Happy Friday, Daily Direction followers!

The Nasdaq 100 E-mini (NQ) is finally breaking into the buy zone! We’ve been out of the market for the past few days as we waited for it to leave the sell zone.

Now that the NQ is very clearly trying to break into the buy zone, we can prepare our buy-in strategy and get ready to trade the market.

But we can’t pull the trigger on a trade until the market closes above the trendline and in the buy zone. So, because of that, the short-term direction for the market is still technically down. If the current trend continues, however, that will change very soon!

All of this shows why trendlines are so important for this strategy. It’s the trendlines that give us a point of reference for when it’s safe to enter or exit a market. They also help us determine the overall direction of a market with impressive accuracy.

Let’s dive into the NQ timeframe analysis to see how close we are to trading the market:

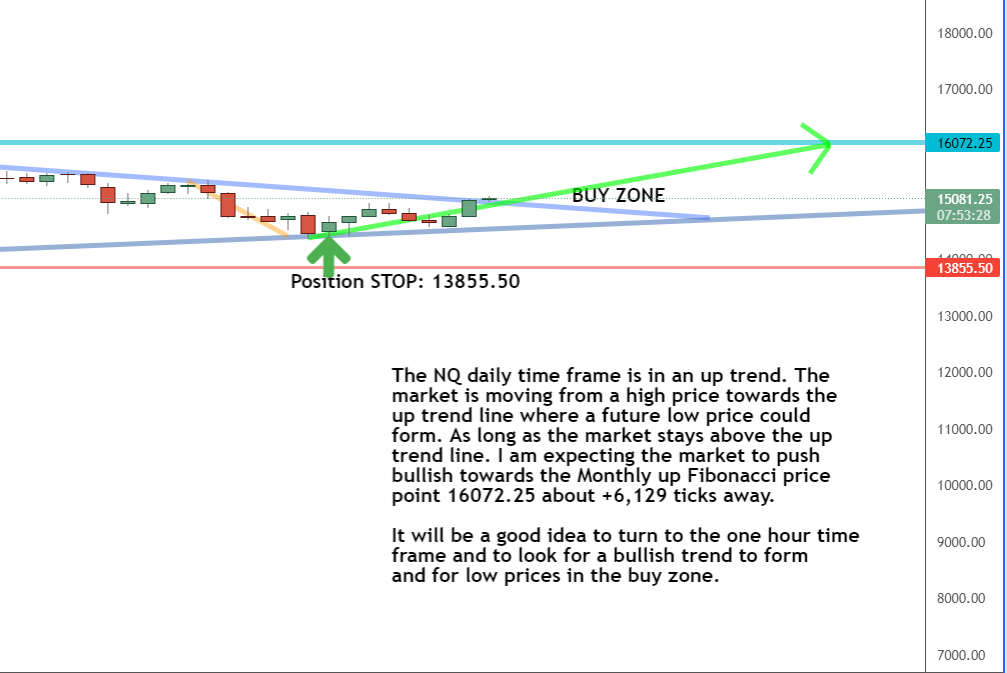

Daily Timeframe Analysis

At the moment, the daily timeframe is peeking through the trendline and into the buy zone. We could see it close above that line today if the trend continues to push up.

Once the market hits the buy zone, we can expect it to continue moving toward the 16072.25 price point in the current bullish push.

The long-term direction is up for the NQ

The short-term direction of the NQ is down, but is very close to turning up!

The NQ is headed for a trendline break and could make the move at any moment

Learn more about the Daily Direction Indicators here…

Based on the daily timeframe chart, we’ll wait for the market to close above that trendline and then turn to the one-hour timeframe to look for buying opportunities within the NQ.

One-Hour Timeframe Analysis

It can be difficult to make out, but the one-hour time frame has risen just above the trendline and into the buy zone. That means the current trend is continuing to push the market to our up Fibonacci extension.

If the market can hold above that trendline, then the short-term direction will be up, and we can start looking for opportunities to buy the market. But until we get that close above the trendline, we’ll have to wait.

Until we see the market hold above that trendline and continue to climb into the buy zone, we’ll hold off on buying the NQ. But don’t worry. We should be able to jump into the market very soon!

The Bottom Line

In the short term, the NQ is on the verge of returning to the buy zone. When that happens, we’ll go ahead and implement our buying plan, intending to profit from the next bullish run. The market will continue to rise in price until it reaches the next high price limit.

And that’s why following my strategy is a must in these trade situations. Trendlines and timeframe analysis are key to getting these right. Don’t put this off any longer. You can get started today!

Keep On Trading,

Mindset Advantage: Plan or Fail

“Everyone has a plan… until they get hit in the face.”

So goes the famous quote from a boxer infamous for knock-outs.

Do you have a plan? Can it withstand a sucker punch?

If not, get one. Start with what you’re willing to lose… each trade, day, week, month and year.

Only with that in mind should you ever focus on the profits. Anything else is just a prelude to failure. Your account and trading career will thank you.

Traders Training Session

Getting Started With Futures Trading

Stay tuned for my next edition of Josh’s Daily Direction.

And if you know someone who’d love to make this a part of their morning routine, send them over to https://joshsdailydirection.

The post It’s Almost Time to Jump into This Market appeared first on Josh Daily Direction.