Good morning, Traders!

The E-mini Russell 2000 (RTY) is rocketing to higher prices, and we may hit the market’s next daily resistance point soon! Right now, the RTY is in the buy zone. We issued a buy alert recently for those of you who follow my Futures Edge platform because the RTY was ready to take off to new heights.

But if you’re still sitting on the sidelines, you missed out on that alert. Don’t let it happen again! Check out my Futures Edge system to make sure you’re getting the latest information about the futures market.

Both the long-term and short-term directions remain up for now within the E-mini Russell 2000 (RTY). To see the latest information about the RTY’s movements, be sure to check out today’s timeframe analysis:

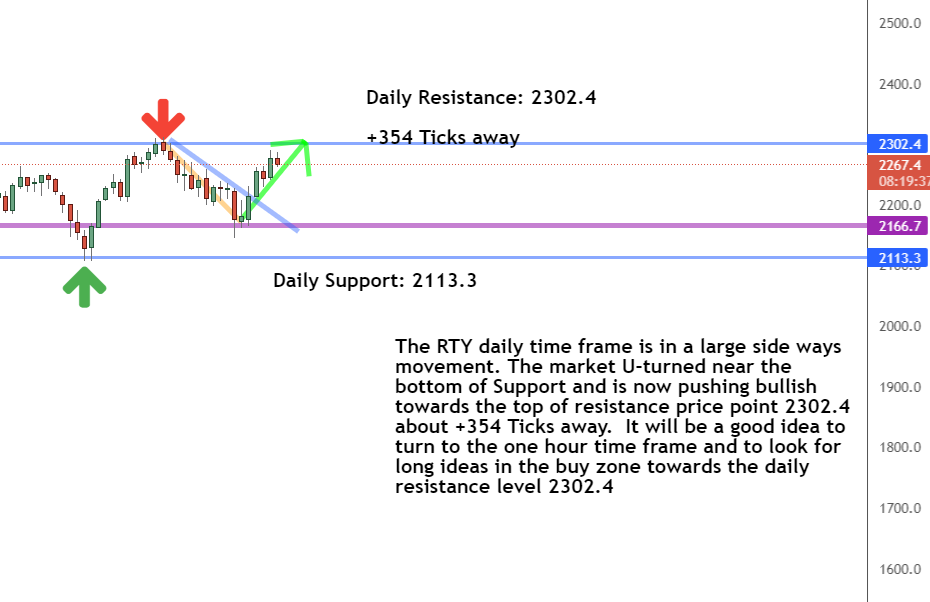

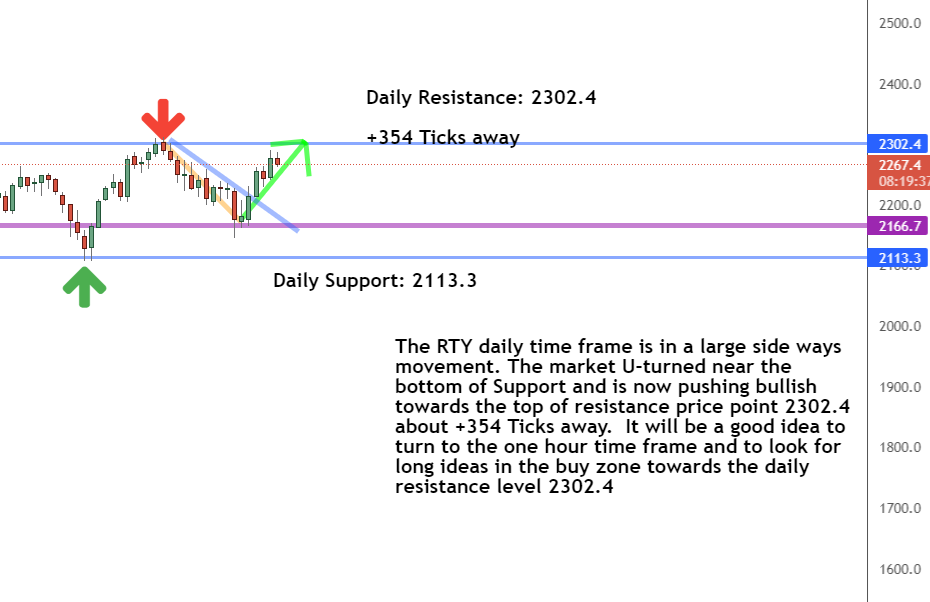

Daily Timeframe Analysis

The RTY daily timeframe is getting pretty close to resistance as the market keeps going higher. It clearly broke into the buy zone and quickly rallied toward the 2302.4 resistance price point.

The long-term direction is up for the RTY

The short-term direction of the RTY is currently up

The RTY has broken the counter trendline and is headed toward resistance

Learn more about the Daily Direction Indicators here…

The daily RTY timeframe has broken the counter trendline and is headed toward the daily resistance of 2302.4

Resistance is simply the price at which buyers start to back off of the market, allowing the price to drop again. We’ll watch the daily timeframe throughout the day to see when/if we hit resistance. Until that happens, we’ll turn our attention to the one-hour timeframe.

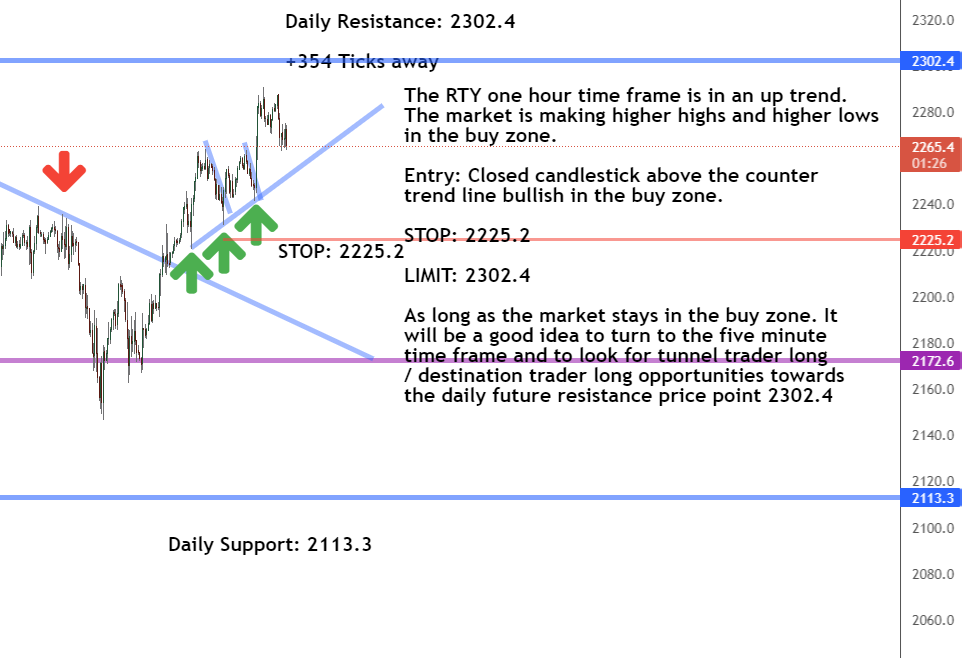

One-Hour Timeframe Analysis

Looking at the RTY’s one-hour timeframe, we see that the market already gave us a nice counter trendline break and entered a bullish push. Yesterday, we issued a buy alert inside Futures Edge, with our stop at 2225.2 and limit at 2302.4

The one-hour timeframe has given us a counter trendline break and has pushed bullish. We’ll monitor the timeframe as the market gets closer to resistance

We’ll keep looking for opportunities to buy the RTY so long as the market stays inside the buy zone and before it hits resistance. The daily and one-hour timeframes will play a crucial role in helping guide our buying strategy.

The Bottom Line

The long-term and short-term directions for the RTY are up. The market has made clear counter trendline breaks and is moving through the buy zone. We’ll want to keep an eye on the market as it gets closer to resistance. So long as we see low prices within the buy zone, we’ll actively look for buying opportunities, but well keep an eye on our charts to make sure the market doesn’t get too high to buy.

Our timeframe charts will be critical in helping us determine what to do with the RTY

And that’s why following my futures trading strategy can benefit you immensely. You’ll see when it’s profitable to enter a market and when it’s wise to stay away. Now’s the time to get on board if you’re ready to make smart trading decisions ASAP. There’s no reason to keep putting it off!

Keep On Trading,

Mindset Advantage: Balance Is Everything

When it comes to your trading perspective, you’ll discover that how you spend your time outside of trading has a lot to do with your capacity to deal with the markets, poor trades, excellent trades, and anything else. More precisely, how well-balanced you are.

In fact, charts and price levels may account for 10% of your entire state of preparedness. The remaining 90% is determined by your amount of rest, how concentrated you are, and how happy you make yourself.

Find a balance that works for you and get started on the road to successful trading.

Traders Training Session

Understanding Futures Contract Sizes and Tick Values

Stay tuned for my next edition of Josh’s Daily Direction.

And if you know someone who’d love to make this a part of their morning routine, send them over to https://joshsdailydirection.

The post Did you miss this trade alert? appeared first on Josh Daily Direction.