Hey, Ross here:

Markets are closed today for Good Friday.

But I’m writing this newsletter anyway – because there’s a big opportunity most traders are ignoring.

Chart of the Day

Yesterday, I showed a chart showing how underlying productivity for S&P 500 companies are posting gains for the first time in 15 years – a good sign.

But today, I want to highlight a related opportunity that most traders are missing.

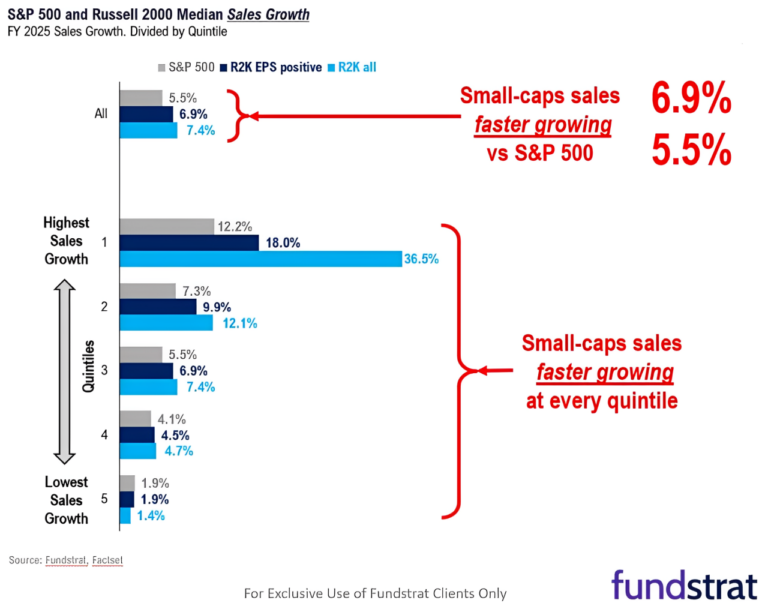

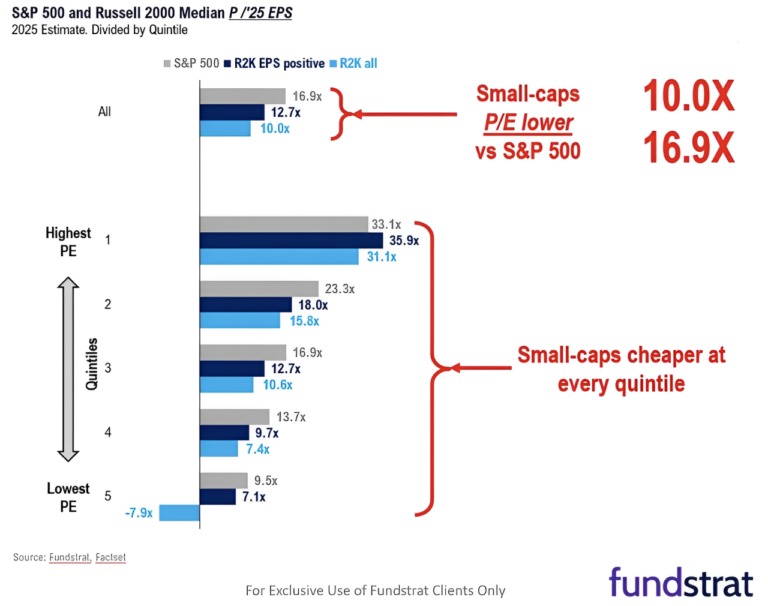

Because as these two charts show, from both a sales growth and earnings-per-share perspective…

Small-cap stocks are both faster growing AND cheaper than their large-cap counterparts.

In short, they’re delivering more value for a lower price.

If you’re not content with average returns – this is where you need to be looking.

Insight of the Day

The challenge with small-cap stocks is their higher variance – winners do better, losers do worse.

As a whole, small-cap stocks are more attractive right now.

But the thing with small-cap stocks is their higher variance – winners do better, losers do worse.

In other words, this is where your trading edge really plays a role in your returns.

And that’s why later today at 11 a.m. Eastern…

I’m going LIVE for a masterclass that will show you exactly how to use this edge for yourself…

So you too will be able to target big fast gains like the above – even if the broader market pulls back sharply.

So make sure you click here to guarantee your seat at my masterclass later…

Look out for the login details in your inbox shortly…

And I’ll see you at 11 a.m. ET sharp.

Embrace the surge,

Ross Givens

Editor, Stock Surge Daily