Good morning, Traders!

We’re still keeping an eye on the NQ as the market recovers from the selloff earlier this week. The long-term direction remains up as the short-term trend begins to turn toward a positive movement.

We want to buy low and sell high as the market moves into the buy zone. But you need to know about counter trendlines before you can execute your entry strategy. Read my article on counter trendlines to get ready for the buy!

There’s a lot going on in the news cycle right now, so we need to be prepared for any market swings that could develop. Remember that Wall Street doesn’t like bad news and responds accordingly when it comes to the market, even if the news isn’t strictly financial.

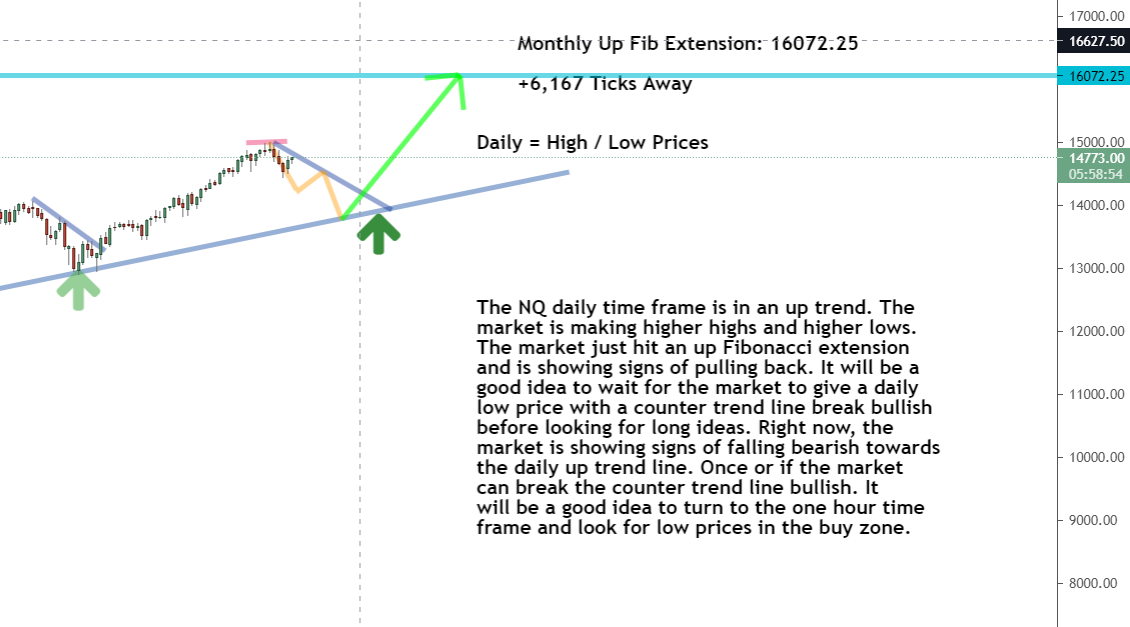

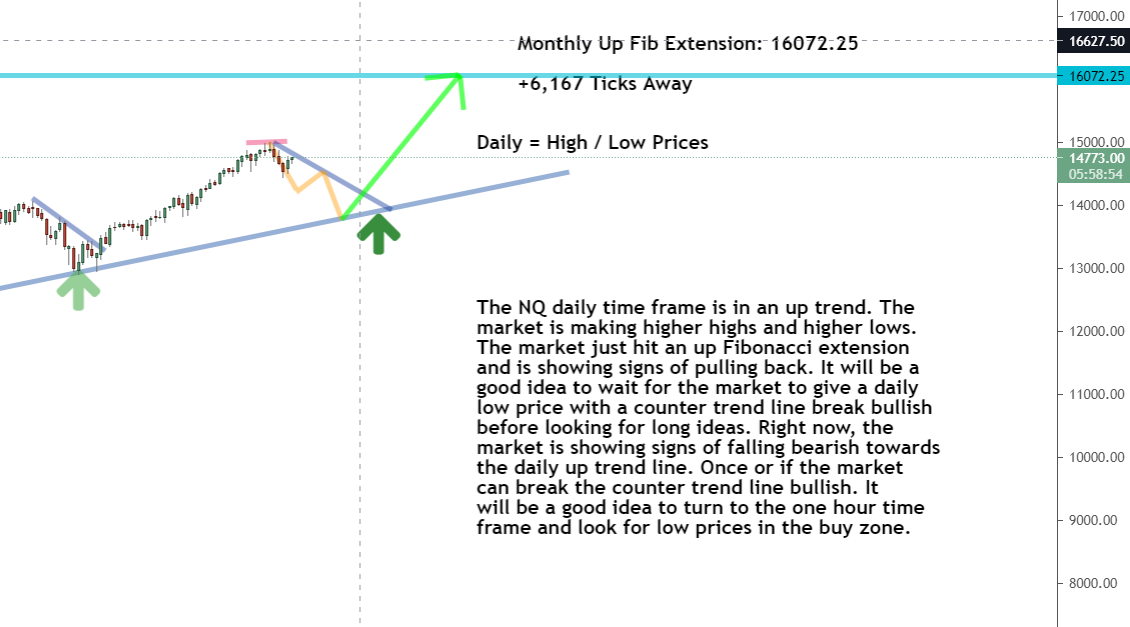

Let’s take a look at the timeframe analysis for the NQ so we can be ready for when the market moves into a position to buy!Daily Timeframe Analysis

Despite Monday’s selloff, the long-term trend for the NQ remains positive. Over the long term, the market continues to make higher highs and higher lows.

When novice traders notice market drops, they worry that they’re witnessing a market crash or correction. But keep in mind that the market works in waves. The selloffs might be mild at times. They can also be rather steep at times. However, we must take into account the market’s long-term trajectory.DAILY TIMEFRAME

The long-term direction is up for the NQ

The short-term direction of the market is down for the NQ right now

We’re waiting for the NQ selloff to bottom out and U-turn back bullish

Learn more about the Daily Direction Indicators here…

The long-term direction for the NQ is still up, despite the recent selloff in the broader market

Understanding how future market price prediction works is one thing that will help you keep track of current events in the futures market. I produced a video that explains everything, which you can see right here.

Our best line of action right now is to keep an eye on the daily timeframe for a daily low price and then look to the one-hour for a positive U-turn. We know it’s time to look for a new bullish push when the market breaks that down trendline (diagonal grey line in the middle of the channel in the above chart).

| Recommended Link:Once you get started, I almost guarantee you’ll be hooked!

That’s because Gold Futures is like a shortcut to massive profits. I was able to turn an initial deposit investment of $500 into $39,282! And my indicators are going haywire once again. This time with GOLD. Take a look at this chart. It will blow your mind. |

One-Hour Timeframe Analysis

The one-hour period will be crucial for this strategy to be successful. We’re looking at +6,000 ticks of profit-making potential if all goes according to plan.

As the price drops, we’ll keep an eye on the market for a low and a U-turn upward. When the market does that and breaks through the counter trendline, we’ll know it’s time to buy!

We’ll watch for a U-turn and prepare our entry strategy once the market heads bullish in the buy zone

However, before jumping into the NQ when it swings around, you’ll need to understand how to join the market on a counter trendline break. If you want to do this transaction properly, read this post!The Bottom Line

Things may appear to be erratic right now, but our timeframe study shows that the NQ’s overall pattern is still up.

We’ll keep an eye on the charts and see whether the price can bottom out and reverse back to the top. And, with my approach in place, we have a good chance of making money with a +6,000 tick movement. However, this technique is only effective if it is executed.

The NQ’s overall direction is up, and the short-term shows signs of turning around

It’s time for you to stop making excuses and start working on becoming a winning futures trader! Follow along as I reveal the crucial aspects of my trading strategy that will allow you to become a profitable futures trader!

Keep On Trading,

Mindset Advantage: Move!

Motion creates emotion – and helps you manage it!

There’s a direct relationship between vigorous exercise, and stress management.

How many times have you found yourself sitting… staring at your screen… instantly realizing that you’ve been sitting there for hours? Riding out that position? Fretting over an exit or even a loss?

Get up! Move around! Go for a walk. Motion creates focus. Focus creates positive energy and clarity!

Better yet, add an exercise element to your trading routine! Your health and your account will thank you!Traders Training Session

How-to Fibonacci Retracement Tutorial

The post Don’t let the news get you down… appeared first on Josh Daily Direction.