Good Wednesday, Traders!

Digital currencies are considered by many to be a great hedge against inflation as well as volatile traditional assets such as stocks and bonds.

And indeed, this has been the case now and again.

The biggest of the digital currencies, BTC, went from $35,364 on Jan. 23 to $47,967 on March 28 for a gain of 35.64% on a cash basis.

We participated in much of that gain inside our Futures Edge and War Room trading services.

And we now are looking for buy ideas again for BTC, which may be shaping up in shorter order.

Charting BTC for Gains

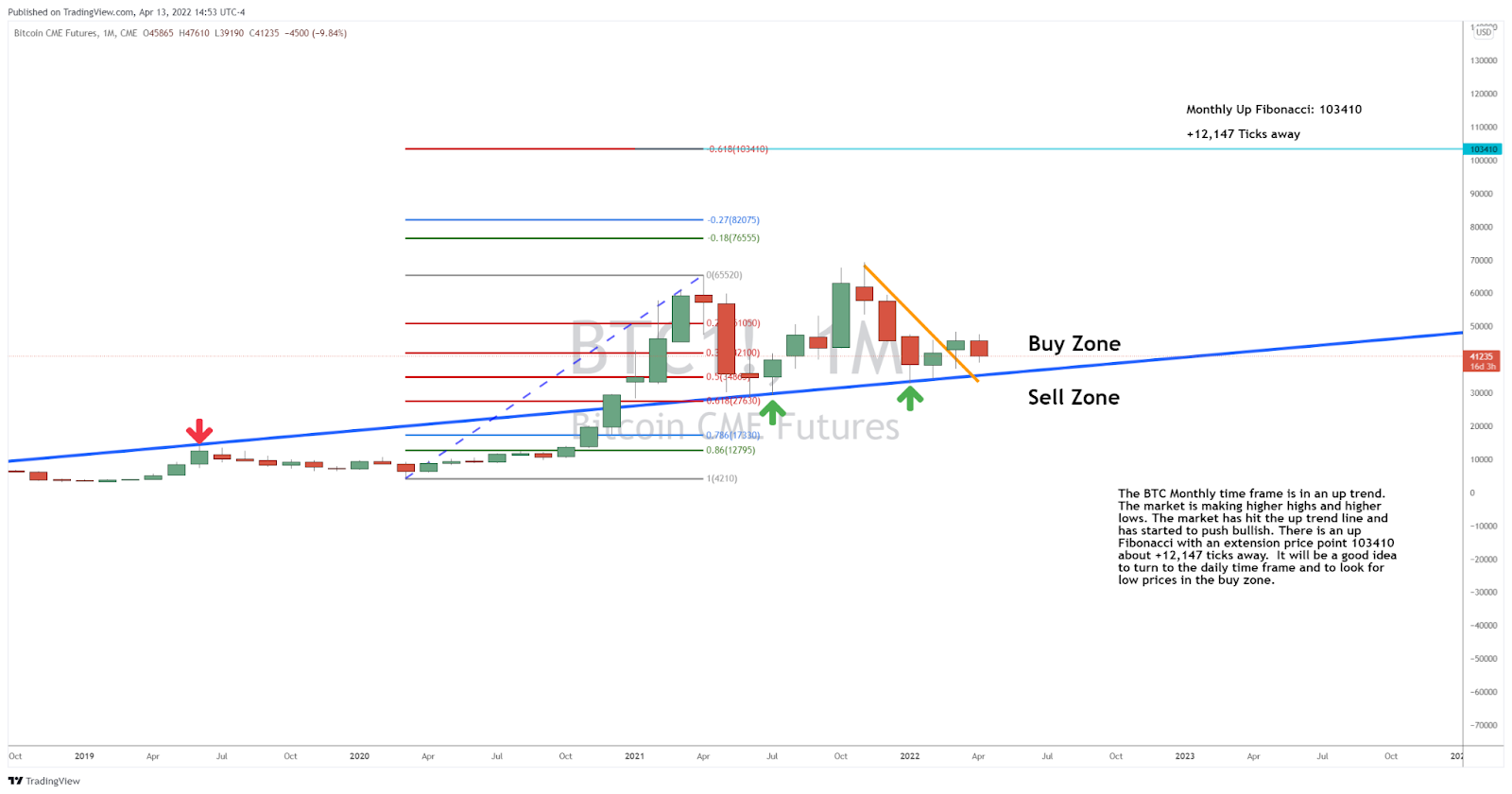

Here’s how BTC is setting up on a monthly basis…

The monthly BTC chart shows a major up Fibonacci level of $103,410, which is a big potential target.

However, it has to be further confirmed by the daily and hourly charts.

The daily BTC chart shows a closer potential resistance level of $48,525 that is closer in line with the last major up move in the digital currency.

And this chart shows the upside potentially in the making right now.

But then we turn to the hourly chart for a closer definitive direction…

The hourly chart for BTC shows the potential for the upward move in the digital currency.

As of today, BTC broke the counter trend line and is now in the buy zone.

According to our research, the rules say it is a good time to start buying BTC again as long as the market stays in the one hour buy zone.

As the BTC futures contract market further develops, look for the next edition of Josh’s Daily Direction in your email inbox each and every trading day.

I’ll be bringing you more of my futures contract trading tutorials as well as some additional trading ideas, including for BTC.

And if you know someone who’d love to make this a part of their daily trading routine, send them over to joshsdailydirection.com to get signed up!

Keep On Trading,

P.S. I’m going to show you all the details of this 7-Day Stock Predictor TOMORROW at NOON.

Click here to reserve your spot for this revealing session!

The post Charting BTC for the Next Big Move appeared first on Josh Daily Direction.