Good morning, Traders!

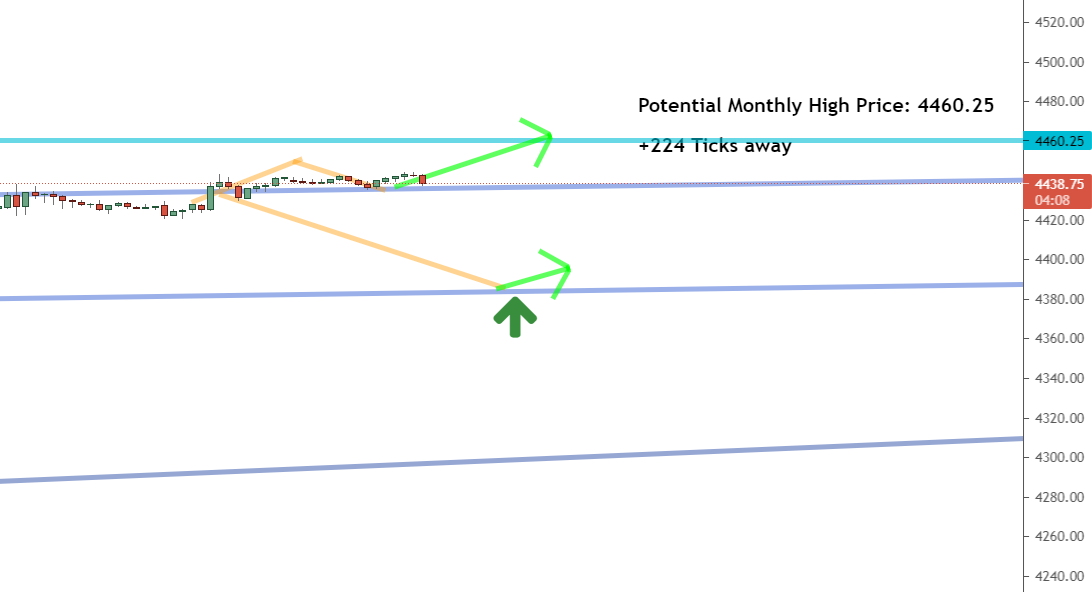

Sometimes a market rises so much that we run out of buying opportunities. And that’s what’s about to happen with the S&P 500 E-mini Futures market (ES). The market is quickly approaching the monthly high price. Once the ES hits the price point of 4460.25, we can expect a bearish turn back down.

And the reason we can predict these sorts of price directions is because we know that the market trades in waves. Even as a market moves in an upward trend, there will be ups and downs along the way. And that’s what we see with the ES.

As the ES hits the monthly high price, we’ll expect buyers to pull back, and sellers take over the market. That will drive the price lower and back down toward support.

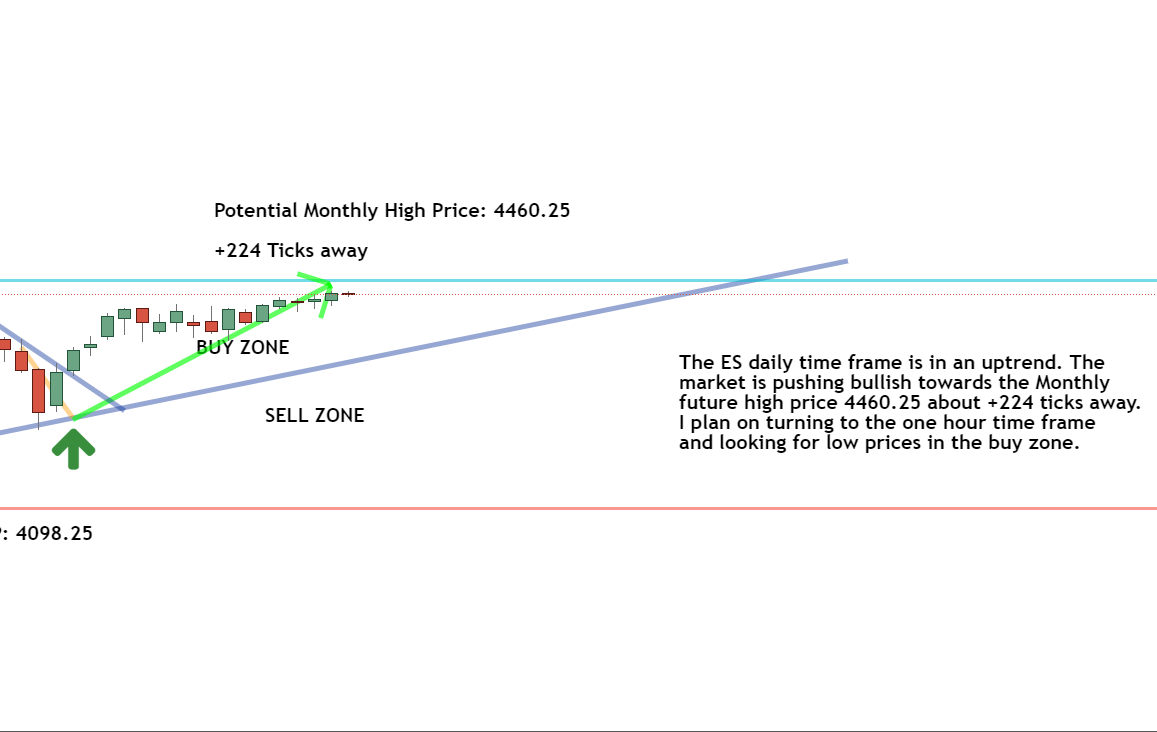

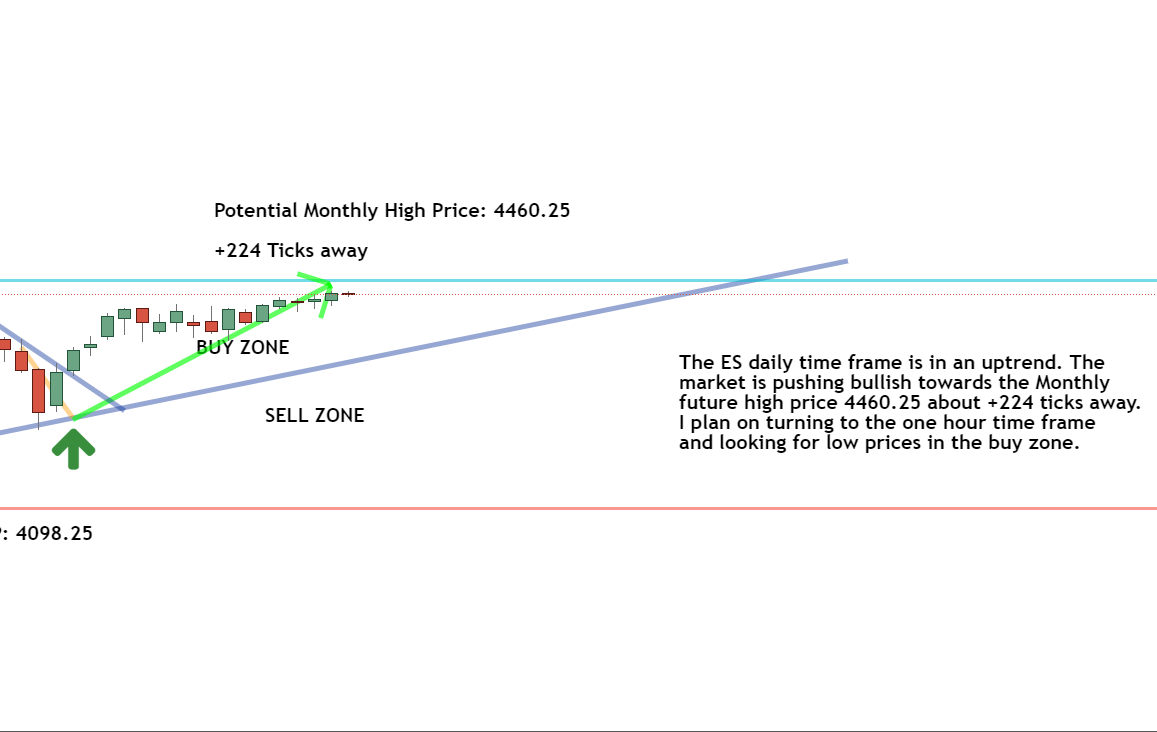

For now, we’ll watch for low prices in the buy zone until the market finally turns bearish. Let’s look at the timeframe analysis for more information:Daily Timeframe Analysis

Though the ES remains in an overall uptrend, the market is quickly approaching the predicted monthly high price (top blue line). That means we’re running out of opportunities to buy the market at low prices in the buy zone.

Once that limit is hit, we can expect a bearish pullback down toward support as sellers take over the market.DAILY TIMEFRAME

The direction within the daily timeframe is up for ES

The short-term direction of the ES is up, for now

The ES remains in the buy zone, but we’re gearing up for a bearish turn

Learn more about the Daily Direction Indicators here…

The ES is quickly approaching the monthly high price point of 4460.25

These sorts of movements shouldn’t catch us off guard. We know that markets dip even when in a positive trend. But by utilizing the right strategy, we can be better prepared for when the market turns bullish again!

| There’s a lot of backroom whispers going on right now that are saying if a stimulus deal isn’t reached soon that we might end up with a major contraction in the markets.

But Josh has identified an opportunity that can help you turn that potential contraction into big profit potential. If you aren’t always quite sure about what to do in the current environment, we have VERY good news for you. Expert trader Josh Martinez keeps uncovering increased trading opportunities like crazy, and they could happen at ANY moment. Click Here to Learn How to Get Started Today While the Market Conditions are so Ripe for the Picking. |

One-Hour Timeframe Analysis

As you can see in the one-hour timeframe, the ES remains in an upward trend within the short-term, but the monthly high price is quickly approaching. The Market is still at the top of the channel, but that bearish pull-back is building up.

We’ll use the one-hour timeframe to look for any remaining opportunities to buy the market while it remains in the buy zone. Once we see the ES start to turn bearish, we’ll watch our timeframes for signs of the market rebounding bullish again.

The ES is still in an uptrend for the short-term. We’ll keep looking for buying opportunities until the market turns bearish

So long as the GC stays within the buy zone, the short-term direction for the market remains up. We’ll use the one-hour timeframe to watch for buying opportunities as the market continues to fulfill the Fibonacci extension and move to a higher price.The Bottom Line

As long as the market is in the buy zone and below the monthly high price point, we’ll keep looking for chances to execute our buy-in strategy! We keep buying so long as there are low prices to buy the ES within the buy zone.

Once the ES hits 4460.25, we’ll expect a bearish turn toward a lower price point. That’s when we’ll watch our timeframe charts and wait for the market to turn bullish again.

We’ll keep our eyes open for when the ES hits 4460.25 and starts to turn bearish

As you watch the ES market move within the timeframe charts, now is the time to get the tools you need to become a successful futures trader. And I’m here to help you realize your money-making potential in futures. Just follow along as I reveal the crucial aspects of my trading strategy that will allow you to become a profitable futures trader!

Keep On Trading,

Mindset Advantage: Breathe

If you’re not breathing, you’re not focused. If you’re not focused, you can’t see the market. Opportunities slide by in an instant. Hazards reveal themselves only when it’s too late.

You need to breathe. Breathing exercises have proven to reduce stress and increase focus.

Sure, you’re already breathing if you read this. But when you trade… you need a breathing regimen. Whatever it is: Through your nose, out your mouth counting to 10 or 100. Find a method and routine that works for you.

You’ll find balance, clarity and focus when you trade. Your heart rate will come down and you’ll just feel better.

Try it. And enjoy your trading.Traders Training Session

Understanding Trading Margin and Managing Losing Trades

The post This market is almost at its limit appeared first on Josh Daily Direction.