Hey friend,

We saw more employment data hit the wire this morning.

Private sector employment was up 122,000 for the month – below the 140,000 expected.

Ironically, this cooler labor market data may actually be better for the market, as it means the Fed may be less worried about inflation and be more willing to cut rates.

However, the weekly jobless claims came in below expectations, so the market’s reaction will likely be mixed.

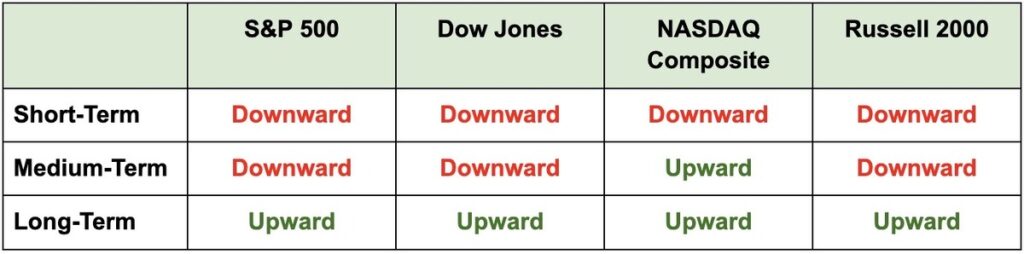

The Daily Direction

Note: Indexes closed lower yesterday as the tech sector sold off, sending the short and medium-term direction of the S&P 500 – as well as the short-term direction of the Nasdaq – back downward.

The Daily Nugget

Bull markets naturally evolve as time goes on.

Bull markets tend to last much longer than most traders expect.

But…

They also evolve as time goes on…

Meaning the “internals” of the bull market at Year 1 can look very different at Year 3.

Many traders are unprepared for this, and make mistakes that cost them gains.

That’s why, as Head Trader Ross Givens said this morning…

To make the most out of 2025, you can’t just repeat what worked in 2023 and 2024.

And that’s why later this afternoon at 3 p.m. Eastern…

Ross is going LIVE to reveal a massive “right now” opportunity that’s totally unique to the 2025 bull market.

It has absolutely nothing to do with what happened these past two years…

Which is why he believes 99% of traders will miss it completely.

Don’t let that be you.

If you haven’t yet, click here to “lock in” your seat for Ross’ live opportunity reveal…

And he’ll see you at 3 p.m. ET later today.

The login details will be in your inbox shortly – try to login early if you can.

The Traders Agency Team