It’s Wednesday, Daily Direction readers!

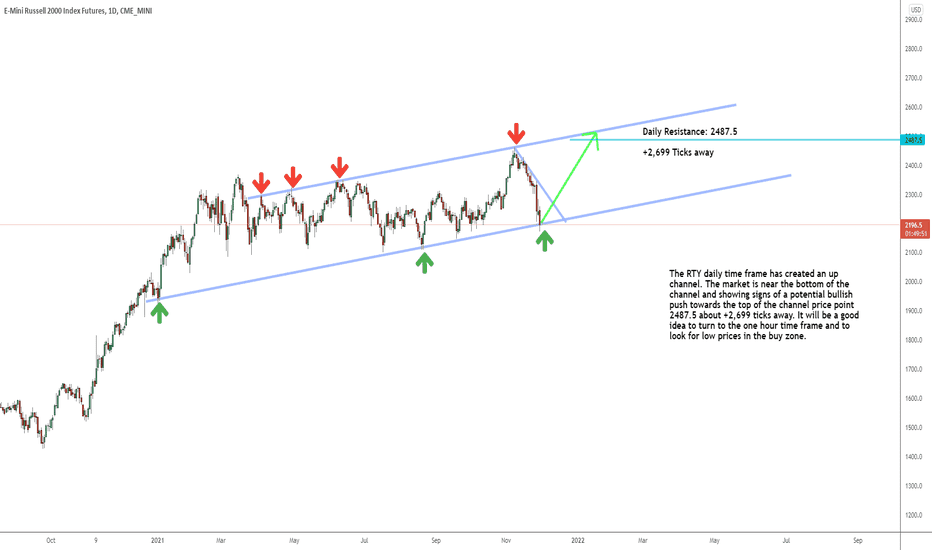

We’re halfway through the trading week already. Right now, I’m watching the E-mini Russell 2000 futures market (RTY). It looks like this market could set up for a new bullish push once it U-turns and breaks into the buy zone.

The RTY is currently in an up channel, with the market hitting the bottom of the channel. We’re just waiting for buyers to reclaim the market and drive it back toward the top of the channel. When that happens, we’ll look to buy the market again and ride the bullish push to a higher price!

For now, we’re just waiting for the right time to get back into the market. While waiting can be tough, it’s the best strategy for the RTY at the moment.

Daily Timeframe Analysis

The daily timeframe shows the RTY in an overall upward trend. If you look at the below chart, you’ll see that the market is hitting the bottom of the channel.

If buyers take over the market, we’ll see a positive U-turn back toward a bullish rally. We’ll want to look for a counter trendline break back into the buy zone before trying to get into the RTY.

But once all of that happens, we’ll be ready to apply our buy-in strategy and find profitable entries in the market. If this holds, we can expect a +2699 tick movement! That’s good because tick movements equal profits if we plan our entry correctly.

DAILY TIMEFRAME

The long-term direction is up for the RTY

1-HR TIMEFRAME

The short-term direction of the RTY is down for right now

THE BOTTOM LINE

We’re waiting for a U-turn bullish in the RTY

Learn more about the Daily Direction Indicators here…

The Bottom Line

Once the RTY rebounds and turns positive in the short-term, we’ll have a chance to buy the market at a low price as it moves into the buy zone.

We’ll want to watch our daily and hourly timeframe charts for signs that the RTY is U-turning positive again. If buyers retake the market, we’ll see a noticeable bounce from the bottom of the channel.

Until that happens, it’s best that we watch our timeframe charts and wait for the shift!

The current RTY scenario highlights how my method may help you navigate the futures market’s ups and downs. So don’t waste any more time. Get started today! You don’t want to miss out on this.

Keep On Trading,

Mindset Advantage: Breathe

If you’re not breathing, you’re not focused. If you’re not focused, you can’t see the market. Opportunities slide by in an instant. Hazards reveal themselves only when it’s too late.

You need to breathe. Breathing exercises have proven to reduce stress and increase focus.

Sure, you’re already breathing if you read this. But when you trade… you need a breathing regimen. Whatever it is: Through your nose, out your mouth counting to 10 or 100. Find a method and routine that works for you.

You’ll find balance, clarity and focus when you trade. Your heart rate will come down and you’ll just feel better.

Traders Training Session

Stay tuned for my next edition of Josh’s Daily Direction.

And if you know someone who’d love to make this a part of their morning routine, send them over to https://joshsdailydirection.com/ to get signed up!

The post Getting Ready for a Bullish Push appeared first on Josh Daily Direction.