Digital currency futures rallied this past Friday, following the gains in the major US stocks indexes.

But while the stock and futures markets shut down for the weekend, the traditional digital currency markets kept gaining.

BTC gained fractionally on Saturday and then rallied another 2.9% on Sunday.

That led to a higher open for BTC futures this morning, but the market is still below a key level of resistance…

BTC Below Counter Trend Line

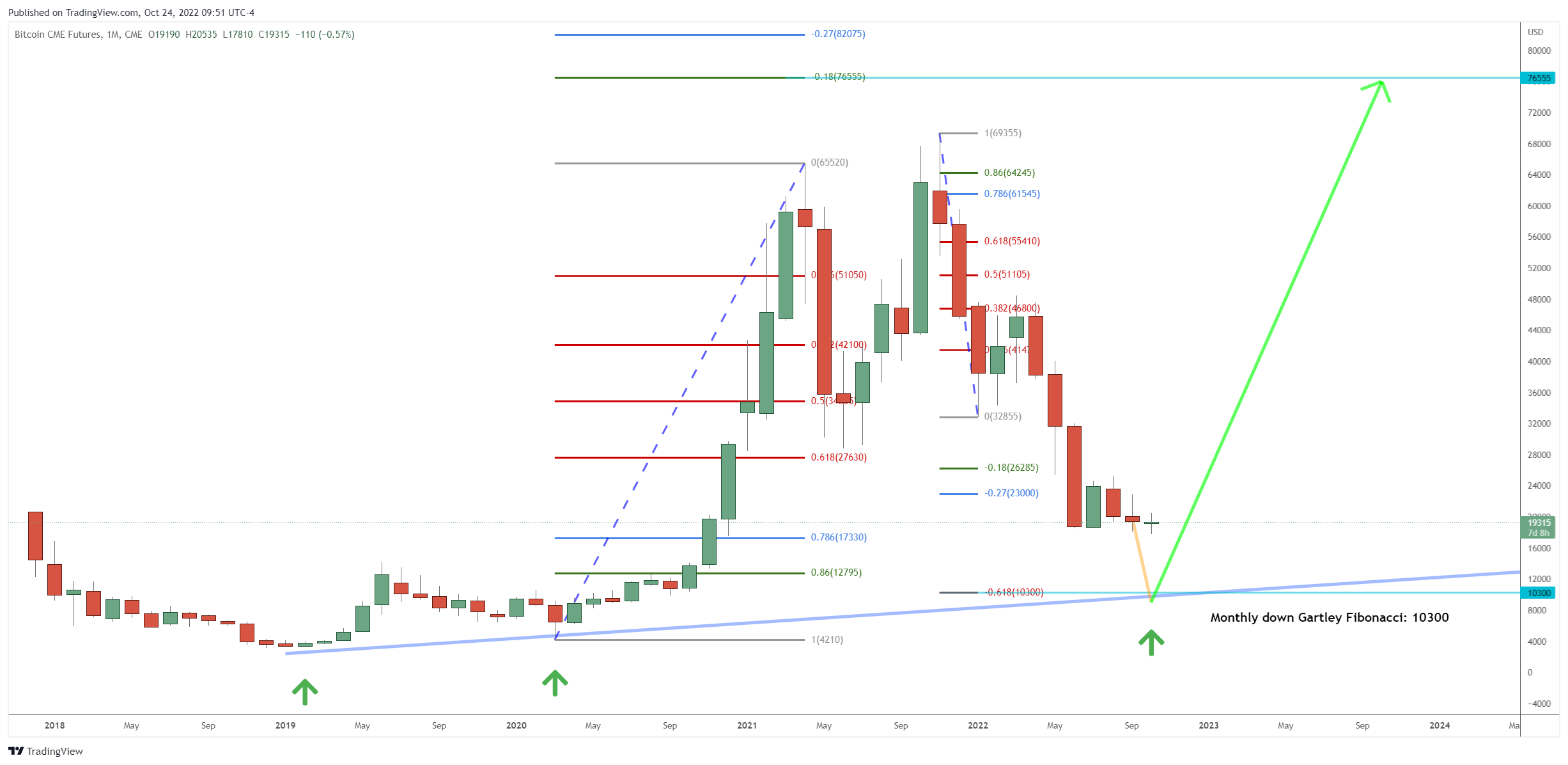

On the monthly time frame, BTC is in a long term bullish trend.

However, the market is moving from a high price towards a future low price and has not yet reached the down Gartley Fibonacci extension price at 10,300 near the long term up trend line.

And on the daily time frame, BTC is still locked in a down trend, with the market making lower lows and lower highs.

As you can see in the daily chart above, the market is testing the underside of its counter trend line, which should act as resistance.

There is also a down Fibonacci extension below the market price point 11,060, about -1,629 ticks below the market.

For now, we are out of the market waiting for the market to hit the down Fibonacci extension. Then, we will look for the bullish reversal towards the monthly Fibonacci extension of 76,555.

The Bottom Line

While waiting for this BTC move to resolve itself, my colleague and equities expert Ross Givens been working on a special strategy for identifying great stocks that you might want to learn more about.

He has come up with a brand new strategy that aims to deliver weekly gain opportunities without ever holding a single stock.

If you’re interested, check out the important P.S. below…

For more on the markets as well as trading education and trading ideas like this one, look for the next edition of Josh’s Daily Direction in your email inbox each and every trading day.

I’ll be bringing you more of my stock and futures contract trading tutorials as well as some additional trading ideas.

And before you go, head on over to the Traders Agency YouTube channel for breaking market news, live trading sessions, educational videos and much, much more!

Keep on trading,

P.S. My colleague and expert stock trader Ross Givens just unveiled his brand new “rapid cash” strategy that is totally market neutral.

It doesn’t matter if a stock goes up or goes down… With this strategy, Ross can set up his trades to win in either direction.

The post BTC Bounces, But This Bear Market Isn’t Over appeared first on Josh Daily Direction.