Hey, Ross here:

As we close out the trading week, let’s look at an encouraging sign for the market.

Chart of the Day

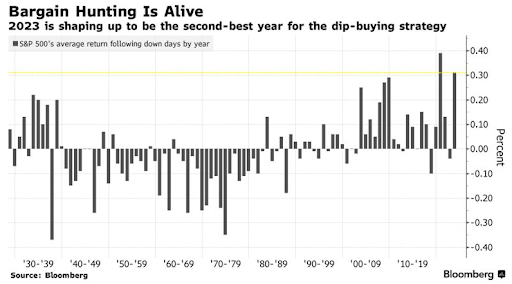

Dip buyers are providing valuable support for the market – and articles like these (not to mention the recent market performance) – will only encourage more of them to join in.

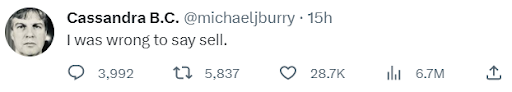

Even notorious market bear Michael Burry tweeted yesterday that he was wrong to tell people to sell earlier this year.

And even though I don’t normally recommend a dip-buying strategy because there’s too much risk of catching falling knives – this is undoubtedly a positive sign for the market.

Because dip buying can quickly turn into rallies – and that’s where my breakout strategies truly shine.

But what if you do want to try your hand at some dip buying? Then read on.

P.S. Want me to send you special trade prospects and potential market moves directly to your phone? Text the word ross to 74121.

Insight of the Day

When it comes to buying dips, those with more knowledge win.

Think about it. You have a whole bunch of stocks that’ve been steadily “dipping” for months.

Which ones are worth buying the dip – and which ones are just falling knives that will puncture more holes in your account?

For dip buying to really work, there must be some catalyst that will eventually cause a particular dip to reverse course.

The problem – most often, you have absolutely no idea what these catalysts could be.

But there is one specific group of traders who could know exactly what these price-moving catalysts – as well as when they could happen.

And if you know how to “follow” these traders, you could get in right before these catalysts cause a dipping stock to rapidly swing upwards.

Embrace the surge,

Ross Givens

Editor, Stock Surge Daily