Happy Tuesday, Daily Direction readers!

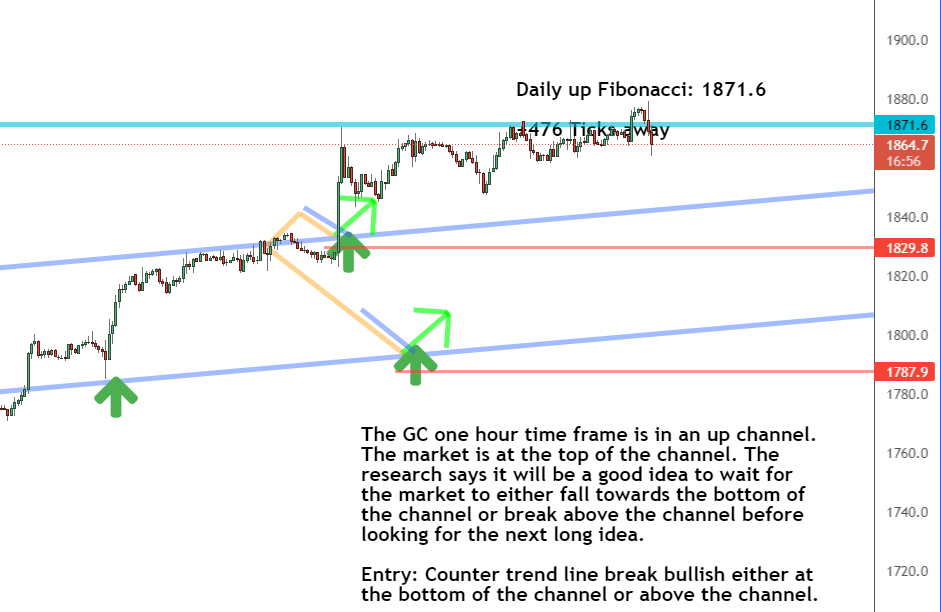

We’re still keeping a close eye on gold futures. Our price limit for the GC is about to be breached. Once the market reaches 1871.6, we should expect a sell-off. We’ll take a step back once the limit is met, though the sell-off should be temporary.

We’re getting close to that limit, which means the short-term trend is set to change. However, the long-term trend remains upward, so we’ll wait for the next bullish push following the current sell-off.

I expect the market to dip back toward the bottom of the channel before giving us a U-turn and a push back into the buy zone.

Our best hope is to keep a close eye on our timeframe charts and track the GC when it makes its next short-term change.

Daily Timeframe Analysis

The long-term direction for the GC remains up, as evidenced by the channel in our daily timeframe chart. That means the market continues to march its way to a new high price, despite a wave of ups and downs along the way.

And we can see how close the GC is to our price limit of 1871.6. Expect the market to begin a downward push once we hit that price point. The sell-off will be temporary, so don’t worry!

DAILY TIMEFRAME

The long-term direction is up for the GC

1-HR TIMEFRAME

The short-term direction of the GC is up, but could be shifting downward soon

THE BOTTOM LINE

The GC is headed for a sell off once it hits our price limit

Learn more about the Daily Direction Indicators here…

Once the sell-off begins, we’ll monitor our daily timeframe to observe when the trend returns to a positive direction.

As soon as that happens, we’ll turn to the one-hour timeframe and start looking for opportunities to get back into the GC.

One-Hour Timeframe Analysis

The one-hour timeframe shows how sideways the GC market has traded recently. But the short-term direction for the market remains up despite the constant ups and downs within this timeframe.

Recently, the hourly timeframe surged ahead toward the top of the channel, breaching our price limit before turning back down toward the original channel.

A retracement (brief price drop) is likely to be followed by a new positive rally. Remember, the long-term trend is up, thus the short-term sell-off will reverse, giving us a great opportunity to purchase the GC on the way back up!

The Bottom Line

When the GC reaches our price limit of 1871.6, we may expect a retreat to the channel’s bottom. Unfortunately, this implies that we’ll see a drop in pricing from where we are now. However, the GC’s general trend remains positive, therefore this market isn’t finished yet.

Once the retracement settles down, we’ll look for a reversal back toward a bullish push and prepare our entry strategy to buy the GC again on it’s way back into the buy zone.

The present GC setup demonstrates how my technique can assist you in navigating the ups and downs of the futures market. So, don’t wait any longer. Get started today! You don’t want to miss out on this.

Keep On Trading,

Mindset Advantage: Accept

It’s not the market. It’s not your indicator. It’s TRADING.

Let it go. The first step toward consistent profits comes when you accept the reality that losses will occur. Prices have a mind of their own at times. The institutions are at the wheel. The sooner you accept this, the more progress you’ll make.

Look at the past, but don’t stare. Accept what’s happened and move on.

Target tighter entries. Get the heck out of those losers you’re hanging on to.

Accept. And start to enjoy trading.

Traders Training Session

Stay tuned for my next edition of Josh’s Daily Direction.

And if you know someone who’d love to make this a part of their morning routine, send them over to https://joshsdailydirection.

The post Here’s Another Look at Gold Futures appeared first on Josh Daily Direction.