Good morning, Traders!

We’ve been watching the Nasdaq futures market (NQ) over the last few days as it continued its climb toward a new high price. Now, the NQ has hit our upper limit and is preparing for a bearish sell-off.

While the long-term direction for the NQ is up, the short-term direction is now down. We’ve fulfilled the up Fibonacci extension. Based on the data, we can expect the market to now sell off toward support. While that means we’re out of the NQ for a few days, the new low price is a good thing! Remember that we buy low and then sell high. It’s that simple. For even more info about how market patterns work, check out this article I wrote.

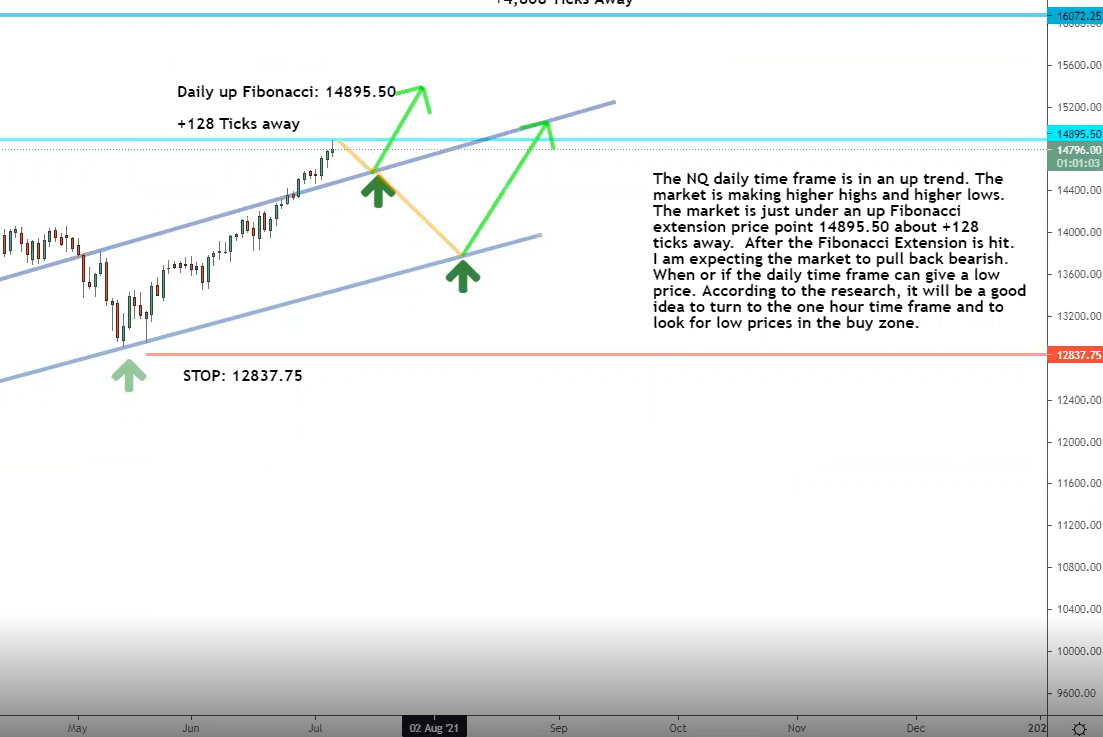

To better understand what’s happening in the NQ and what we need to do while the market makes its move, let’s take a look at our timeframe charts:

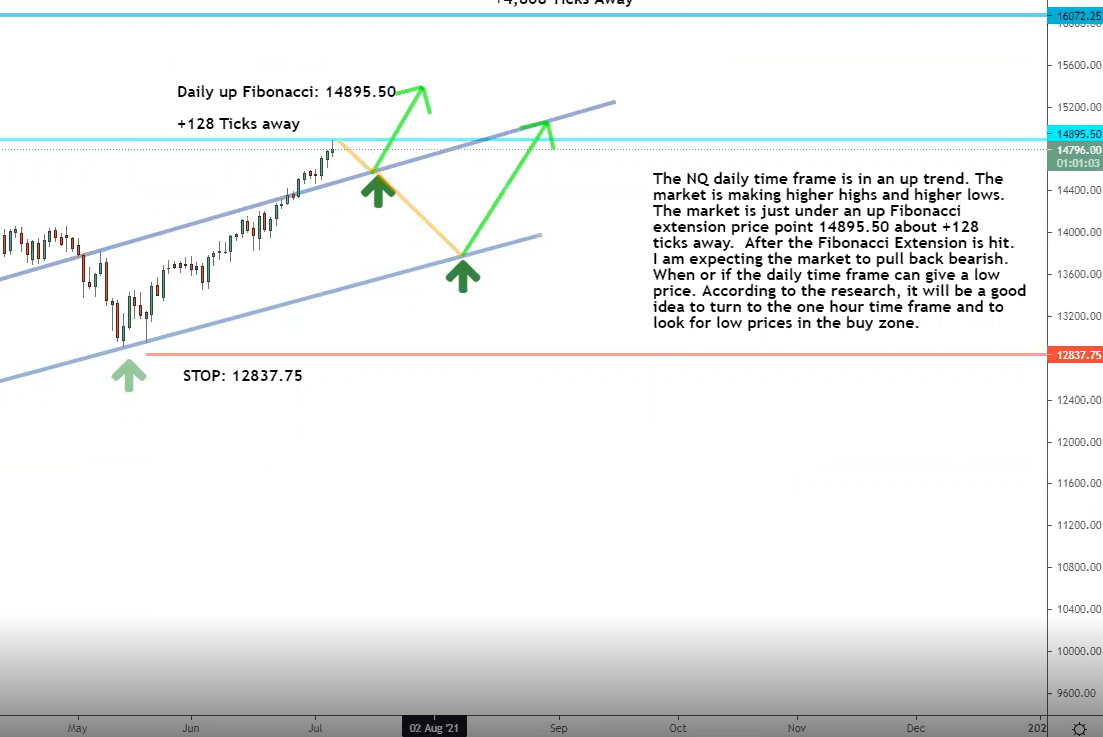

Daily Timeframe Analysis

The NQ has fulfilled the up Fibonacci extension, meaning we’ve hit the price point at which buyers will pull back and allow sellers to take control of the market temporarily.

As the market prepares for a sell-off, we’ll see the price dip towards support, before U-turning back up and into a new bullish rally.

The direction within the daily timeframe is up for NQ

The short-term direction of the NQ is down as the market prepares for a sell-off

The NQ has hit the up Fibonacci and is about to turn down toward support

Learn more about the Daily Direction Indicators here…

The NQ has fulfilled the up Fibonacci and is setting up for a sell-off toward the bottom of the channel (lower grey line). We’ll stay out of the NQ for now until we see the market bottom out at a new low price

This is a good time for us to step back and look at the overall picture for the NQ. The long-term direction is still up, so we know that this is just the ebb and flow of the market as it works its way up to new heights.

We don’t let price drops like this one keep us away from trading. We simply watch the price fall and then prepare our entry strategy once we know the market is on its way up again.

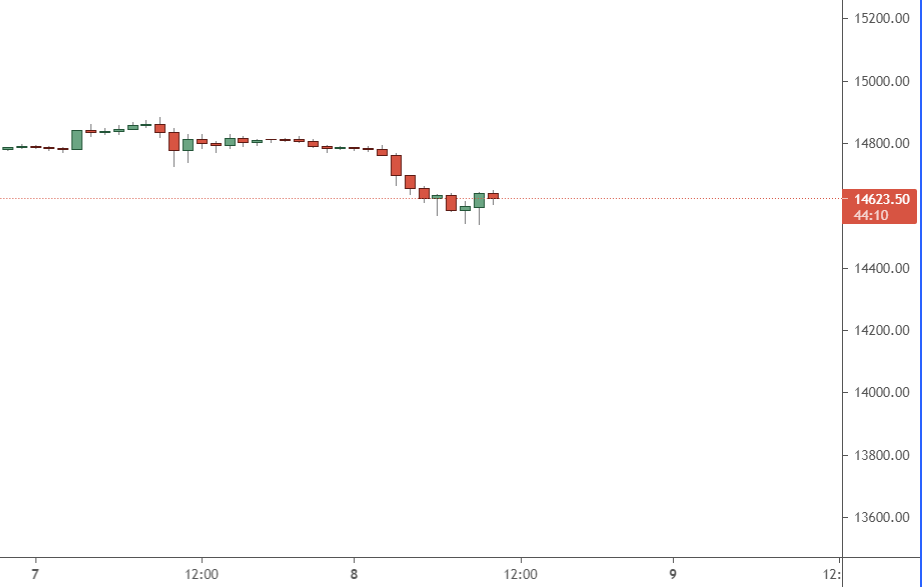

One-Hour Timeframe Analysis

The one-hour NQ timeframe confirms that the short-term direction for the market is now down as the NQ is gearing up for a bearish push.

We’ll see the price drop from its current point as it heads for support. Once the price settles out, we should get ready for another rally!

We can see that the NQ price is gearing up for a pull-back after reaching the latest point of resistance. It’s a good idea to watch the charts and wait for evidence of a U-turn after the price has settled down

Once the NQ settles at a new low price, that should entice buyers to jump back into the market. That will give us the U-turn we’re looking for to signal that it’s time to prepare our entry strategy.

And after the market breaks through the counter trendline and into the buy zone, we’ll be ready! But before that happens, read up on how entering the market on a counter trendline break actually works.The Bottom Line

The overall long-term direction for the NQ is up, but we need to prepare for a short-term sell-off that will keep us out of the market for a few days.

The price will dip, U-turn, and then rebound back into another bullish rally. And the new low price will provide a new opportunity to make money in the NQ. For now, we’ll sit back and wait for everything to play out for the Nasdaq futures market!

While the long-term direction for the NQ is up, we need to get ready for a short-term price drop!

And as you wait for the NQ strategy to unfold, now is the time to get the tools and knowledge you need to become a real futures trader. I’m here to help you realize your money-making potential in futures. Just follow along as I reveal the crucial aspects of my trading strategy that will allow you to become a profitable futures trader!

Keep On Trading,

Mindset Advantage: Breathe

If you’re not breathing, you’re not focused. If you’re not focused, you can’t see the market. Opportunities slide by in an instant. Hazards reveal themselves only when it’s too late.

You need to breathe. Breathing exercises have proven to reduce stress and increase focus.

Sure, you’re already breathing if you read this. But when you trade… you need a breathing regimen. Whatever it is: Through your nose, out your mouth counting to 10 or 100. Find a method and routine that works for you.

You’ll find balance, clarity, and focus when you trade. Your heart rate will come down and you’ll just feel better.

Try it. And enjoy your trading.

Traders Training Session

Understanding Trading Margin and Managing Losing Trades