The bears are showing, without much of a question, that they are still in charge.

While I included one long idea in Monday’s Watchlist Update, the majority of my ideas are focused on the short side right now.

Will there be some long ideas that work out? Sure!

But being a long-only investor right now means you’re swimming against the tide.

Here’s what I mean…

Pop & Flop

Early last week, we saw a big two-day gain in the major indexes as they bounced from their very oversold conditions.

However, that bounce didn’t last long…

In fact, I said last week that we were looking for resistance at the 50-day moving average (MA) to keep a lid on the rally.

In the daily chart of the S&P 500 above, you can see that the market couldn’t even make it up to the 50-day MA (red line).

Instead, the bulls only mustered up enough strength to barely test the 21-day MA (purple line) where it failed and turned lower again.

The market is now back below the June low , and all signs are pointing towards lower lows ahead.

Market Breadth

One of the main reasons I am expecting lower lows is that the internals of the major indexes are still very weak.

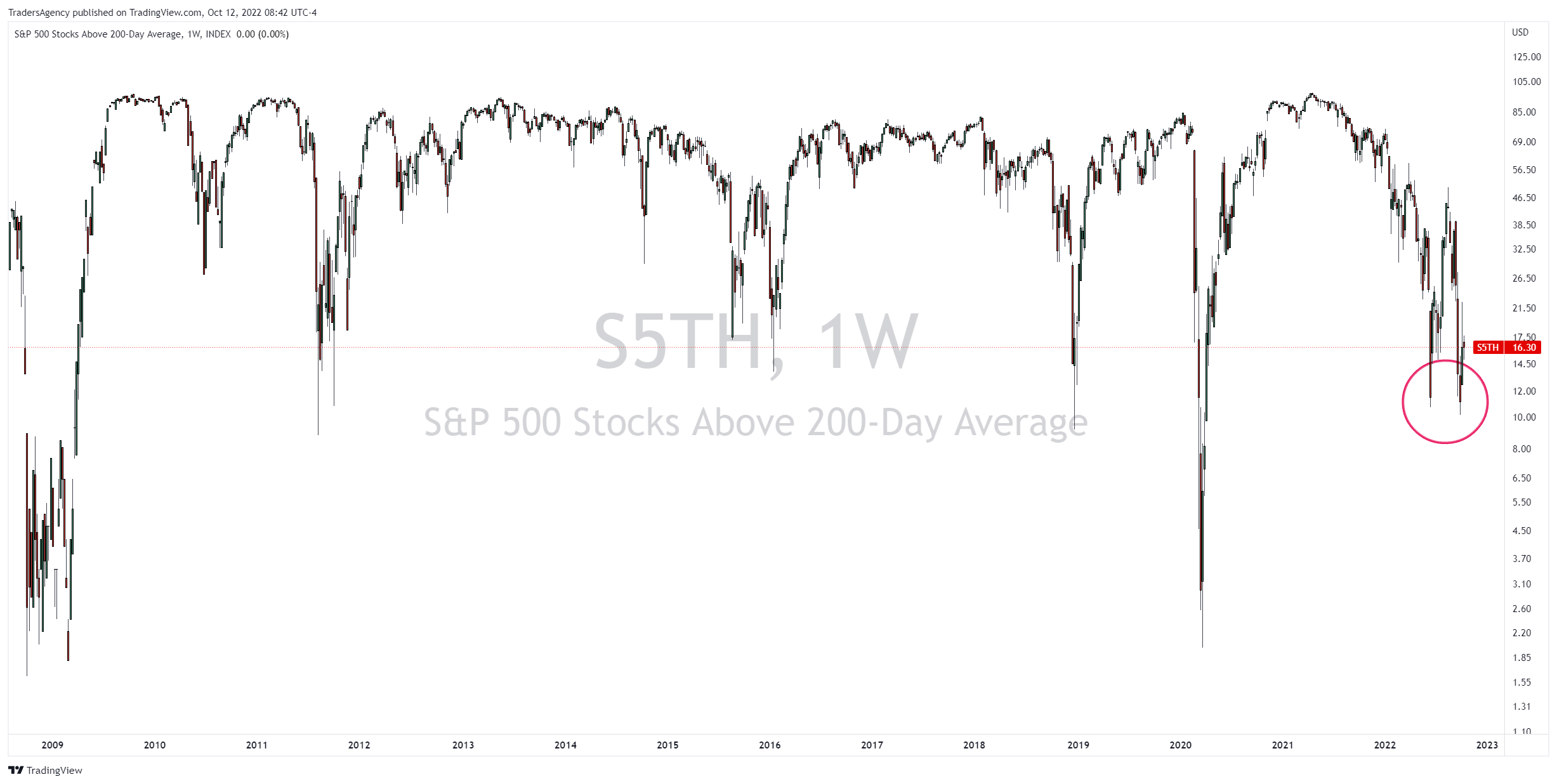

For example, the percentage of S&P 500 stocks trading above their 200-day MA is back down to 16%…

As you can see in the long-term chart above, this percentage reading is historically low.

While these levels were reached briefly during the downturns in 2011, 2015 and 2018, market breadth has only been weaker during the Financial Crisis in 2008-2009 and the pandemic bear market in 2020.

This tells us that about 85% of S&P 500 stocks are in confirmed downtrends, so trying to find long ideas in this environment is going to be harder than usual.

Now, this could be another indication that the market is oversold…

But with the fundamentals, including a tighter Federal Reserve, sky-high inflation and further escalation in the Russia-Ukraine situation, I’m inclined to take this reading at face value.

Trade with the Tide

Now, if you are looking for a system that can help you start racking up more consistent wins on the downside as well as the upside, you need a way to find intraday opportunities…

For my colleague and expert trader Josh Martinez, this is why he developed his Tunnel Trader strategy.

Utilizing this strategy, Josh has been identifying shorter-term up and down entry and exit levels for profitable trading opportunities along the way as markets move toward their full price targets.

Josh is going to teach you the simple, systematic approach to trading that is the basis of his Tunnel Trader tool.

If you can follow basic instructions, you can definitely follow along with Josh as he walks you through his approach.

So, don’t wait…

Register for today’s 12 p.m. ET session with Josh and his team by clicking right here.

Embrace the surge,

Ross Givens

Editor, Stock Surge Daily