Good morning, Traders!

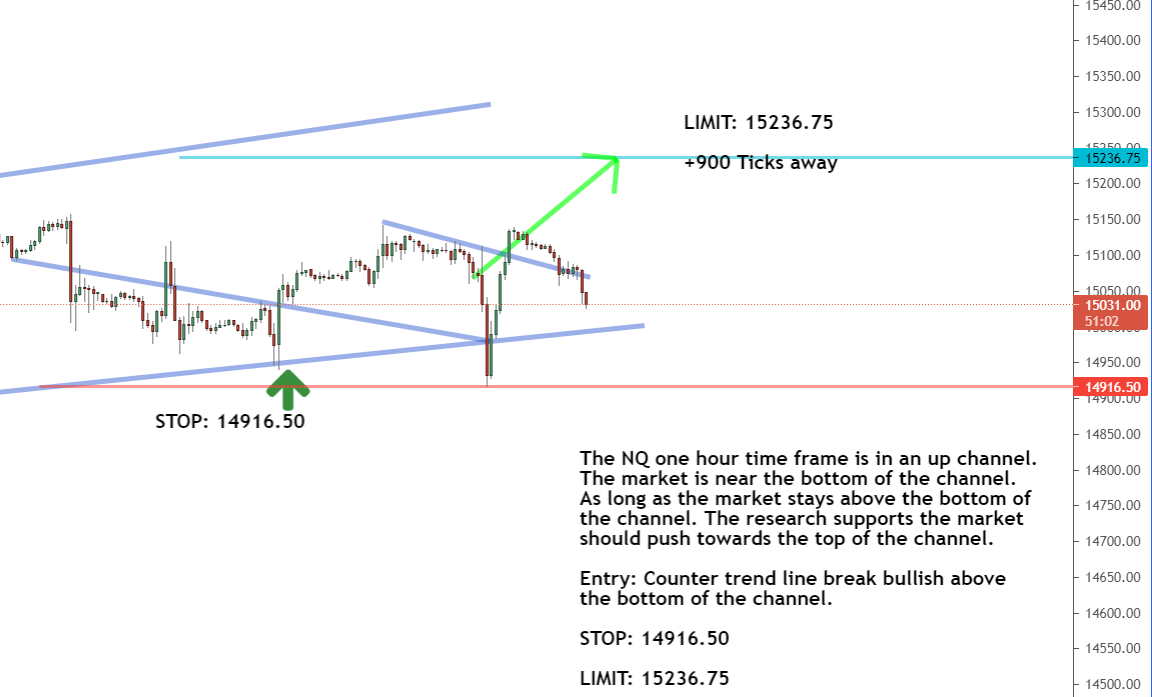

We’re back looking at the Nasdaq 100 E-mini futures market (NQ), as the long-term and short-term directions are up! We hit a low of 14917.25 with a stop set to 14916.50. That means we survived the massive bearish retracement and can now focus on trading the NQ again. It will continue to make up and down movements as it works it’s way back to the top.

Right now, the market is headed toward the 15236.75 price point as it makes higher highs and higher lows. By utilizing my strategy, we can buy into the NQ at a low price in the buy zone and ride the market to a new high price.

After all, that’s how we make money in the futures market! We buy at low prices in the buy zone and sell when the market reaches a new high price.

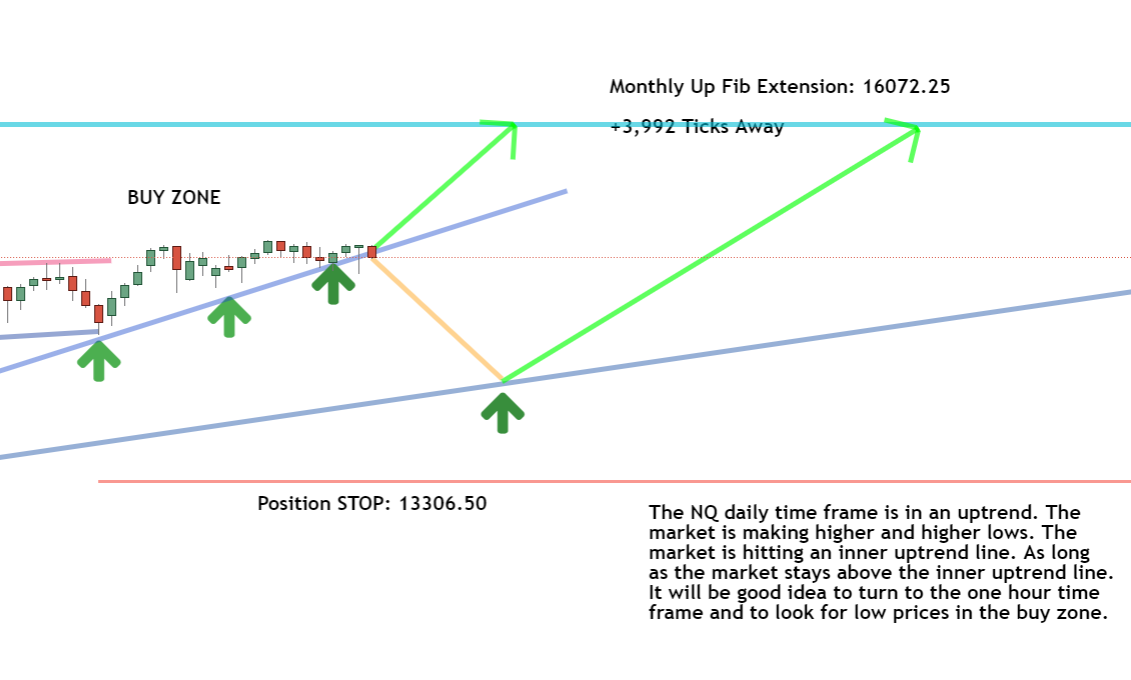

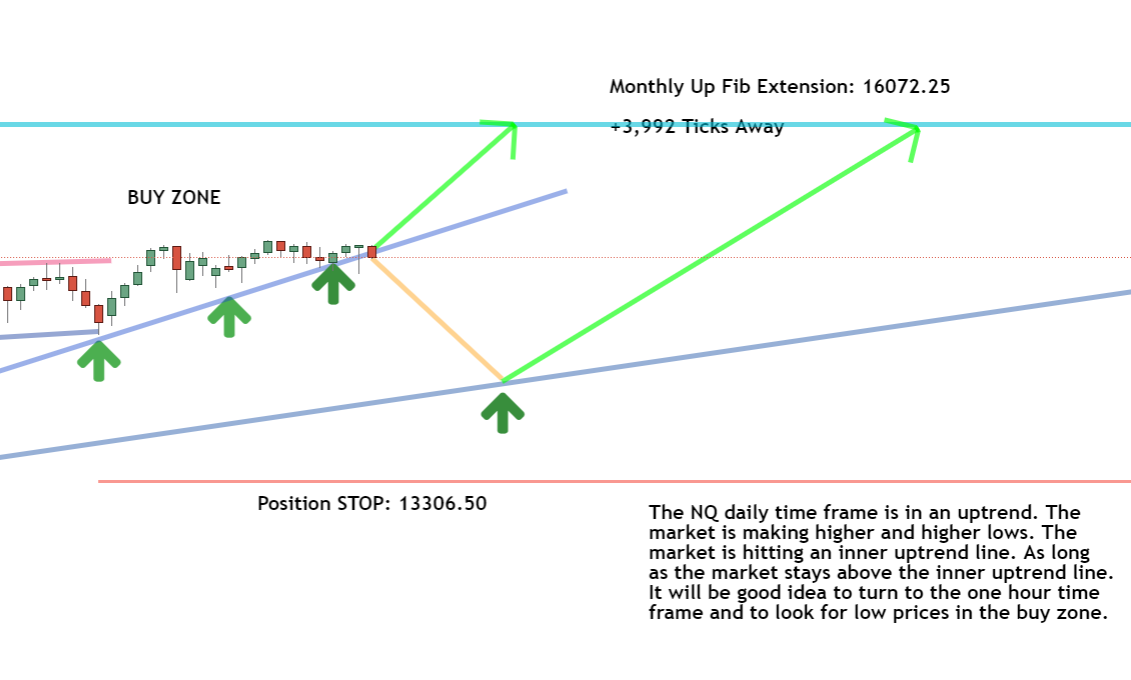

Now let’s take a look at the timeframe analysis to see where the NQ is headed:Daily Timeframe Analysis

The NQ is hitting an inner uptrend line in the daily timeframe. That means the market is making higher highs and higher lows and will continue to do so as long as it stays above that line.DAILY TIMEFRAME

The long-term direction is up for the NQ

The short-term direction of the market is up for the NQ

The NQ has turned away from a recent retracement and is climbing higher

Learn more about the Daily Direction Indicators here…

The overall direction for the NQ remains positive

Remember that trendlines allow us to see overall patterns developing within a market. Without them, we wouldn’t be able to see when and how we should execute our entry strategy. That’s why drawing them correctly is so important!

| There’s a lot of backroom whispers going on right now that are saying if a stimulus deal isn’t reached soon that we might end up with a major contraction in the markets.

But Josh has identified an opportunity that can help you turn that potential contraction into big profit potential. If you aren’t always quite sure about what to do in the current environment, we have VERY good news for you. Expert trader Josh Martinez keeps uncovering increased trading opportunities like crazy, and they could happen at ANY moment. Click Here to Learn How to Get Started Today While the Market Conditions are so Ripe for the Picking. |

One-Hour Timeframe Analysis

As we turn to the one-hour timeframe, we can see that the NQ is still following the wave movement within the channel. We’ll see the market rise and fall, but the overall direction remains positive.

The NQ will move in waves as it continues its positive trajectory to a new high price!

When the market is in the buy zone, we’ll use the one-hour timeframe to looks for low prices to buy. That’s why dips along the way back to the top aren’t a bad thing. That gives us a chance to buy the market.

Remember that the market moves in waves. It’s perfectly normal to see these ups and downs in price. So long as the overall trend remains positive, we’re good!The Bottom Line

Both the long-term and short-term directions for the NQ are up as the market is preparing to move to a new high price within the channel.

All of the pieces are there. We just need to wait for them to come together as the NQ moves into a position that we can buy. This entire setup is a great example of how the markets move in waves! We’re watching for a major U-turn, a push bullish into the buy zone, and movement toward a new high price that we can buy and make money with!

We’ll watch the NQ as it continues to move within the channel

So what are you waiting for? Dump the excuses and get started now! Follow along as I reveal the crucial aspects of my trading strategy that will allow you to become a profitable futures trader!

Keep On Trading,

The post We survived this major retracement appeared first on Josh Daily Direction.