Hey, Ross here:

Welcome to a new trading week.

Despite the hotter-than-expected jobs report last Friday, the market defied expectations and closed higher – even ending higher for the week.

This tells me that my thesis for a short-term technical bounce is sound.

But again, I don’t believe this is the resumption of the bull market (yet). And today’s chart explains why.

Chart of the Day

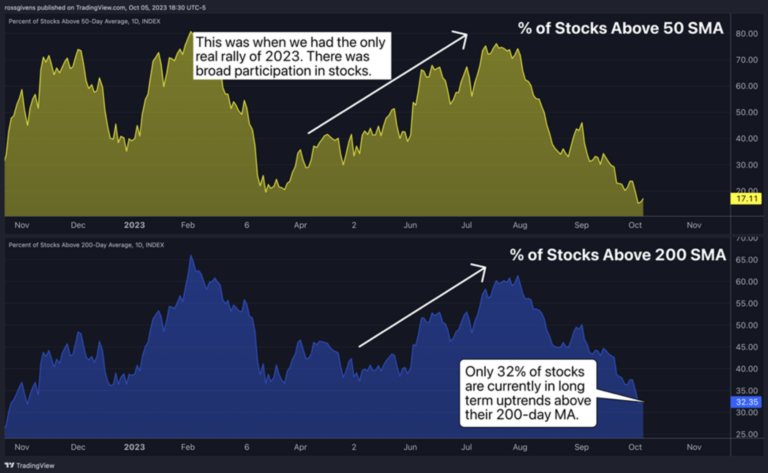

This chart shows the percentage of stocks above their respective 50 and 200-day moving averages.

It gives a clear view of market participation by revealing how much of the market is in short and long-term uptrends.

And it also highlights the deterioration that has taken place beneath the surface over the last couple months.

As of today, only 32% of stocks are above their 200-day moving average and 17% are above their 50-day.

Translation?

The majority of the market right now is in decline, regardless of what the indexes look like.

That’s why I believe the resumption of the bull market won’t happen just yet. We need a final flush lower and for greater participation to come in at the bottom.

BUT things are looking good for a short-term technical bounce – which is likely just beginning.

And that’s something we can take advantage of.

Insight of the Day

Even if I’m wrong about this market bounce – and this IS the resumption of the bull market – you can still win.

The recent price action is pretty much confirming that a market bounce is starting.

As you know, I believe this is just temporary.

But if I’m wrong, and this is indeed the continuation of the bull market…

You can still win.

As long as you position yourself in the highest-potential stocks, you have the best chance of making fast profits no matter if it’s a short-term bounce or the continuation of the bull market.

If it’s the former, you get out when it starts to go down.

If it’s the latter, you keep letting your winners ride.

Either way – you win.

So the question is – what are the highest-potential stocks right now?

Well, my answer is – let the institutional investors decide.

After all, they’re the ones with the real power to move markets…

Meaning all we have to do to get into the highest-potential stocks is to follow their moves…

And you can click here to start using my best strategy for doing that right now.

Embrace the surge,

Ross Givens

Editor, Stock Surge Daily