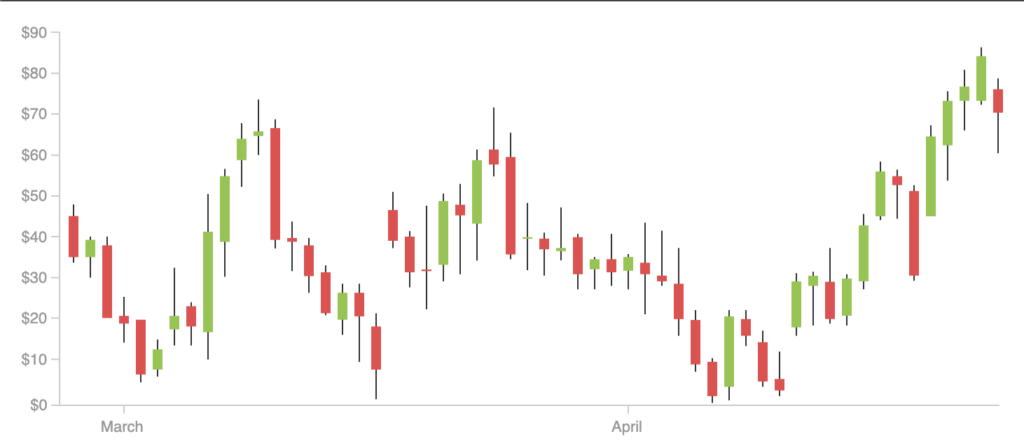

Properly setting up my charts is a critical part of becoming a successful trader.

We wouldn’t be able to know how or when to enter a market without our timeline charts!

And, while it may feel intimidating at first, I’m going to show you how simple it is for any trader to use those timeframe charts.

Let’s take a look at how I set up my timeline charts so you can leverage my information to boost your own success:

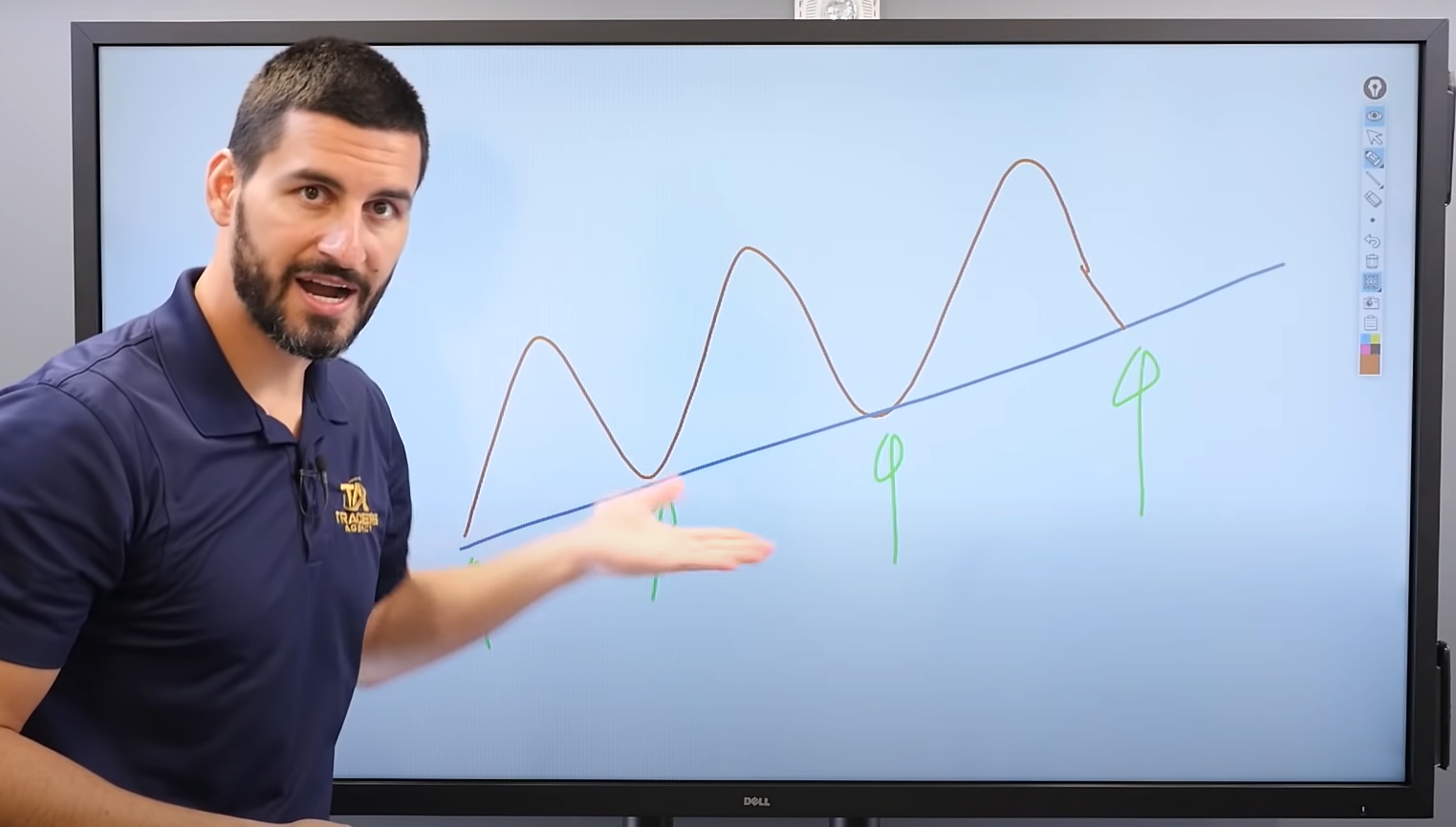

Setting Up Trendlines

Drawing Trendlines

Trendlines are one of the most important parts of my strategy. In Trading View, the trendlines icon is the one that can be found on the top left side of the screen and two icons below the profile photo. Click on the icon to apply it and then scroll over the chart with the mouse to the desired location. When a starting point is decided, click once and click again on the endpoint we’ve determined.

Next, use the mouse to highlight the line until both endpoints are visible, and then right-click on it. An immediate list of choices will pop up, select format to change a variety of things. These functions are available on all tools with minor tweaks depending on the tool selected. Here are the functions of each tab under the trendlines tool:

Style tab – permits a multitude of modification options. Some examples are line design, color change, line extensions, applying numerical data, and even adding arrows to lines’ ends.

Coordinates tab –allows traders to view and edit where the line is set to begin and where it is meant to end. The tab is also the best way to see specific numbers that allow users to properly calculate the line slope.

Alerts tab – here, we have an option to play a sound, send an email, show a popup, or send a text in the event a preset condition should be met.

Other Chart Icons

The Pitchfork

The pitchfork icon is located directly below the trendlines icon. We use it to create a trend channel to follow the overall direction of a market. To set it up, click on the screen three times. The first click is for the median, while the succeeding two are for the outer variables. Right-click when you’re done to exit and to ensure you don’t end up creating unintentional drawing tools. As with the previous tool, users can play around with various functions simply by selecting the style tab. Remove lines, change up the color, switch line thickness, or even go from a solid line to a broken one. To learn more about how market direction works, read more here.

A Long Position

Next, we’ll look to use the Long Position indicator. It allows traders to set an entry point and assume a long position from that point. We click on the icon once where we want to start our position. We make it a point always to right-click afterward to avoid adding more to the items we just drew. Manually adjusting the profits or loss section can be done by dragging the top or bottom circle. Dragging the circle allows us to move the entire box. We format this by scrolling over the box, right-clicking, and then selecting “format.”

The Bottom Line

While there are numerous tools and icons to use with your charts, these are the most basic ones you’ll need to get started. But you can’t trade with charts alone. You need insight and data to make them work. That’s where I come in! Follow my futures trading strategy to learn how to turn your charts into trading profits!

Keep On Trading,

Stay tuned for my next edition of Josh’s Daily Direction.

And if you know someone who’d love to make this a part of their morning routine, send them over to https://joshsdailydirection.

The post The Right Way to Set Up Your Charts appeared first on Josh Daily Direction.