Good morning, Daily Direction readers!

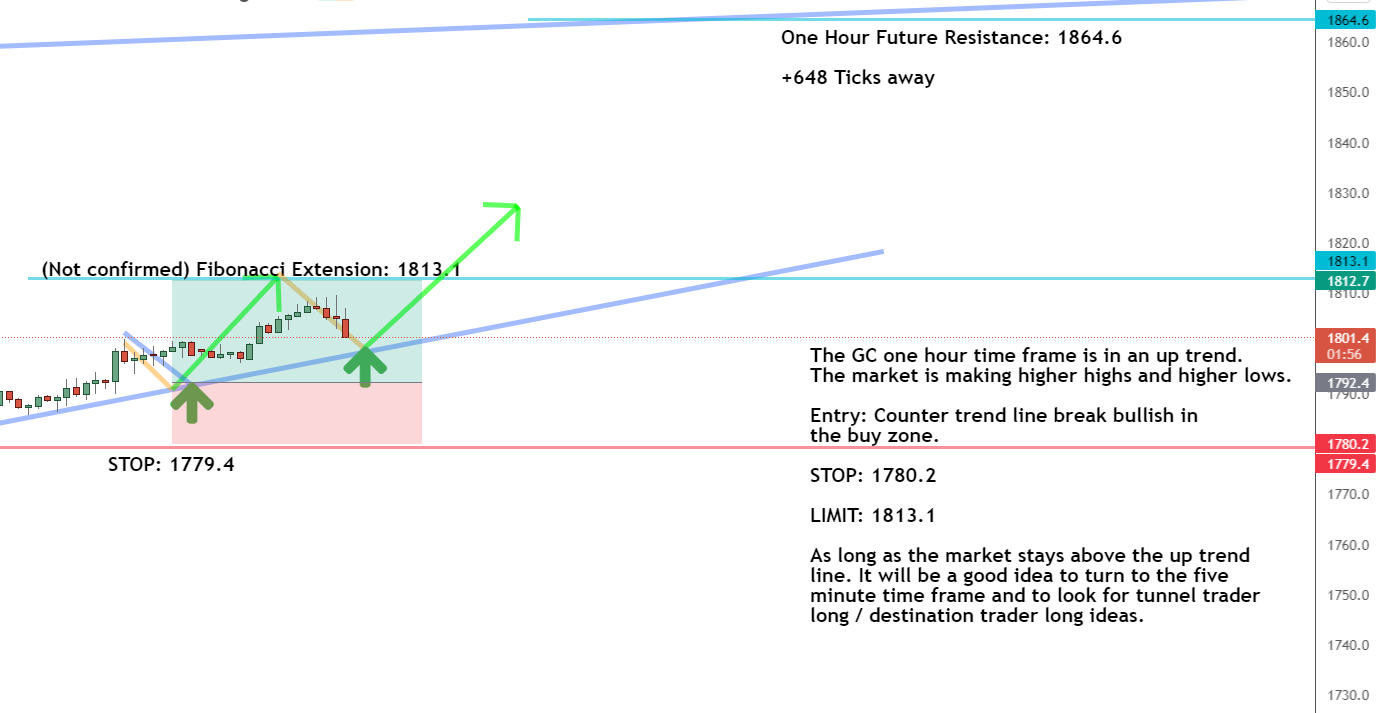

For today’s edition, we’re watching Gold Futures (GC) for opportunities to make profitable trades. GC is making higher highs and higher lows as it moves within an up channel.

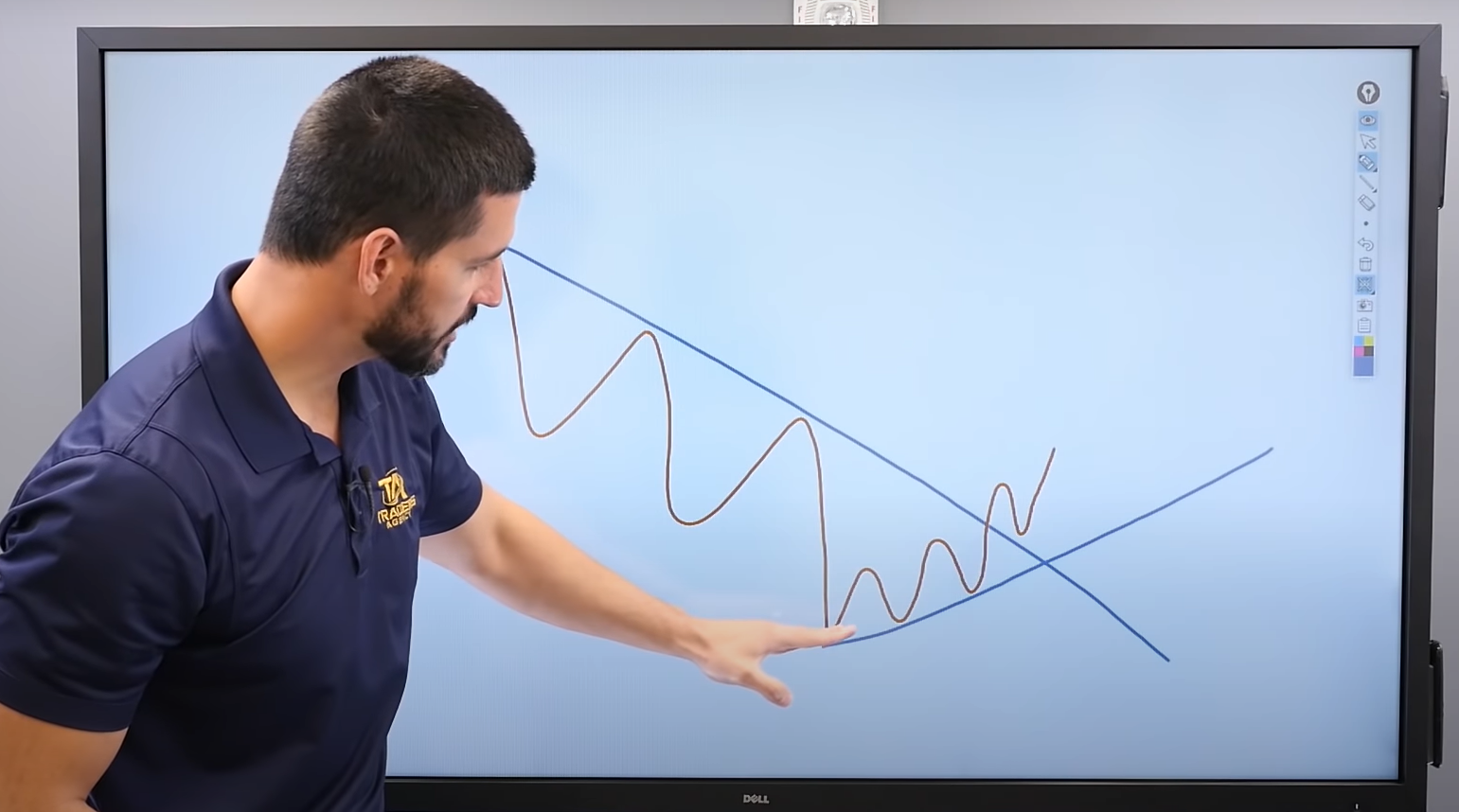

We’re waiting for the market to break a counter trendline and push bullish into the buy zone. Once that happens, we’ll look at our short-term analysis and find opportunities to buy the market.

Once we see that counter trendline break bullish, we can use our timeframe charts to plot our entry and start trading the market!

If you’re a regular reader of the Daily Direction, you’re aware that gold futures may be a lucrative trade if you know when to enter. That is why my timeframe approach is so effective.

Let’s check it out for more information on the GC:

One-Hour Timeframe Analysis

Right now, the market is close to the up trendline. So long as the GC stays above that line, we can expect a counter trendline push into the buy zone.

We’ll keep watching the GC for opportunities to buy the market. As we watch, our limit is set to 1813.1, and our stop placed at 1780.2.

This setup is dependent on the long-term outlook remaining positive for the GC. We want the market to stay about that trendline as it moves to higher territory.

This is where a good timeframe analysis comes in handy. Be sure to read more about how using timeframe charts can improve your trading.

Learn more about the Daily Direction Indicators here…

Don’t miss out on another opportunity to grow your skills and abilities!

The Bottom Line

We’ll use short-term timeframes (one-hour, 5-minute, etc.) to plot our entry as we aggressively look to purchase the GC as the market continues to make higher highs and higher lows.

So long as the market continues to follow the up trendline, we’ll trade the GC.

However, many investors use gold as a hedge against market instability, so we’ll keep a careful watch on what’s going on in the broader market.

If you’re ready to start trading Gold Futures, have a look at my other trading advice to see how you can get started.

This way, you may use my market knowledge to develop your own trading strategy as your trading account grows! There’s no reason to do this without guidance.

Keep On Trading,

Mindset Advantage: Execute

In the end, trading is about execution. A detached, matter-of-fact execution that takes into account market data. It’s those darn emotions that get in the way.

What if you were able to execute every trade like you were cleaning up after a great meal with friends or family?

Instead of each entry or exit being the heart-pounding, drama-filled moment that it is (for many) – remove your emotions and treat it as though it just needs to be done.

Like taking out the trash, you don’t think about it. You don’t shed any tears over the 5-day old ravioli or hamburger buns that you’re throwing away. Why waste another second on that trade?

Good or bad. Simply execute. And free yourself to see the market from a different point of view.

Traders Training Session

Stay tuned for my next edition of Josh’s Daily Direction.

And if you know someone who’d love to make this a part of their morning routine, send them over to https://joshsdailydirection.

The post The Latest Outlook for Gold Futures appeared first on Josh Daily Direction.